With strong demand and improving market sentiment, Bitcoin is likely to hit its two-month high of $69,000. This analysis dives into the key factors driving this potential bullish trend.

Bitcoin Miners Could Play a Key Role

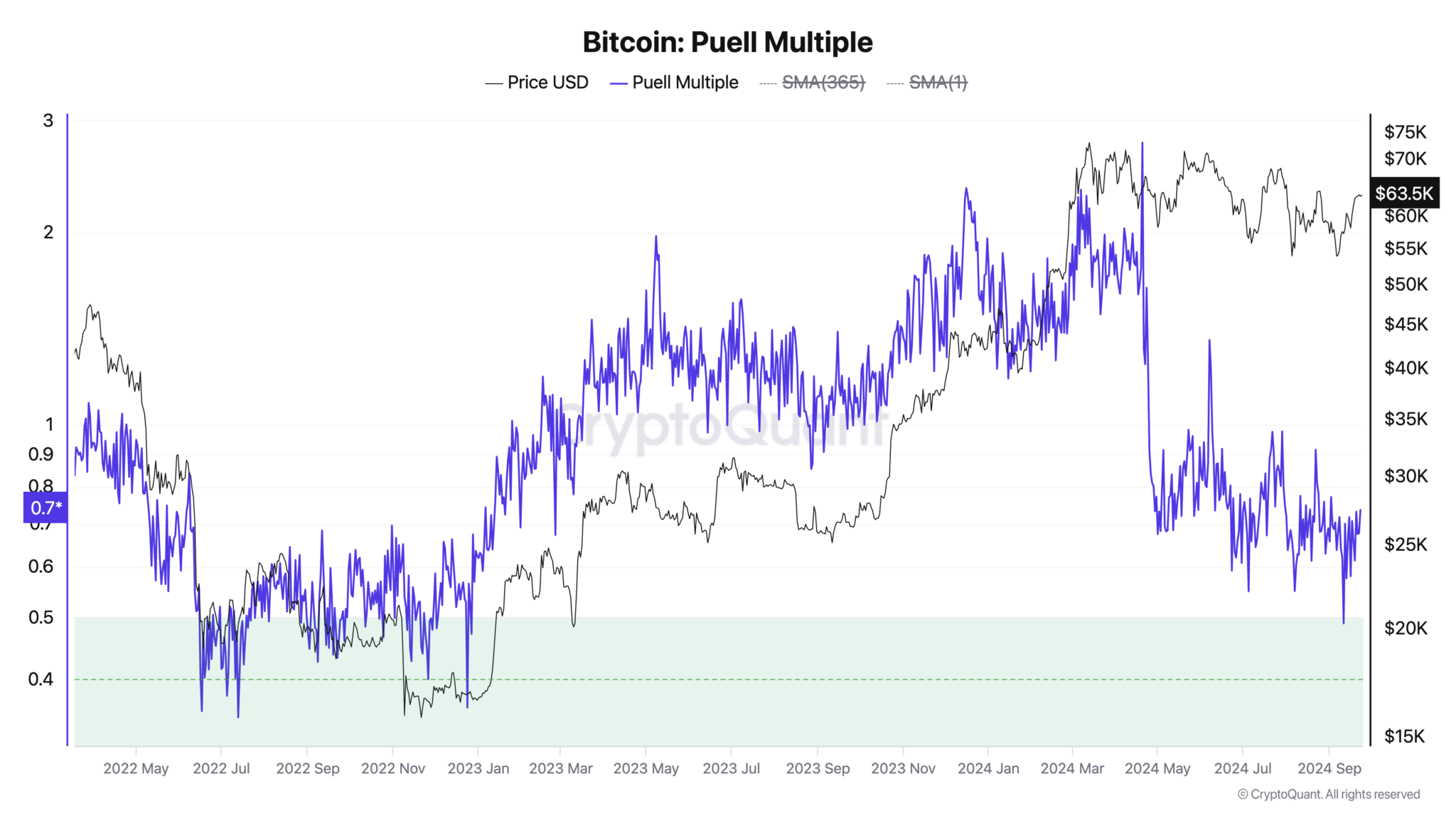

Based on Bitcoin’s Puell Multiple, there are signs that the coin could be poised for a long-term rally. For the first time since the end of the bear market in 2022, the index, which measures Bitcoin miner profitability, has entered the “green zone” at 0.5.

