Bitcoin surged to nearly $90,000 last night, setting a new all-time high. The rally brought Bitcoin’s market capitalization to nearly $2 trillion, placing it among the top eight most valuable assets globally.

Sell Block Appears at $90,000

On the 1-hour chart, a sell block appeared at $90,000, indicating that traders were preparing to short Bitcoin when the price reached this level. When BTC hits $90,000, shorts may be triggered, potentially leading to a slight correction for Bitcoin. Another sell block was recorded at $91,150.

Bullish investors want to break above $90,000 to trigger short liquidation in the price range extending to $93,000. Another sign of an attempt to break above $90,000 is the surge in Spot trading volume, especially on Coinbase, where Bitcoin is often traded at a premium.

Futures Market Volatility

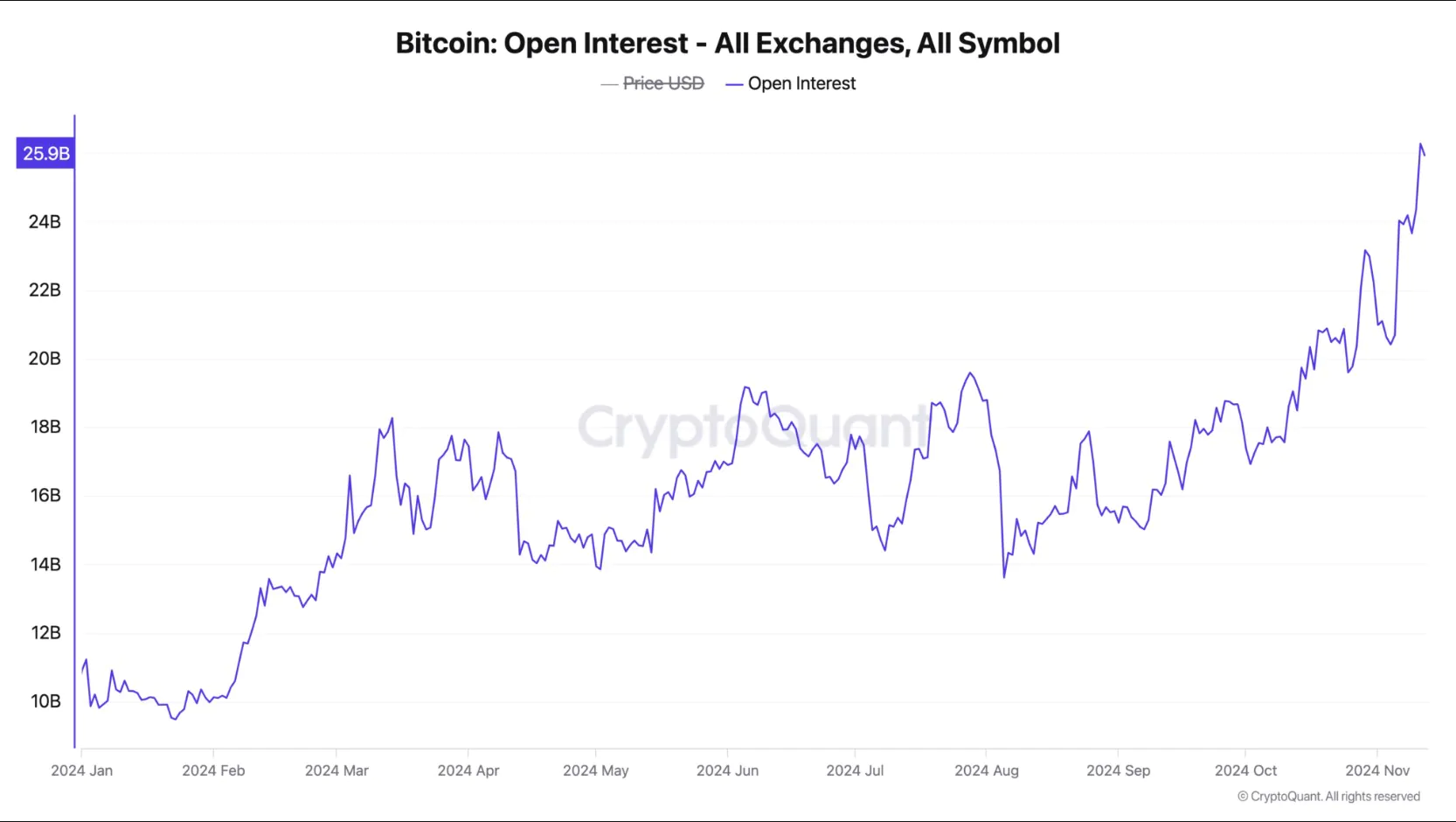

The explosion in open interest is a major factor that could prevent Bitcoin from reaching $90,000 in the short term. According to data from CryptoQuant, the Futures market has added more than $16 billion in open positions in the past week alone, indicating a significant increase in leverage. Currently, BTC’s open interest has reached $25 billion, the highest level since August 2022. When the price of an asset increases too quickly, high open interest can be a warning sign of potential instability.

Bitcoin has increased in value by 25% over the past week. The surge in open interest suggests that many investors are using high leverage. If Bitcoin corrects, these leveraged positions could create a chain reaction, leading to more volatility.

Read more: Whale Gains Massive Profits from Shiba Inu Bull Run

In addition, BTC’s rising funding rate is another factor that could keep prices below $90,000 in the short term. Currently, the rate is at 0.015%, the highest level since late March, when BTC experienced a sharp correction.

In Futures trading, the funding rate is a periodic fee between long and short positions, which is used to maintain market balance. When the rate spikes, it usually signals that the buyers are in control, which is a bearish sign and could foreshadow a correction.