Bitcoin has reached lower peaks since achieving its all-time high in March. Expectations for a bullish run were high after the crash in early August, but weak demand has eroded the market’s fragile confidence and hopes for a recovery.

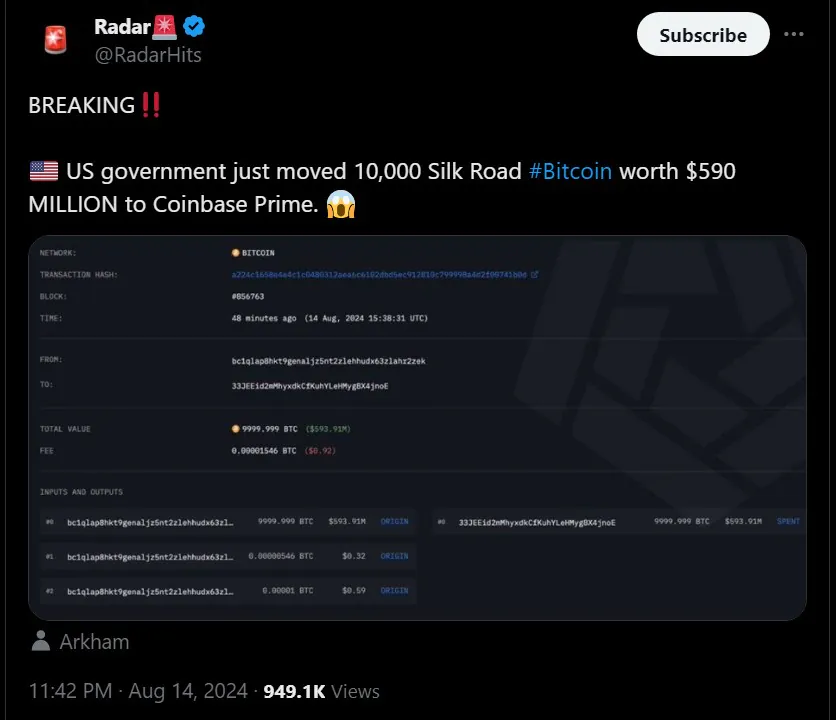

In the latest development, BTC’s price has once again fallen below $60,000. This occurred amid reports that the U.S. government recently transferred 10,000 BTC to Coinbase Prime.

This move has contributed to the resurgence of fear, uncertainty, and doubt (FUD) among Bitcoin holders. The amount of BTC transferred is nearly equivalent to what the German government sold in July. This has led to significant selling pressure.

Is the government selling Bitcoin?

While it’s possible that the U.S. government may sell some BTC, recent findings do not necessarily indicate this. The transfer may have been made for custodial purposes. The U.S. Department of Justice has selected Coinbase Prime to provide custodial services.

However, this announcement may have further destabilized the already fragile situation. This comes as Bitcoin struggled to surpass the $61,900 mark. Cryptocurrency could soon overcome this selling pressure in the short term as optimism returns to the market.

Economic data released this week suggests the Federal Reserve (Fed) might intervene soon. This includes the Consumer Price Index (CPI) data, which came in lower than expected. This means the Federal Reserve is likely to cut interest rates in September.

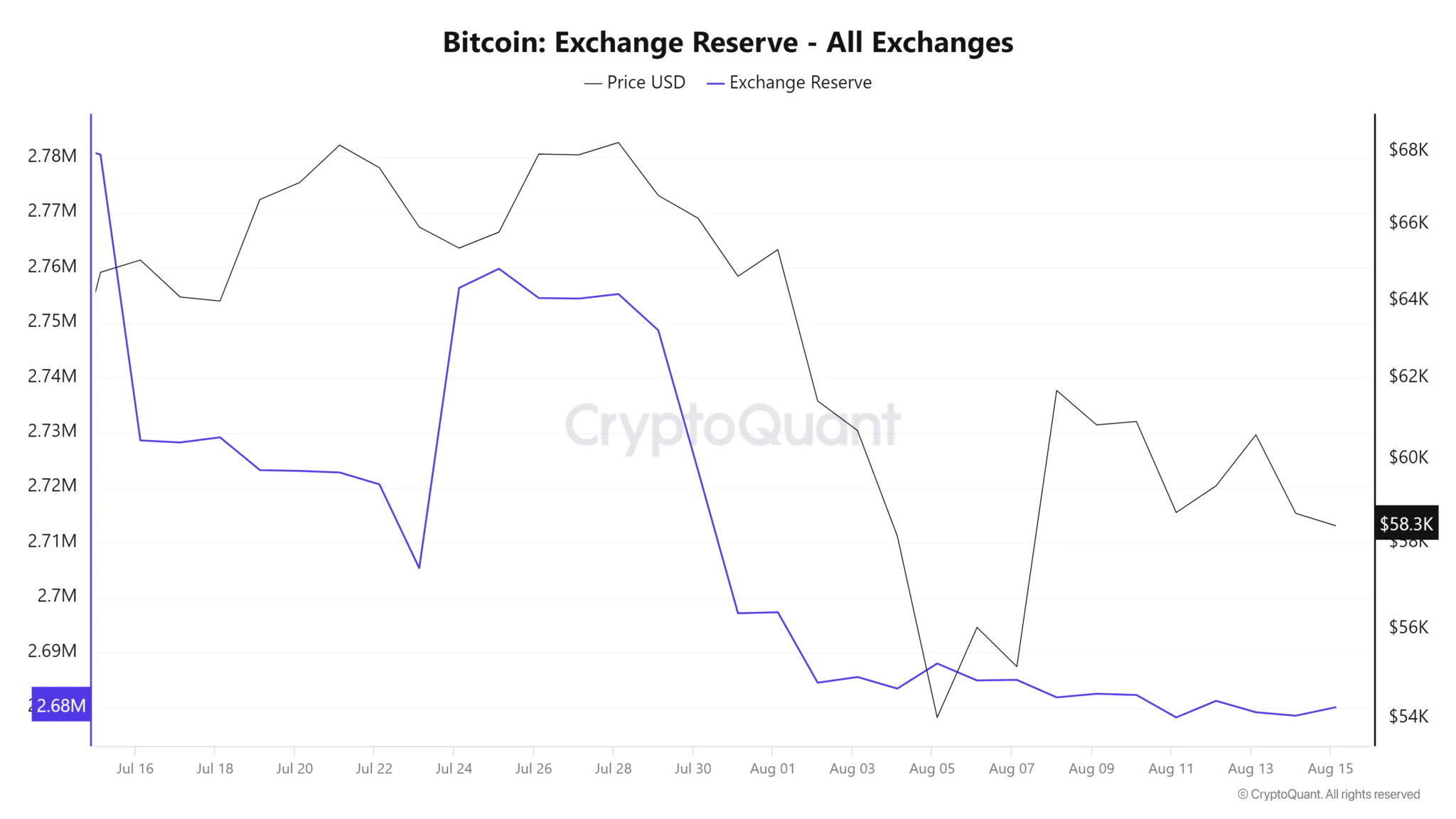

A rate cut is considered beneficial for riskier assets like Bitcoin because it facilitates access to liquidity. However, the market has been cautious due to the increasing risk of a price decline. This caution is evident in the amount of BTC held on exchanges.

BTC exchange reserves have been declining steadily this year. Recently, however, they have stabilized and even recorded some inflows. The current outlook suggests that exchange reserves may be shifting towards a more bullish direction.

A shift towards increased Bitcoin exchange reserves supports the notion that selling pressure is mounting. This could confirm the possibility of Bitcoin heading towards the low $50,000 range. However, if the situation continues to decline, it will result in a supply shortage.