Bitcoin has dropped to $96K amid a sharp decline in network activity, which has fallen to its lowest level in a year. According to CryptoQuant, Bitcoin’s network activity index hovers around 3,760—the lowest since February 2024—indicating a 15% decline from its all-time high in November 2024.

CryptoQuant’s weekly report explains that this index tracks key Bitcoin metrics such as block size, active addresses, and transaction volume. The downturn suggests a broad slowdown across nearly all aspects of the Bitcoin network. Notably, the index has fallen below its 365-day moving average for the first time since July 2021, when China banned Bitcoin mining.

A closer look at different segments of the Bitcoin network reveals a sharp drop in activity. The number of active addresses and transactions has seen double-digit declines. Daily transaction volume has plunged 53% from its all-time high of 734,000 in September 2024 to just 346,000—the lowest level since March 2024.

Similarly, the number of active Bitcoin addresses has dropped by 20%, falling from 1.14 million in November 2023 to 942,000 today—the lowest level since October 2024.

Bitcoin miners are also feeling the pressure as total transaction fees have declined due to reduced network activity. Daily transaction fees now stand at $593,000, a sharp drop from late October 2024, when local peak fees reached $4.7 million. Transaction fees currently account for just 1.8% of Bitcoin miners’ total revenue, signaling lower profitability for this segment of the market.

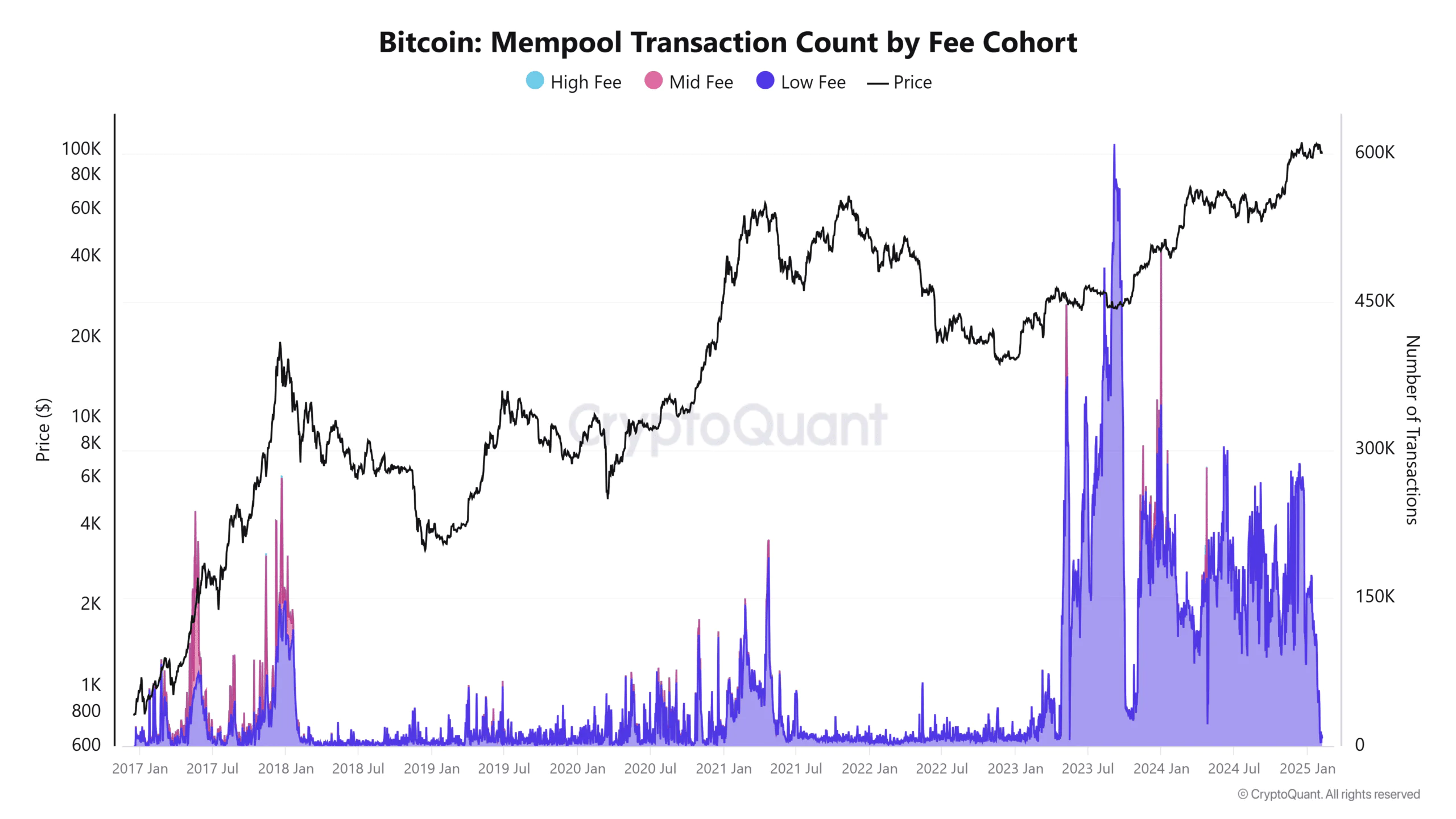

Moreover, the sluggish network activity is evident in Bitcoin’s nearly empty mempool. The number of pending transactions awaiting block confirmation has plummeted by 99%, from 287,000 in December 2024 to just 3,000 today. According to CryptoQuant, the mempool hasn’t been this empty since March 2022, during the last major bear market.

In addition to the nearly vacant mempool, Bitcoin’s network has also seen a dramatic collapse in the use of the Runes protocol. Designed for minting tokens on the Bitcoin blockchain, Runes drove daily OP RETURN outputs to a peak of 802,000 when the protocol launched in April 2024. However, that number has now plunged to just 10,000, indicating a significant decline in the use of OP RETURN in Bitcoin transactions.