Bitcoin ended January 6 at $102,000, buoyed by positive inflows from ETFs worth $978.6 million. However, by January 7, the price had fallen sharply below $97,000.

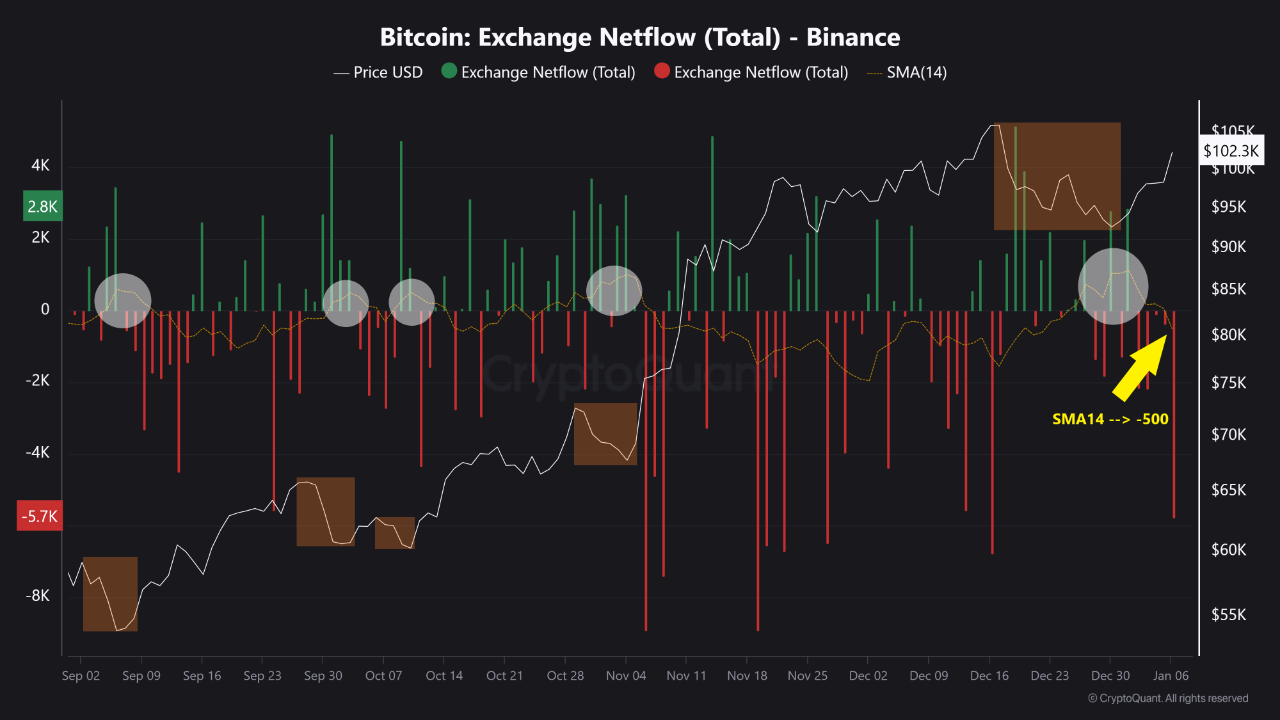

However, strong investment activity was still recorded on major exchanges, indicating that demand for Bitcoin remains high. According to an analyst at CryptoQuant, the 14-day simple moving average (SMA14) – which tracks inflows from Binance – has turned negative. Data from the chart shows that whenever the SMA14 turns negative, Bitcoin tends to increase in price.

Bitcoin outflows from Binance reached 5,407 BTC, the highest level in the past month.

“Both of these indicators confirm that investor behavior on Binance is leaning towards accumulation. This trend provides strong momentum for Bitcoin’s price to rise in the short term,” the analyst emphasized.

Along with traders on Binance, retail investors in the United States also showed signs of increased buying pressure, as the Coinbase Premium turned positive in 2025. The indicator has crossed above the SMA14 moving average, signaling a strong uptrend. Previously, when the indicator crossed above the SMA14, Bitcoin’s price rose from $69,000 to $108,000 in Q4 2024.

Bitcoin’s current move from above $102,000 to below $98,000 occurred in the middle of liquidity zones. This is where traders place positions such as limit orders, sell orders, stop-loss orders, and take-profit orders, causing prices to fluctuate in these areas.

Read more: A New Exchange Acquires FTX to Operate in the EU

On January 6, Bitcoin price crossed the $99,000 level, breaking the highs (EQ) made on December 21 and 26. However, sellers liquidated their positions around the supply zone afterwards, leading to the current price decline.

Following the same market trend, Bitcoin is likely to test the lows around $97,377 and $96,700 before bouncing from the support at $96,700.

Therefore, a daily close above $97,000–$98,000 would help Bitcoin maintain its upward momentum in the near term.