Bitcoin has fallen below $93,000, with less than 24 hours to go until 2025.

At the same time, Tether transferred 7,629 BTC, worth about $700 million, to its Bitcoin reserve address. The transaction was made from Bitfinex’s hot wallet on the morning of December 30. This is the largest addition to Tether’s strategic reserves since March 2024, when the company moved 8,888.88 BTC.

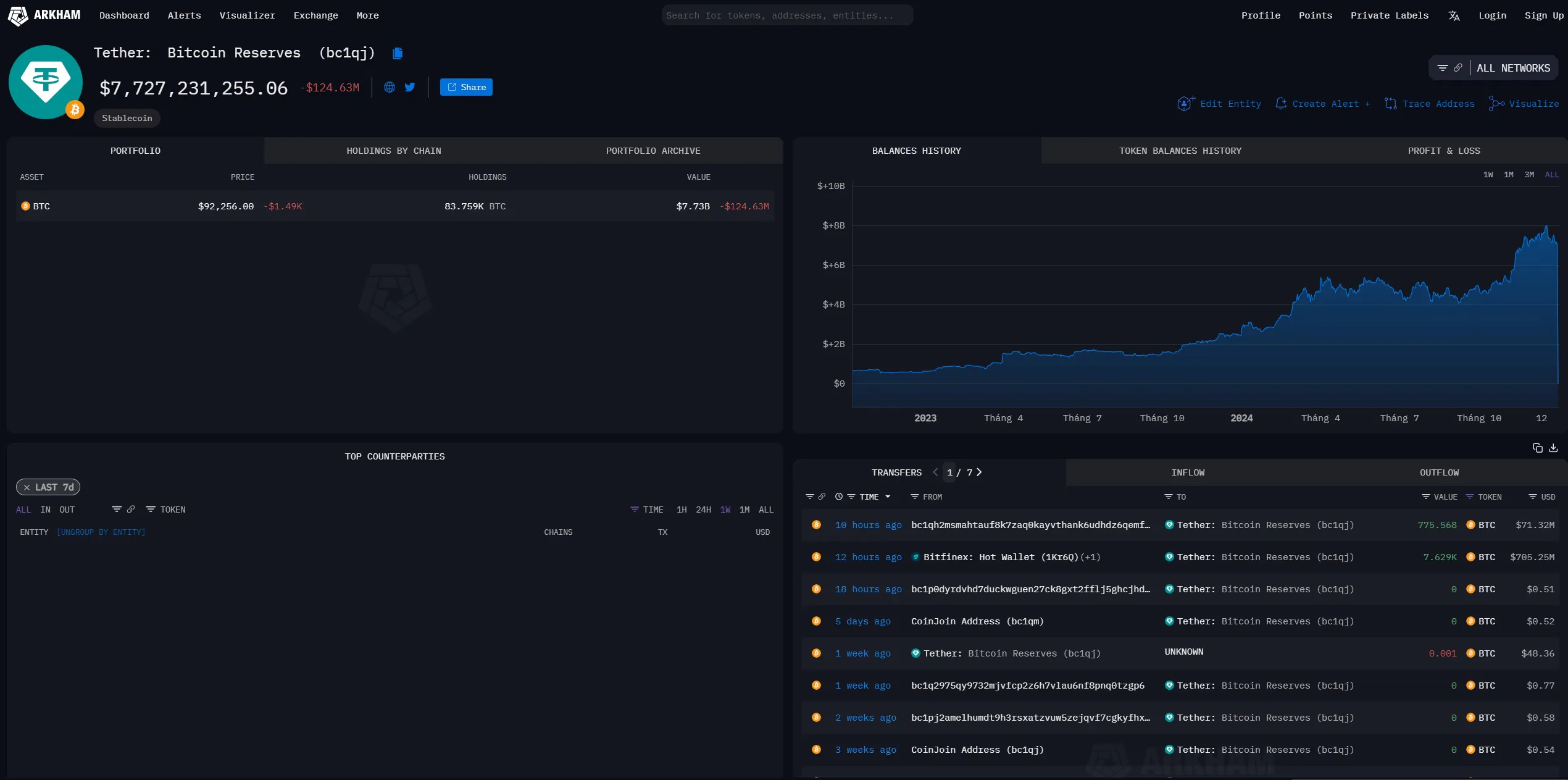

A similar transaction previously took place on December 31, 2023. According to data from Arkham, Tether’s current reserves are 83,759 BTC, purchased for a total value of $2.99 billion and at an average price of about $36,125 per BTC.

The move is in line with Tether’s strategy in 2023, when the company decided to allocate up to 15% of its profits to Bitcoin. Currently, Tether holds more than $7.6 billion worth of BTC, as part of its asset diversification strategy to cope with the growing demand for USDT issuance.

Tether’s stablecoin USDT is still primarily backed by US Treasury bonds and cash equivalents. The profits from these investments have enabled Tether to expand into emerging areas such as artificial intelligence (AI), Bitcoin mining, and decentralized communications.

In 2024, Tether continues to expand into renewable energy and telecommunications, demonstrating the company’s increasingly diversified and long-term investment vision.

However, Tether is facing great pressure from the European Union (EU) when the MiCA regulation officially takes effect. Several EU exchanges have delisted USDT in recent weeks to comply with this regulation.

One notable opinion is that: “Tether holds $102 billion in US Treasuries. The EU’s failure to recognize this collateral is a clear signal of its lack of confidence in US sovereign debt. The EU requires stablecoin issuers to hold at least 60% of their fiat-denominated stablecoins in EU banks. This could be a political move, and I believe it will have negative consequences for the EU.”

In addition, Tether has decided to stop issuing EURT – a euro-backed stablecoin – and give holders a one-year window to redeem their assets. The increasingly fierce competition in the stablecoin market has also posed challenges to Tether’s leading position.