Last week, excitement surrounding Bitcoin [BTC] surged to near euphoric levels, fueled by the anticipation of the Bitcoin 2024 conference.

However, this week has seen a slower market pace, which is reflected in BTC’s price movements. While Bitcoin’s recent price rally was driven by generally positive news, this week’s performance has been affected by negative developments.

This has influenced Bitcoin’s volatile sentiment, as evidenced by its nearly 6% drop to $66,042 at the time of reporting. BTC has rebounded approximately 30% from its July lows, making short-term traders who bought the dip likely to sell, contributing to the ongoing pullback.

But how long can this trend continue?

Fibonacci retracement analysis indicates that the next pivot point could be between $61,921 and $59,693, assuming the selling pressure persists.

Bitcoin is currently in a cooling-off phase. Last week saw much political speculation, but now the hype has subsided. Instead, the market appears cautious this week due to FOMC data and the upcoming FED meeting.

The uncertainty surrounding economic announcements often impacts investment decisions, prompting many traders to exit their positions and wait for clearer signals before making their next move. This behavior could explain the profit-taking observed recently.

Further selling pressure, influenced by this cautious stance, might have been amplified by new data from Mt. Gox. According to Lookonchain, Bitcoin has moved 47,229 BTC into anonymous wallets in the past 24 hours.

This development has heightened concerns about market selling pressure. If the transferred BTC were to be sold, it would introduce approximately $3.8 billion worth of selling pressure.

Were long-term buy orders liquidated?

Long positions in Bitcoin might have contributed to the rapid pullback this week. An analysis of the heatmap for buy positions indicates two key areas.

The first is at the price levels of $68,875 and $68,901, where BTC buy orders surged to $101.8 million. The second major area lies between $69,472 and $69,500. BTC’s swift decline below these leveraged buy positions could provide additional downside liquidity for short sellers.

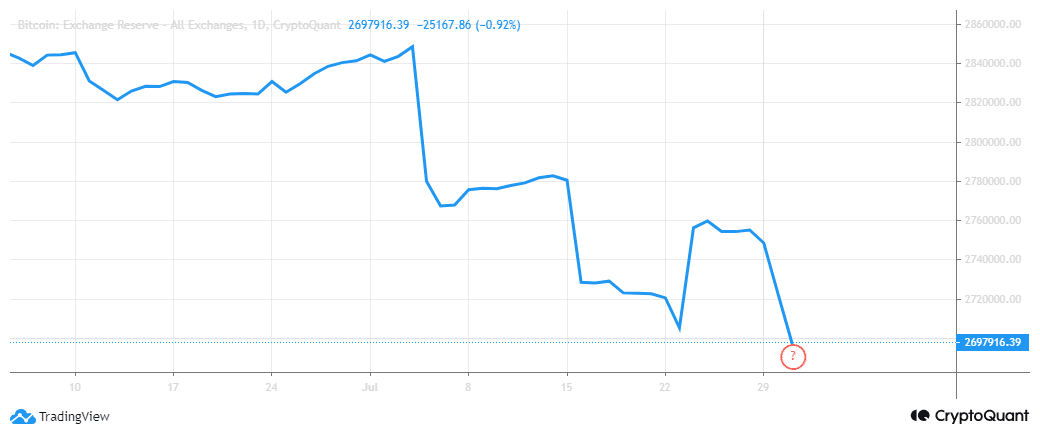

Will Bitcoin fall further? That remains to be seen, especially since market dynamics can shift at any moment. However, Bitcoin reserves just ended July at their lowest level since 2018. The exchange reserve index confirms that around 2.6 million BTC remain on exchanges at the time of reporting.

I am happy to be here with this memorable project, and am sure it is going be a good one.