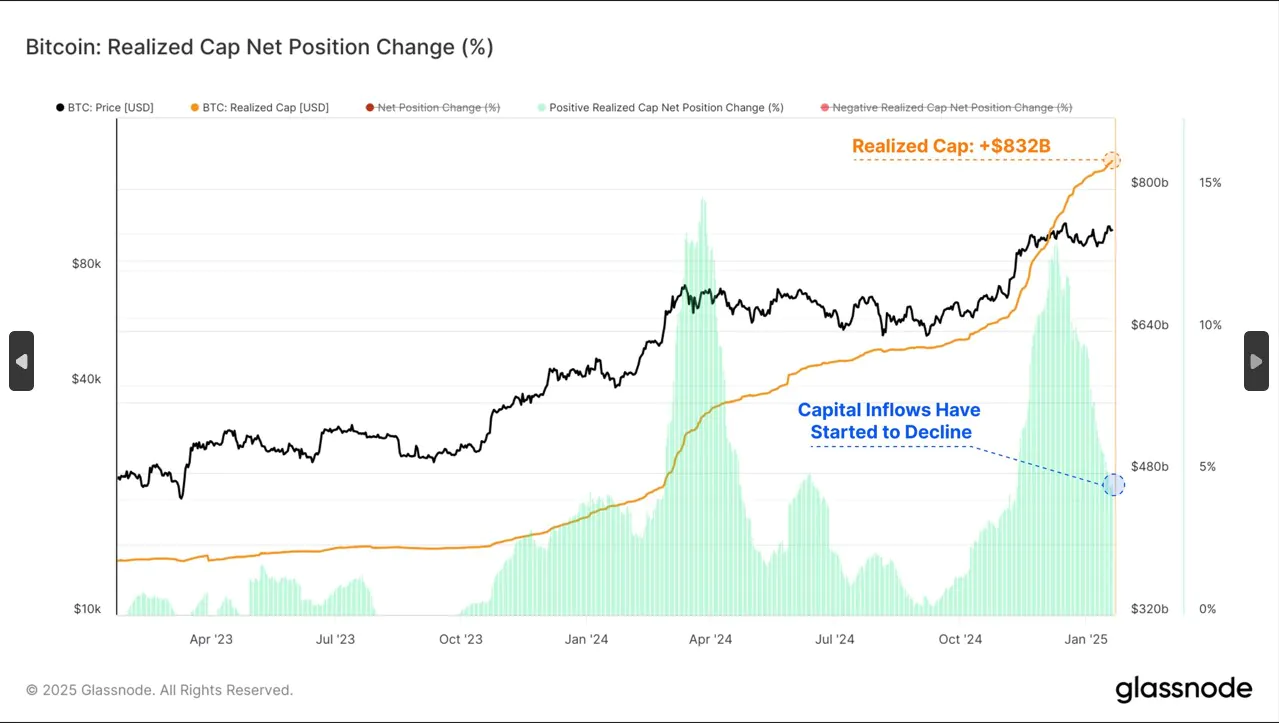

Bitcoin recorded a slight decline yesterday, currently trading around $104,000. This comes amid market expectations that Bitcoin would enter a strong bull run after surpassing the important $100,000 milestone. However, data from Glassnode shows that market momentum appears to have weakened after reaching this historic price level.

According to the chart, the change in Bitcoin’s Realized Cap has decreased significantly, from 12.5% to less than 5% since November 2024. This reflects that less Bitcoin is trading at prices above $100,000 than in early December 2024. In addition, realized profits have also dropped sharply from a peak of $4.5 billion in December 2024 to $316.7 million, a decrease of 93%. This data shows that the selling pressure in the market has decreased sharply, suggesting that the market is entering a phase of rebalancing supply and demand.

Liquidity in the Bitcoin market remains thin, making investors concerned about the possibility of sustainable growth in the near future. However, despite these not-so-positive signals, some optimistic analysts believe that the total cryptocurrency market capitalization can still double in the next six to eight weeks. They believe that Bitcoin has a very good chance of reaching $150,000.

Read more: President Donald Trump Officially Speaks Out About the Memecoin He Issued

A technical analyst pointed out that Bitcoin’s weekly RSI has bounced from the bottom of the trend channel, similar to the periods of March 2017 and September 2020. “As long as Bitcoin remains within this trend channel, the bull market still has a chance to continue to explode,” he said. Overall, the market outlook is still potential, but investors need to be cautious of unpredictable fluctuations.