At block 839,856, the Bitcoin network is only 144 blocks away from the next halving event, at block 840,000. History shows that Bitcoin prices often increase sharply after each halving. However, there are opinions that this scenario may not follow the rules that have happened before. This week, the founder of the stock-to-flow (S2F) price model, Plan B, mentioned that the upcoming halving event will likely follow the historical trend, no deviation from with past models.

As the halving day approaches, analysts predict that the new period may re-price Bitcoin. Since its inception in 2009, Bitcoin has gone through three halvings, each time seeing a significant price jump. Specifically, after the 2012 halving, the price of BTC increased by 9,500% and after the 2016 event, the price increased another 3,000% in the following year.

Growth after the 2020 halving was less noisy, reaching only 650%. In contrast to previous times, BTC increased by 110% before the upcoming halving. This has led some to speculate that the current situation may be different from the past. Many people believe that the halving event could lead to a “news selling” phenomenon, which could cause the price of BTC to “drop deeply”.

These precautions

Recently, Bitwise, an asset management company, expressed caution, stating that the upcoming Bitcoin halving event could be a “sell the news” situation. The cryptocurrency community is enthusiastically discussing and evaluating whether this is a case of “selling rumors”. Meanwhile, JPMorgan has forecast that BTC could touch $42k post-halving, while global asset management firm Alliance Bernstein has an opposing view.

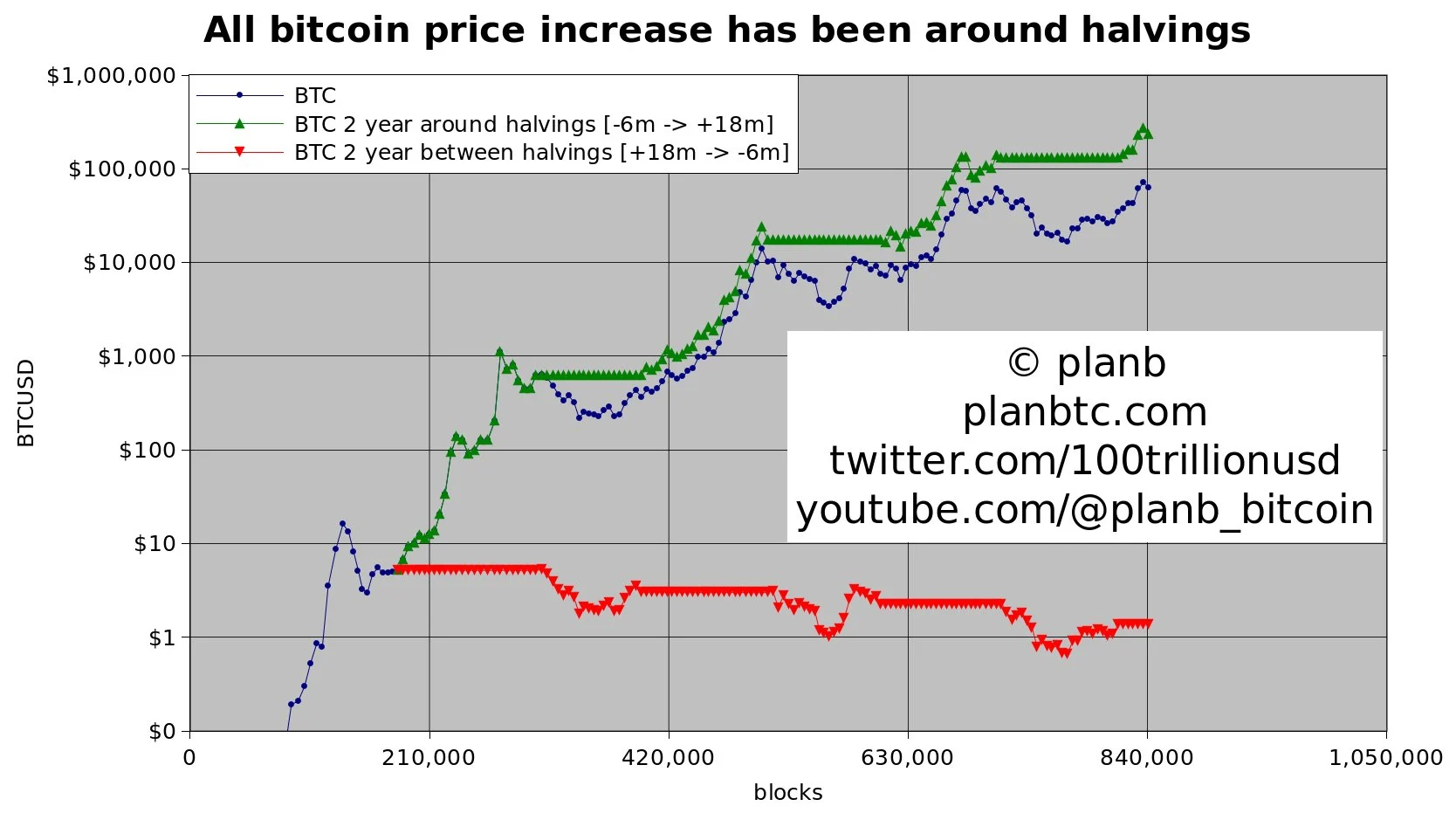

The creator of the S2F model, Plan B, confidently believes that the upcoming Bitcoin halving event will not change the established rules. “In my opinion, this halving event will be no different,” the analyst emphasized in a post on X on Wednesday. “Bitcoin’s bullish phase will occur around the halving. Buying 6 months before the event and selling 18 months after the event (green line) will be more efficient than buying and holding. BTC will surpass $100k in 2024. BTC could peak over $300k in 2025.”

IMO this bitcoin halving will NOT be different:

– All bitcoin price increase will again be around the halving

– Buying 6m before the halving and selling 18m after the halving (green line) will outperform buy&hold

– BTC > $100k in 2024

– BTC top > $300k in 2025 pic.twitter.com/lCZjnuoYMO— PlanB (@100trillionUSD) April 17, 2024

In response, Adam Back from Blockstream commented on Plan B’s analysis, saying, “[I] think Bitcoin will surpass gold in the next market cycle.” Plan B seconded this view, “I agree, Bitcoin will surpass gold as it will have twice the scarcity/S2F. ‘My BTC peak of over $300K was the low between 250K and 1 million dollars. Last cycle I set the highest target and BTC chose a lower level, let’s see how it will be this time,’ the analyst added.

Related: Bitcoin Drops as the World Hosts Halving Parties

Optimistic forecasts

Plan B’s insights come amid a flurry of recent optimistic forecasts. This week, a finder.com survey of fintech and cryptocurrency experts predicted that BTC could reach a high of around $122,000 this year and then stabilize at around 109,000. USD at the end of the year. Still, one critic pointed out shortcomings in Plan B’s previous forecasts. “Wow, your predictions weren’t very accurate a few years ago,” the person said. “That’s fine by me,” Plan B commented, unfazed by the comment.

Plan B asserts, “I predicted $55k in March 2019 when BTC was under $4k, so at current levels of $62k, I (and all S2F followers ) made a 15-fold return.”

Hay