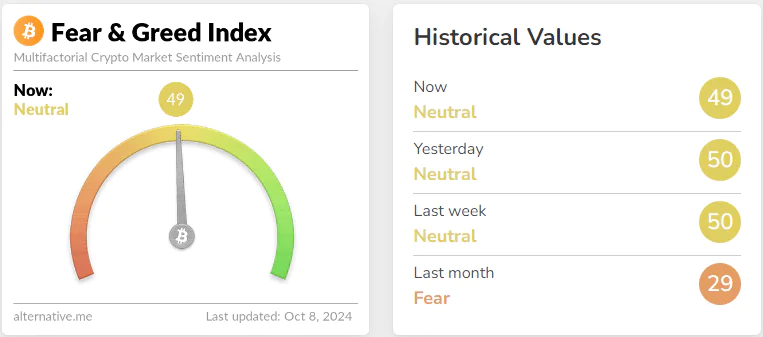

The Crypto Fear and Greed Index is showing a neutral market sentiment, marking an improvement from the fearful atmosphere in early September.

The recent correction from $66,500 to $60,000 has not had a major impact on investors in the market.

Bitcoin Chart Technical Analysis

A recent report has outlined liquidation zones around the price that could act as a magnet. The $66,200 level remains a strong resistance level, and a return to this area could face resistance from buyers.

On the other hand, the possibility of a strong rally is well-founded based on historical trends. The Bitcoin Fear and Greed Index chart reflects a neutral sentiment, which is understandable given the price action over the past two weeks.

The descending channel (white) was broken at the midpoint on September 18, followed by a rally that nearly reached the top of the channel but was rejected. Since then, the $64,000 level has turned into resistance.

The current CMF at -0.09 indicates a large outflow of capital, along with increased selling pressure. The OBV also shows a steady sell trend over the past two weeks, despite a slight recovery.

The RSI is currently at 52, suggesting a neutral outlook. If the price drops to the $58,000-$60,000 zone, this could be a buying opportunity. On the other hand, if the price breaks above $66,000-$67,000 and retests the support level, it could also be a good time for long-term investors. This scenario is likely to shift the market sentiment towards more greed.

USDT Chart Analysis

Analysis from the Tether chart shows that BTC has an inverse relationship with Tether (USDT). When Tether dominance increases, it usually means a weakening of the crypto market, as investors move their funds to stablecoins. The current resistance level of USDT.D is 5.79%, and the possibility of further declines in the coming days could create an opportunity for Bitcoin to rally in the short term.

However, Tether dominance has been on an upward trend since March, as shown by the rising trendline. Until this trend is broken, investors and traders need to be cautious when aiming to profit from crypto market rallies.