This decline has triggered widespread losses in the cryptocurrency market, fueled by negative sentiment surrounding Bitcoin’s historically weak September returns.

The downturn in Bitcoin and the broader cryptocurrency market coincides with the U.S. stock market’s losses. On Tuesday, the stock market extended its decline, wiping out $1.05 trillion in market value. Notably, the “Magnificent 7” stocks—Apple, Nvidia, Amazon, Meta, Microsoft, Alphabet, and Tesla—collectively lost over $550 billion in market capitalization within the past 24 hours, according to The Kobeissi Letters.

A similar trend is evident in the cryptocurrency market, where Bitcoin and several other top 20 cryptocurrencies are trading at daily losses. This movement underscores Bitcoin’s increasing correlation with traditional stock markets. Unlike in the past, when investors turned to Bitcoin for uncorrelated exposure, the influx of traditional investors—particularly with the introduction of Bitcoin ETFs—has altered this narrative.

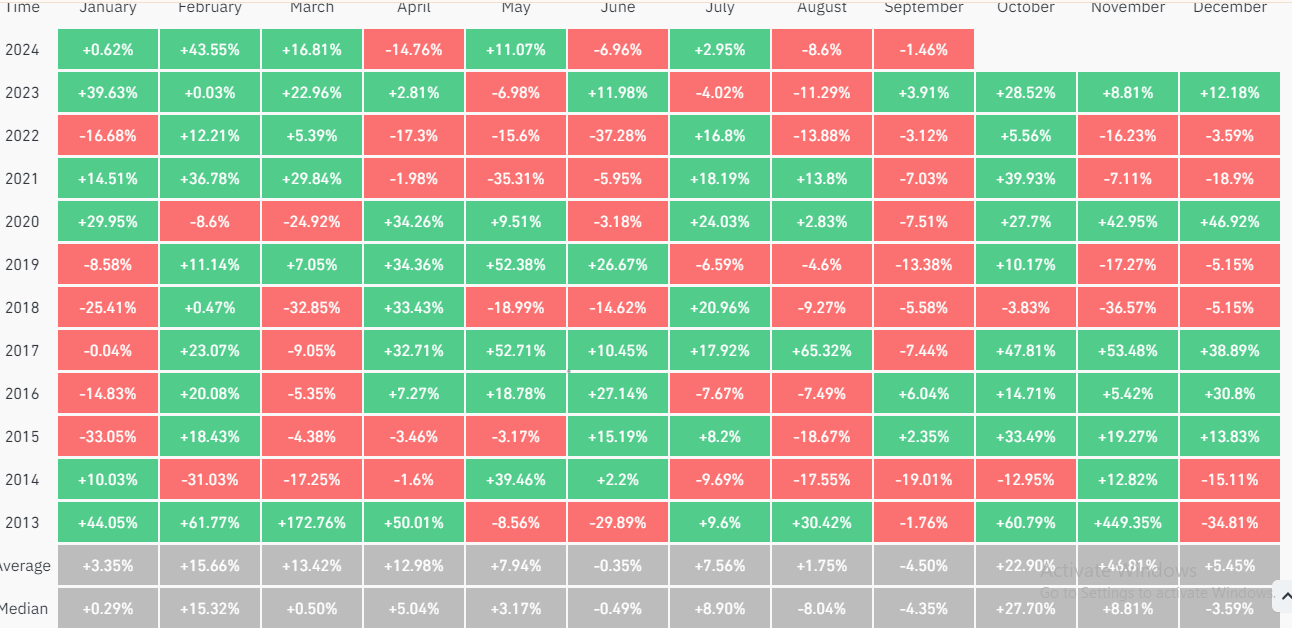

Bitcoin’s recent decline aligns with its historically poor performance in September, which has proven to be the worst month for the cryptocurrency. On average, Bitcoin has suffered losses of -4.5%, with a median loss of -4.35%, the lowest returns compared to any other month.

A similar pattern has been observed in the S&P 500, marking September as the worst-performing month over the past 30 years.

This recent price drop occurred despite an increase in the supply of stablecoins in the cryptocurrency market, which is typically a bullish signal. As a result, a CryptoQuant analyst suggests that a significant portion of new capital has yet to be allocated.

“Most of the capital tied up in stablecoins hasn’t yet exerted buying pressure on the order books, but this ‘power’ could enter the market at any time,” the analyst noted. “It’s possible that institutional investors are acquiring digital assets through TWAP orders or using algorithms to minimize short-term price impact,” he added.

Meanwhile, Bitcoin’s recent price weakness has led to gains in Meta stocks and gold, challenging Bitcoin’s position as the second-best asset in terms of risk-adjusted returns.

Additionally, the BTC MVRV Z-Score has turned red, indicating that bearish sentiment is prevailing. A prolonged period with this indicator in the red zone could signal the beginning of a bear market.