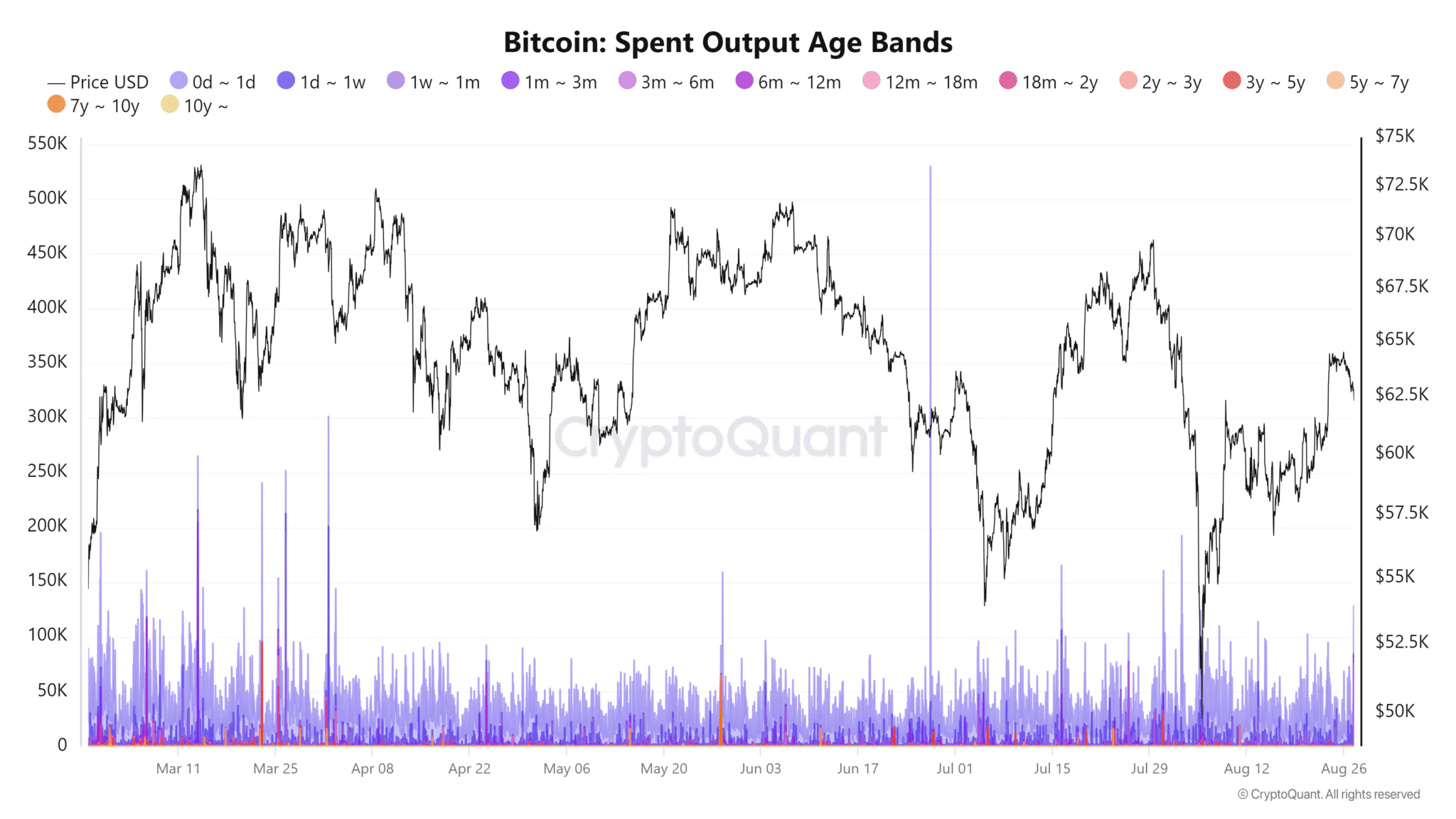

Bitcoin experienced a sell-off from short-term holders. Recent data from CryptoQuant indicates that previously dormant Bitcoin addresses have started to show new activity. Specifically, an analysis of the 1-week to 1-month spent output age band reveals that short-term Bitcoin holders have moved a substantial amount—33,155 BTC.

This uptick in short-term holder activity could indicate immediate selling pressure in the market. The current volatility and market uncertainty may be driving these decisions to transfer and sell holdings. Investors might be looking to secure profits following recent price swings in Bitcoin or to minimize potential losses if they anticipate further declines in its value.

Additionally, some investors may be rebalancing their portfolios in response to the shifting market dynamics.

This increased activity among short-term holders could exert further downward pressure on Bitcoin’s price, especially if it results in significant sell-offs across exchanges.

