The Australian Securities Exchange (ASX) listed the VanEck Bitcoin Exchange Traded Fund (ETF) on Thursday, marking it as the platform’s first spot bitcoin ETF.

According to VanEck’s website, the VanEck Bitcoin ETF, trading under the ticker VBTC, had net assets totaling approximately AUD 982,850 (USD 655,560) as of Wednesday. VBTC serves as a feeder fund, enabling investors to gain exposure to bitcoin by investing in the VanEck Bitcoin Trust (HODL) listed in the United States.

“While Bitcoin can be traded through cryptocurrency exchanges, gaining exposure to Bitcoin through an ETF on an exchange like ASX allows you to buy and sell these units via a traditional brokerage account, simplifying the process and broadening access for more Australians,” said Andrew Campion, ASX’s General Manager of Investment Products and Strategy, in a statement.

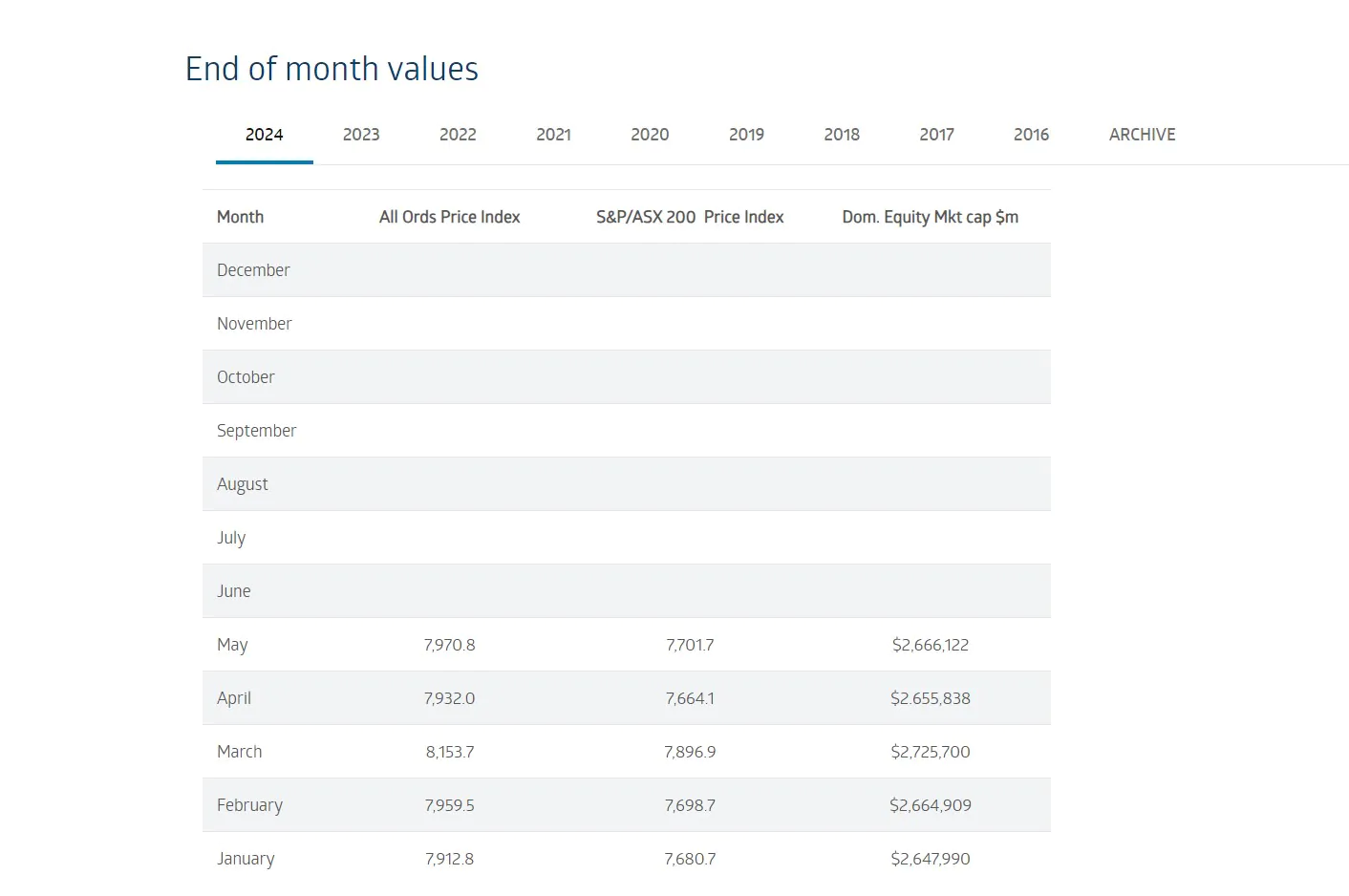

ASX is Australia’s premier stock exchange, handling about 80% of local trades. As of May, ASX had a domestic market capitalization of USD 2.6 trillion, according to its website.

Earlier this year, it was reported that ASX was preparing to list its first bitcoin ETF, noting that several issuers besides VanEck had filed applications. This list includes local issuers BetaShares and DigitalX.

Related: Binance Announces MEW Memecoin Listing on Binance Futures

In addition to ASX, Australia’s second-largest stock exchange, Cboe Australia, approved the Monochrome Bitcoin ETF (IBTC) earlier this month. Australian investors have been trading spot bitcoin ETFs, with Global X 21Shares Bitcoin and Ethereum ETFs listed on Cboe in April 2022.

The United States introduced its first spot cryptocurrency ETF in January. Since then, 11 spot bitcoin ETFs in the U.S. have accumulated total net assets of $56.06 billion, exceeding expectations prior to their launch. Hong Kong also introduced spot ETFs for bitcoin and ether in April, which have amassed over $1.38 billion in total net assets.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

And yes we will see what happens next year for me and my mom will see if you have my mom