Bitcoin briefly dipped to $93,500 yesterday before rebounding to its current level. Over the past two weeks, BTC has remained below the $100,000 mark, with technical indicators reflecting an ongoing battle between buyers and sellers. Despite attempts at recovery, the cryptocurrency remains in a sideways trend, facing strong resistance levels that prevent a breakout.

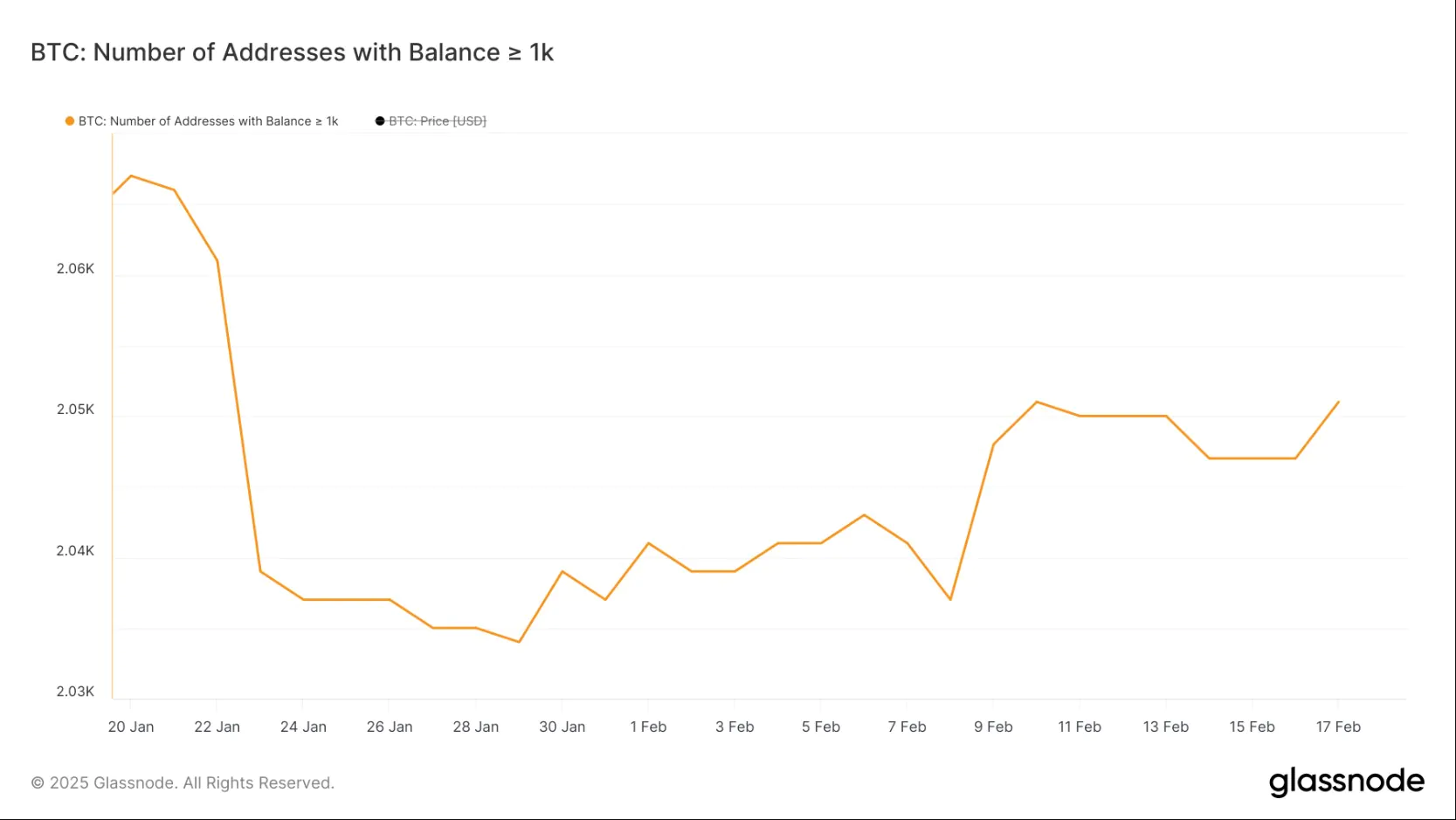

The number of Bitcoin whales has seen a slight uptick, signaling some accumulation. However, it remains significantly lower than the peaks observed in December and January. Whether BTC regains upward momentum or continues to face selling pressure will depend on how it reacts to key support and resistance levels in the coming days.

Currently, the number of Bitcoin whale addresses—wallets holding over 1,000 BTC—has increased to 2,051, up from 2,037 ten days ago. Tracking these large holders is crucial, as their accumulation or distribution often signals potential shifts in market sentiment.

A rise in whale numbers typically suggests growing confidence in BTC’s long-term value, as these major holders tend to buy during perceived undervaluations. Conversely, a decline in whale addresses could indicate distribution, potentially leading to increased selling pressure and a price downturn.

While the recent increase in whale addresses hints at renewed accumulation, the overall count remains well below levels seen in December and January. This suggests that although some large investors are returning, institutional and long-term investor confidence has yet to fully recover.

If the number of whales continues to grow, it could support a more sustained bullish trend. However, if the increase stalls or reverses, it may signal lingering uncertainty in the market.