Bitcoin records its biggest outflow of the month

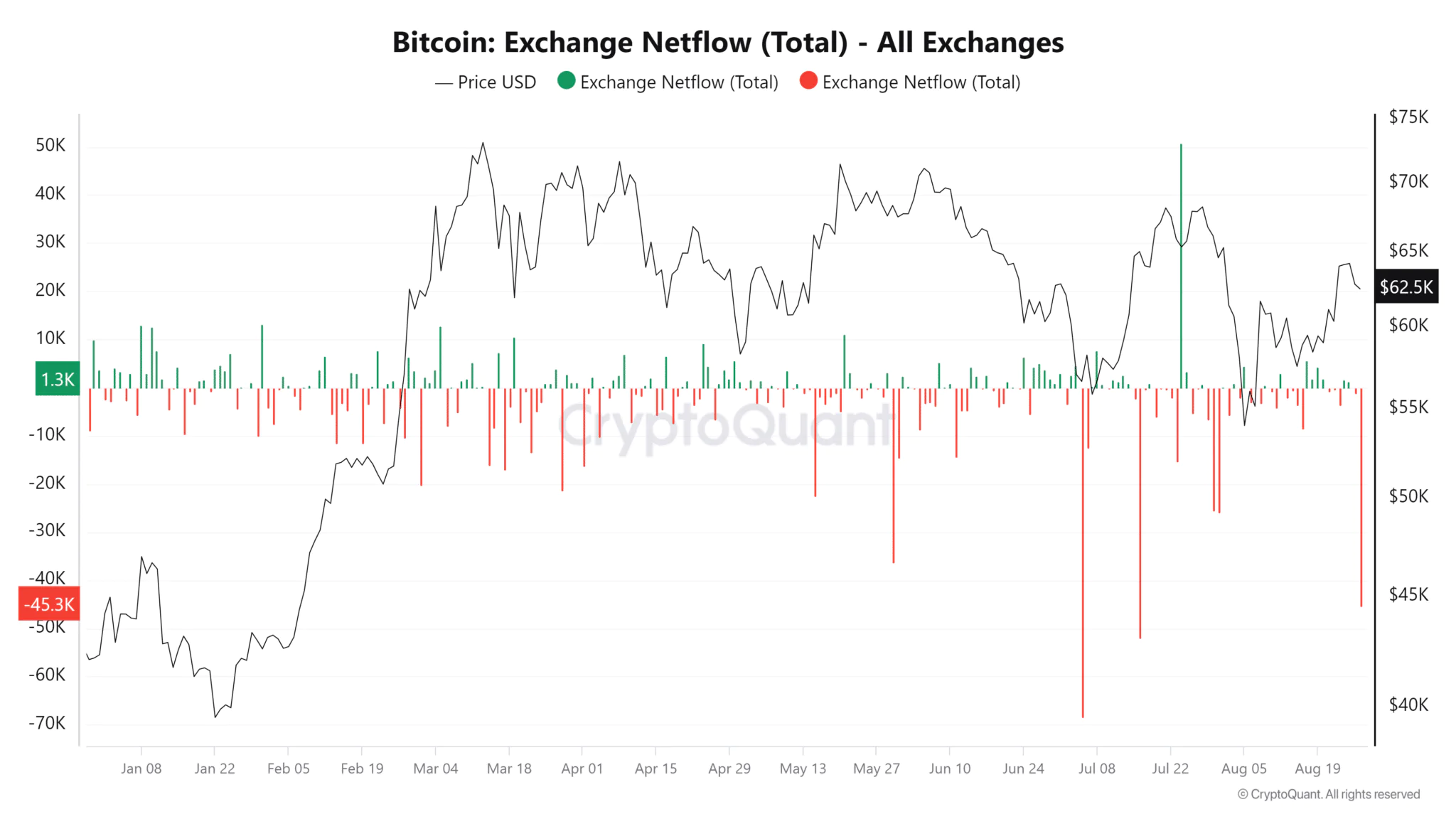

Bitcoin records its largest outflow of the month Despite the recent sell-off by short-term holders, Bitcoin witnessed its largest capital outflow on August 26, signaling a notable shift in market behavior.

According to CryptoQuant’s analysis of exchange net flows, the net flow was deeply negative, around -45,432 BTC. The last time Bitcoin experienced such a substantial negative net flow was in June, nearly two months ago. A negative net flow indicates that more BTC is being withdrawn from exchanges than deposited.

This trend is often seen as bullish, indicating that holders are moving their Bitcoin off exchanges. When investors withdraw their assets from exchanges, it typically reflects a sense of confidence in the market. This development contrasts with the selling pressure from some short-term investors.

It suggests that while some market participants are locking in profits or minimizing risks, a significant number of investors are choosing to hold their BTC off exchanges. Ongoing BTC Volatility An analysis of Bitcoin’s daily trends highlights the persistent volatility the cryptocurrency is experiencing.

Research on the Bollinger Bands—a technical indicator that measures price volatility—reveals that these bands have widened in recent days, reflecting an increase in price fluctuations. In the most recent trading session, Bitcoin lost over 2% of its value and continued to decline by nearly 1% in the current session.