Bitcoin first closed above $100,000 on December 8, but has since corrected steadily until now, before once again surpassing this important price level. Analyst Posty noted that BTC’s current price action is reminiscent of the bull run in Q1 2021.

Based on the law of diminishing returns in four-year cycles, if BTC continues to follow the pattern of the previous cycle, the price of Bitcoin could reach around $138,000 by February. Meanwhile, another analyst predicted, “If we follow a similar trajectory, the price of Bitcoin could reach $200,000.”

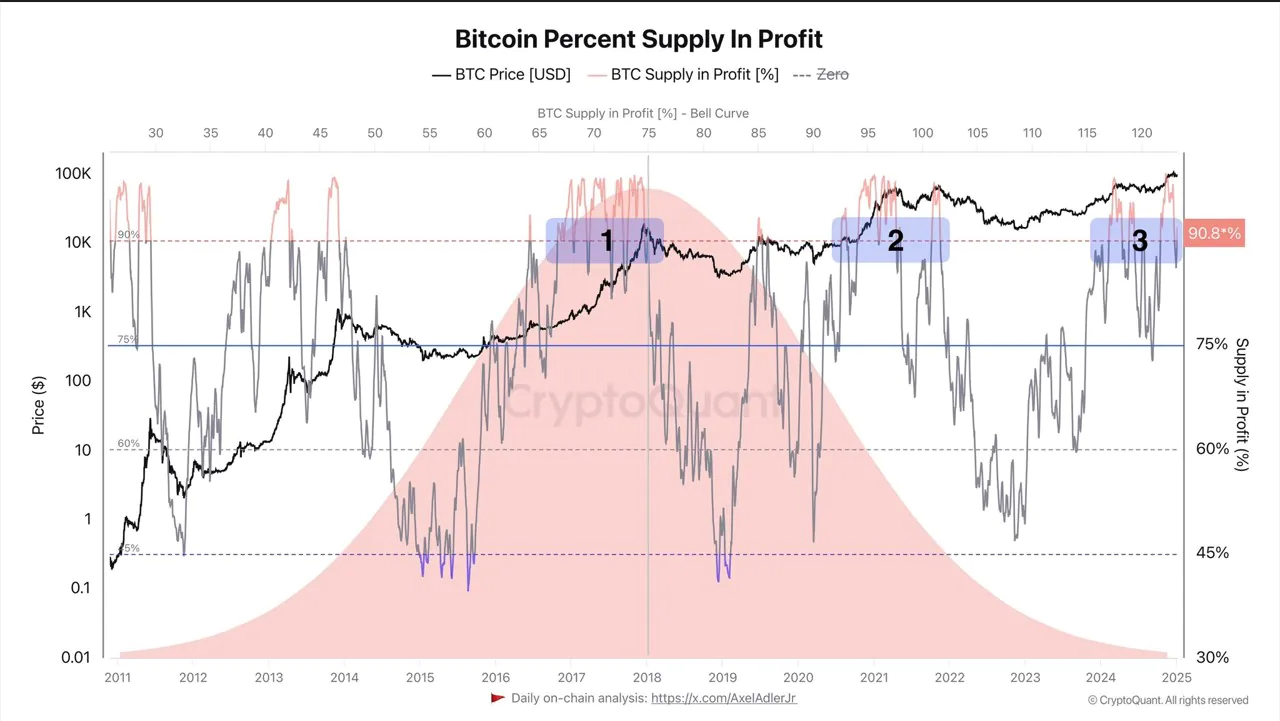

In addition, Axel Adler Jr. noted that 90% of the total Bitcoin supply is currently profitable. Barring a “black swan” event in the current cycle, BTC withdrawals are likely to be minimal, similar to the 2017 bull run rather than 2021, when China’s Bitcoin mining ban temporarily halted the uptrend.

After a sharp sell-off from December 18 to January 2, Bitcoin premiums on Coinbase returned to neutral levels on January 4. According to CryptoQuant analyst IT Tech, the premium’s recovery to breakeven levels suggests “a return to improved sentiment among institutional and U.S. investors.” However, Coinbase premiums largely reflect U.S. retail investor sentiment rather than institutional.

Read more: Nokia Officially Enters the Blockchain Sector

Total Bitcoin retail investor trading volume has plummeted since BTC hit $108,000 last month. The 30-day sustained volatility in retail trading volume below $10,000 has dropped to a low similar to September 2024.