Bitcoin has adjusted to $65,000, amid imminent selling pressure from the FTX exchange. FTX, which filed for bankruptcy last year, has unveiled a major plan to repay its creditors, potentially injecting fresh momentum into the cryptocurrency market. On May 8, it was revealed that the exchange could reimburse creditors up to 98%, amounting to around $16.3 billion.

Creditors with claims under $50,000 are eligible to recover up to 118%, based on cryptocurrency prices from November 2022. This move has been well-received by the market, with CEO Ray stating:

“We are pleased to propose a Chapter 11 plan that anticipates repaying 100% of bankruptcy claims plus interest to non-governmental creditors.”

FTX’s repayment strategy is expected to have significant ripple effects across the cryptocurrency market. This was highlighted in the latest report by K33 Research, authored by analysts Vetle Lunde and Anders Hesleth. They suggest that cash payments from FTX could create a “positive price bump” in the market, potentially leading to increased buying pressure.

Analysts Assess: FTX Repayments vs. Market Dynamics

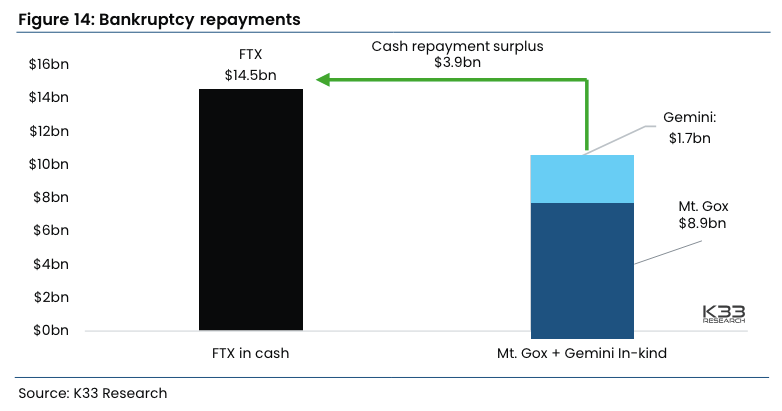

K33 Research analysts argue that not all creditor repayments will exert downward pressure on the market. In their view, FTX’s cash repayments contrast with cryptocurrency-based repayments planned by other entities like Mt. Gox and Gemini, which total $10.6 billion.

They argue that the buying pressure from FTX’s cash recipients could offset the selling pressure from those receiving cryptocurrency payments. They emphasize, “Not all creditor repayments are bearish,” suggesting that the overall impact may be more balanced than initially expected.

However, predicting the exact market impact of these repayments remains challenging. Consequently, the timing of these payments will be crucial in assessing their full effect.

While Gemini’s $1.7 billion repayment is anticipated in early June and Mt. Gox’s $8.9 billion payout is slated for October 2024, FTX’s repayment schedule is still under court review, with most creditors expected to be reimbursed by the end of the year.

“The different timings of these repayments suggest a slow summer for the market and a strong finish to the year.”

Related: Bitcoin Whales Accelerate While Prices Lag Behind

Market Trends and Future Outlook

Meanwhile, the global cryptocurrency market has recently shown robust bullish signs, with Bitcoin and Ethereum breaking key resistance levels. In the past 24 hours alone, the market has surged by 5.8%, adding over $100 billion to the global cryptocurrency market cap.

Source: Coinglass

This surge has led to significant short-seller liquidations. During this period, 58,875 traders were liquidated, totaling $159.13 million in liquidations. This wave of liquidations follows a recent trend where ETH and PEPE caused $50 million in losses for short traders. Additionally, Bitcoin’s open interest has risen nearly 10% in the past 24 hours, indicating increasing capital inflows into the market. This also reflects growing investor confidence in market developments.

I love dis page

Hy