When BTC’s Puell Multiple exceeds 4, the market is said to have entered the “red zone,” where miners are making significant profits. This is typically a sign of a market top, accompanied by increased selling pressure and a downward trend in prices.

Conversely, when the Puell Multiple drops into the “green zone,” mining profitability is much lower than usual. This phase typically leads to price increases, as low profitability forces miners to scale back or shut down operations, reducing the supply of BTC and pushing its value higher.

In a recent blog post, CryptoQuant contributor Darkfost confirmed this trend.

“Historically, when Bitcoin hits the green zone, the price usually increases. Conversely, when it hits the red zone, the market usually decreases,” the analyst noted.

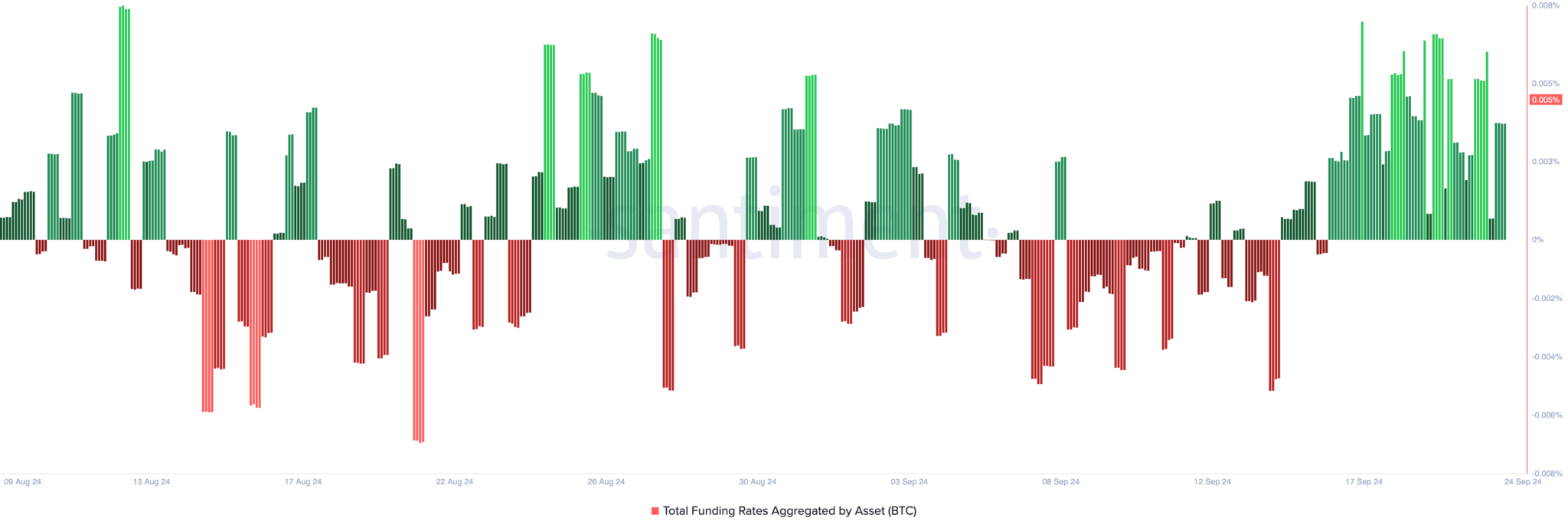

Bitcoin’s positive funding rate since September 15 is another positive signal that its price could continue to rise. At the time of writing, this funding rate, which represents a recurring fee to keep the contract price in line with the spot price, is at 0.005%.

A positive funding rate reflects the expectation of the majority of traders that the price will continue to rise, leading to higher demand for buying than selling.

BTC Price Prediction: $69,000 Could Be Near If History Repeats

If the historical trend repeats itself and the indicators from Bitcoin’s Puell Multiple are correct, the cryptocurrency is likely to continue its uptrend, with a potential recovery to the resistance level of $67,078. If Bitcoin successfully breaks through this level, it could head towards $69,000, a level it last touched in July.

However, if the expected consolidation fails to materialize and selling pressure increases, Bitcoin could fall to $54,672.