According to market analytics platform Santiment, community optimism towards Bitcoin is gradually increasing, with data showing a significant shift in sentiment. However, this positive outlook has raised concerns about a possible market top, which often leads to price corrections in the crypto space.

Santiment warned that if the current fear of missing out (FOMO) turns into fear, uncertainty, and doubt (FUD), the Bitcoin market could face greater volatility. Santiment also pointed out that the market often goes against popular expectations, hinting at the possibility that this correction could continue.

Bullish Sentiment and ETF Inflows

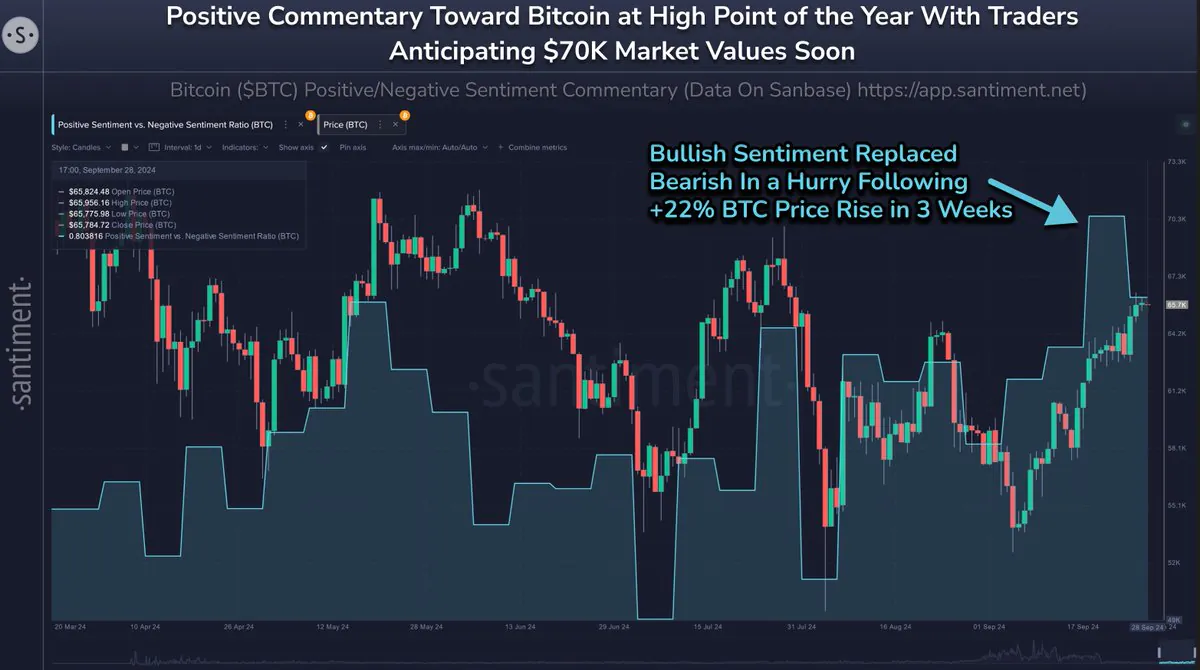

A Santiment analysis last Friday showed that Bitcoin traders’ confidence is on the rise, following a 22% price increase over the past three weeks.

The sentiment ratio, which tracks the balance between positive and negative articles about Bitcoin, recorded a sharp increase in optimism, with 1.8 positive articles for every negative article. While this indicates positive sentiment, Santiment warns that overconfidence is often a sign of a market downturn as traders can become overly optimistic.

At the same time, Bitcoin exchange-traded funds (ETFs) have seen large inflows. On September 30, Lookonchain reported that Bitcoin ETFs saw 7,111 BTC in net inflows. This is equivalent to approximately $453.42 million. A large portion of this, around 3,085 BTC ($196.71 million), came from ARK21Shares, bringing the fund’s total Bitcoin holdings to nearly 50,684 BTC.

The inflow from large institutions comes as the market awaits the decision of the US Securities and Exchange Commission (SEC) on applications for approval of spot-priced Bitcoin ETFs. The anticipation of the approval of these ETFs has contributed to the increased interest from institutional investors.

Slight correction in the market

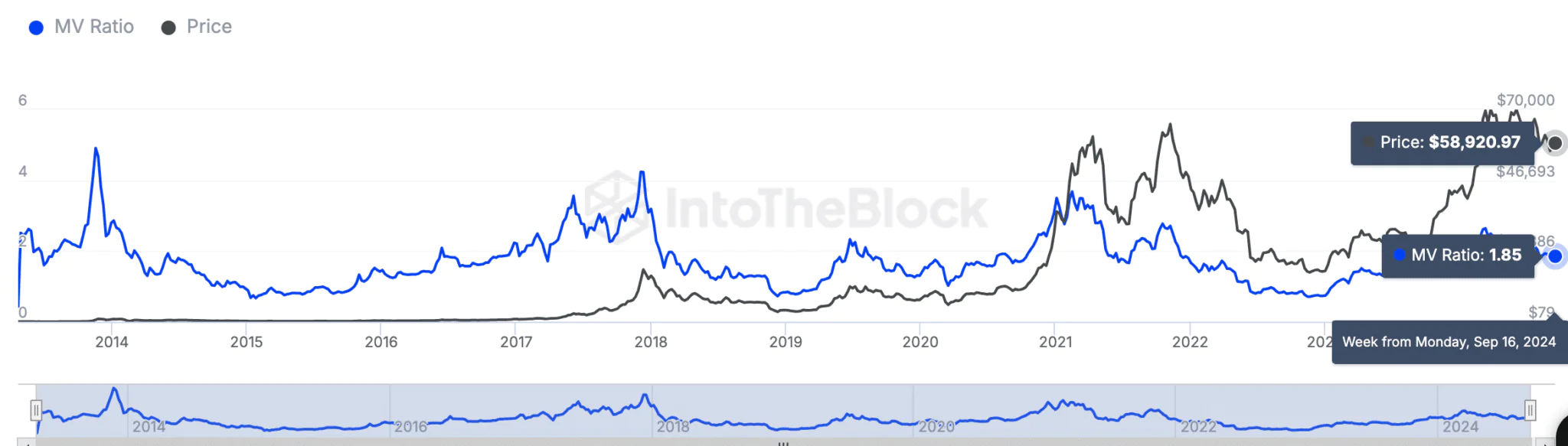

The MVRV index, which compares Bitcoin’s market value to its intrinsic value, is currently at 1.85. This suggests that Bitcoin is trading above its intrinsic value, but not at an overheated or undervalued level.

Historically, MVRV peaks, typically above 3.5, have marked Bitcoin’s peak rallies, such as in the bull markets of 2013, 2017, and 2021. These periods are often followed by sharp corrections and bear markets. When the MVRV falls below 1, this implies that Bitcoin is trading below its intrinsic value, often creating attractive buying opportunities.

The current 1.85 ratio suggests that the market is in a state of equilibrium, with the potential for further correction or recovery, depending on changes in investor sentiment.