Bitcoin experienced a sharp move overnight. The price dropped by around 13% from $104,000 to $90,000 before recovering to its current price. The move led to a massive liquidation of leveraged trades. Over the past 24 hours, 211,476 traders were liquidated, totaling $1.1 billion. Notably, the largest liquidation occurred on the Bitcoin/USD trading pair on OKX, reaching $18.94 million.

The main reason for this 13% move is believed to be profit-taking by investors. According to data from CryptoQuant, many long-term investors took advantage of Bitcoin’s record high price of $104,000 to make profits.

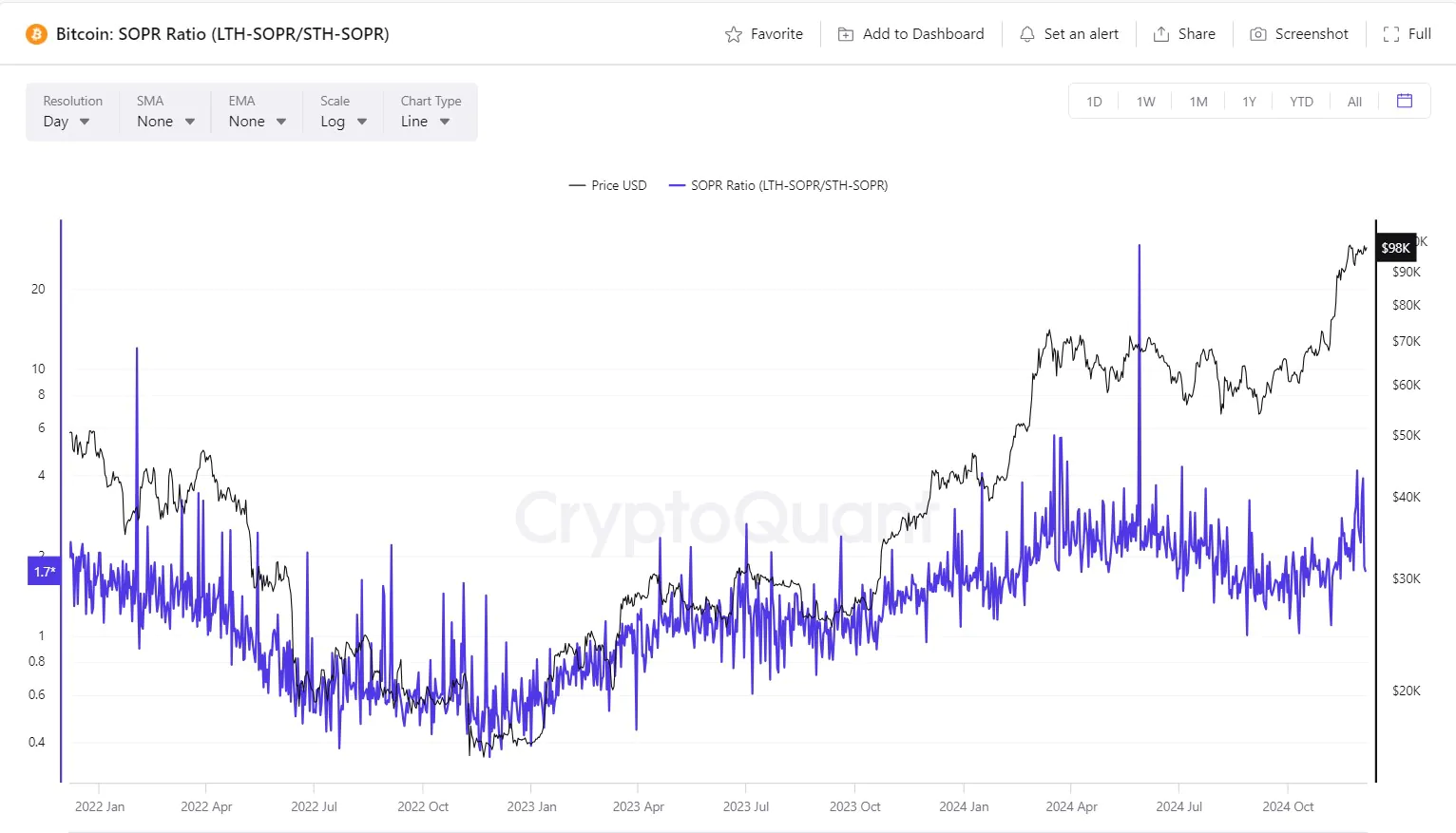

The long-term investor’s profit-output ratio (SOPR) – a measure of the price at which Bitcoin was bought versus the price at which it was sold – has increased significantly since Bitcoin crossed the $100,000 threshold.

The LTH-SOPR (long-term investor profit-output ratio) on CryptoQuant’s chart has reached 4, indicating that recent sellers have reaped four times the initial return on their Bitcoin purchases. This suggests that they bought Bitcoin at an average price of around $25,000 – a level that Bitcoin has not returned to since the bear market in 2022.

Read more: MicroStrategy Stock Soars as Bitcoin Hits $100,000

In addition, Bitcoin’s correction could also be related to macroeconomic factors. A strong US jobs report could prompt the Federal Reserve to reconsider the pace of interest rate cuts, potentially opting for a slower pace. This could strengthen the US dollar, putting downward pressure on risk assets like cryptocurrencies. Conversely, if the jobs report is weaker than expected, expectations for faster and stronger rate cuts could be reinforced, boosting liquidity in the market and having a positive impact on the price of Bitcoin and other cryptocurrencies.