XRP Technical Analysis and Upcoming Price Levels

XRP is currently facing strong resistance around the $0.75 level. Previously, this level created strong selling pressure, leading to a price drop. However, since March 2024, the price has reached this level again and the market sentiment has changed as investors and traders are now focused on higher prices.

Based on the recent price action and historical momentum, if XRP can break through the resistance and close the daily candle above $0.76, there is a high possibility that the price could increase by 75% to $1.36 in the coming days.

However, this target is not easy to achieve as there is a resistance near $0.95, which could act as an obstacle and potentially halt XRP’s upside momentum.

XRP is currently trading above the 200 exponential moving average (EMA) on both the daily and weekly timeframes. Meanwhile, XRP’s relative strength index (RSI) suggests that the uptrend is likely to continue in the coming days, as it is in the oversold zone.

Positive On-Chain Growth Indicators

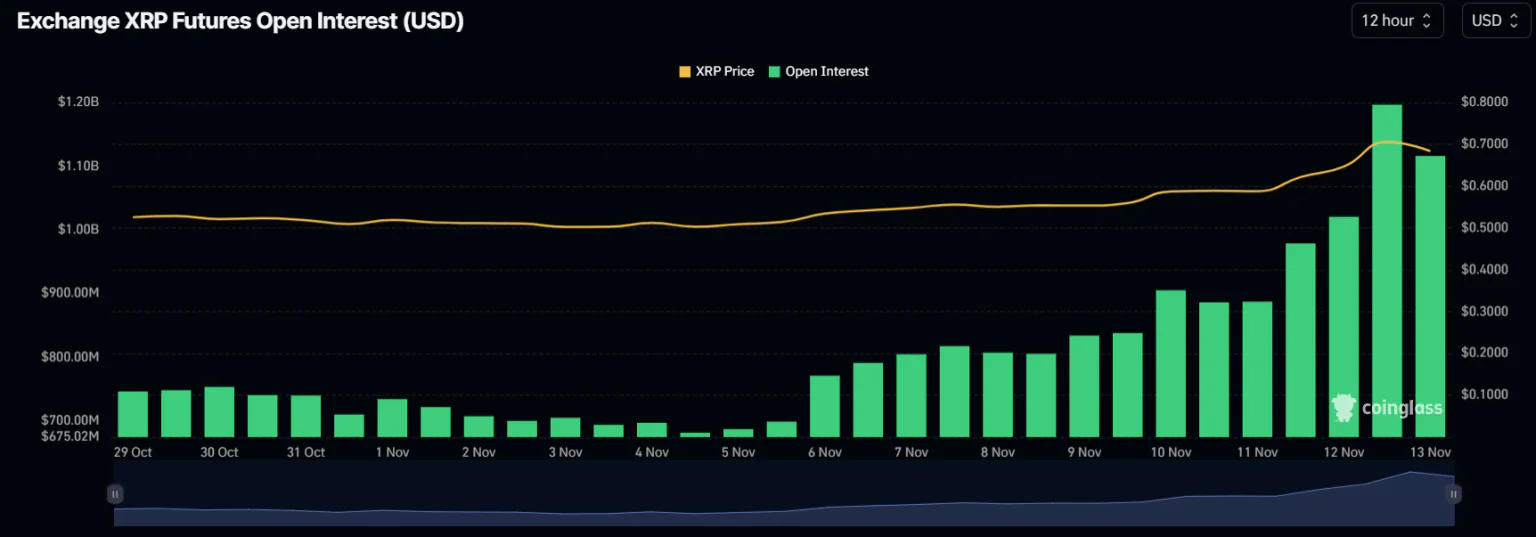

Along with the bullish technical analysis, on-chain indicators also reinforce the positive outlook for XRP. According to blockchain analytics firm Coinglass, XRP’s open interest (OI) has surged by 22% in the past 24 hours and 7.25% in the last four hours. This increase suggests that traders are heavily participating in the XRP token as it approaches a breakout level, which is a bullish signal.

According to data from Coinglass, at the moment, the major liquidation levels are at $0.657 below and $0.736 above, with many traders using excessive leverage at these levels. Specifically, there are currently approximately $47.56 million and $31.72 million worth of open positions at these liquidation levels, and these positions will be liquidated if the XRP price moves in either direction. At the time of writing, XRP is trading at around $0.68 and has gained 13.5% over the past 24 hours. During the same time period, XRP’s trading volume has spiked 170%, indicating strong participation from traders and investors as XRP approaches a potential breakout.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE