Technical Analysis

Daily Chart

On the daily time frame, it is evident that the price has yet to rebound and stabilize above $60,000 after being quickly rejected by the 200-day moving average, which is around $63,000.

After a recovery from $52,500, the price has once again tested a key level. For the market to enter a new bullish phase, it must first break through both the $60,000 level and the 200-day moving average to the upside.

4-Hour Chart

On the 4-hour time frame, the price is in a sensitive zone as it retests the upward trendline that has been maintained for several weeks.

If this trendline holds, the likelihood of the price breaking above $60,000 is high. On the contrary, if the trendline is broken, the price could correct down to $57,000 or even towards the $53,000 zone in the coming weeks.

On-chain Analysis

Bitcoin Funding Rate

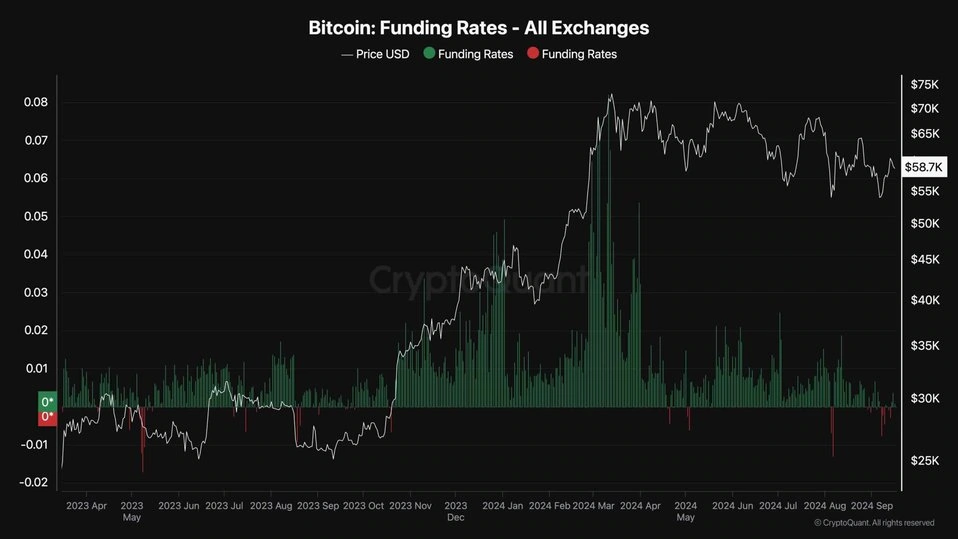

The futures market has played a crucial role in influencing Bitcoin’s short-term price movements in recent years. Therefore, understanding the sentiment in this market can provide valuable insights.

The chart below illustrates Bitcoin’s funding rate, which measures whether buyers or sellers are dominating the futures market. Positive values indicate bullish sentiment, while negative funding rates are associated with fear and pessimism.

As seen in the chart, the funding rate has dropped significantly during the recent consolidation and correction phase, as many futures traders have liquidated their positions or shifted their market outlook to the selling side.

Although this is a clear bearish signal, it could also indicate that the market is no longer overheated, and with sufficient spot buying pressure, a sustainable price rally may soon begin.