Bitcoin is currently trading around $57,700, edging closer to the critical $60,000 level, as the market shows signs of recovery. However, it remains trapped in a downward trend. For a more bullish scenario, a confirmed close above $60,000 would be ideal.

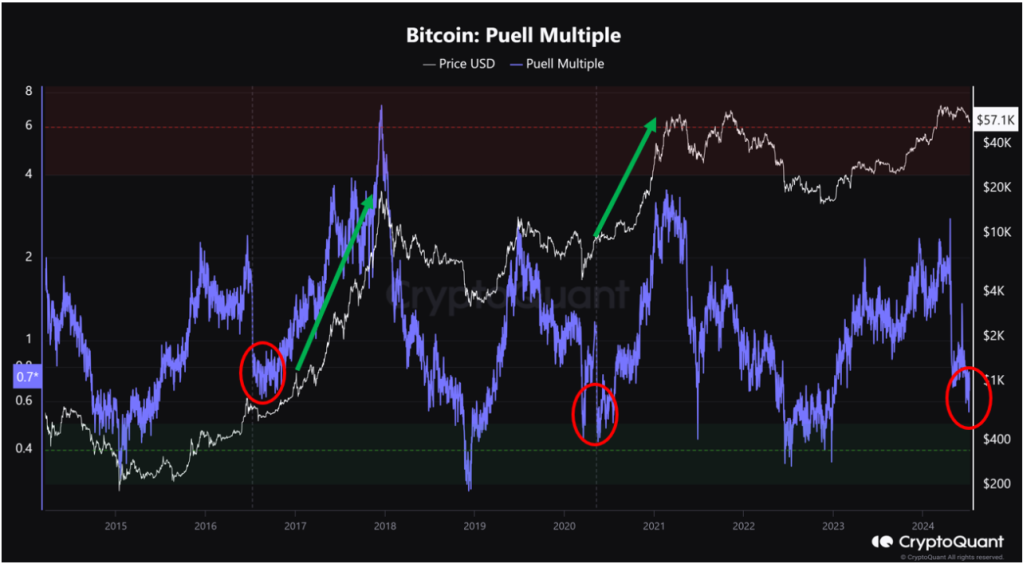

Given the recent strong sell-off that pushed BTC down to a low of $53,500, there is still optimism. Some traders believe Bitcoin is preparing for a stronger rally, as indicated by the Puell Multiple. This essential tool helps assess miner profitability across various price levels, determining whether Bitcoin is overpriced or undervalued.

According to CryptoQuant data, the Bitcoin market may have hit a bottom, with last week’s downturn serving as a rebound from June’s decline. By analyzing the Puell Multiple, users can predict whether the correction has concluded or is just beginning.

Historically, when this indicator is low, it often signals a favorable buying opportunity for traders calculating price bottoms during market downturns. Identifying such entry points becomes easier when considering the Puell Multiple.

Bitcoin’s Puell Multiple is currently decreasing, following a pattern observed in 2016 and 2020 before significant price surges. This suggests that the ongoing decline has compelled long-term holders to liquidate their positions, potentially signaling its end. However, whether the subsequent price increase is in its early stages remains to be seen.

As of now, Bitcoin has remained stable, recovering 7% from its lowest point in July 2024. Despite lingering optimism, the recent breach of the May and June 2024 lows indicates bearish control.

Related: Comparing ETH with BTC Before ETF Launch

For the upward trend to continue, as previously mentioned, buyers must close above $60,000. Yet, more conservative traders may look for confirmed closures above $66,000 and $72,000, signaling significant trend changes. In such a scenario, Bitcoin could retest and even surpass $73,800.