The violent sell-off was reminiscent of previous market crashes, leading many to fear that a similar downturn could be coming.

Is the market rebalancing?

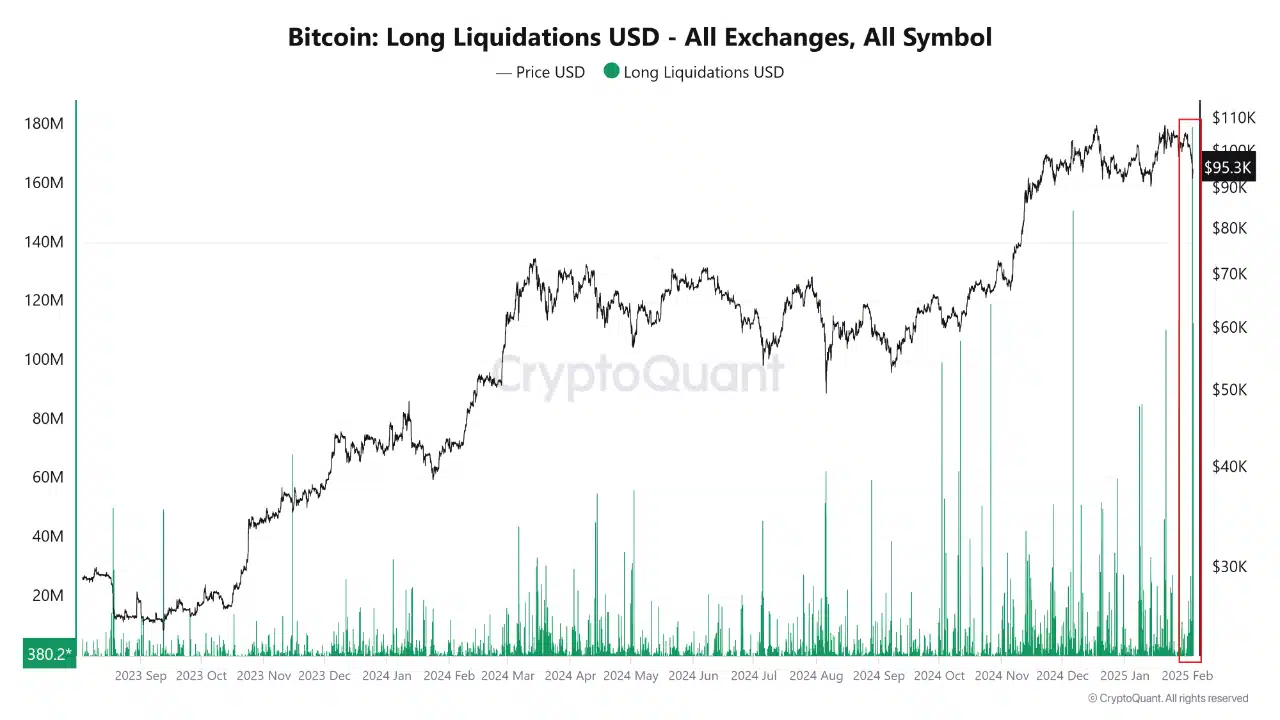

Recent data shows that Bitcoin long liquidations have reached their highest level since September 2023.

The latest total liquidations exceeded $180 million, indicating strong confidence among traders in the uptrend before the sudden price drop. BTC’s drop to around $95,300 triggered a series of forced sell-offs that wiped out a slew of leveraged long positions. Confidence in the upside momentum was quickly extinguished, creating a large-scale liquidation.

The sharp increase in liquidations in late January and early February showed that leverage was too high. This caught many leveraged traders by surprise, leading to one of the largest market corrections in recent times.

Bitcoin: Causes and Effects of the Price Drop

The sudden price drop of BTC was caused by several important factors. Overleverage was the main cause, as highly leveraged traders were forced to sell off as prices fell, creating a chain reaction of liquidations.

In addition, macroeconomic instability, including concerns about monetary policy or new regulations, also caused investors to panic and contributed to the sharp sell-off.

The sharp drop in Bitcoin had significant effects. The mass liquidation event wiped out many overleveraged traders, helping the market reset to a more reasonable leverage level.

In addition, price volatility increased, leading to strong swings. However, once excess leverage has been removed, the market may be in a better position to recover in a more stable and sustainable manner.