BTC Dominance (BTC.D or Bitcoin Dominance) is one of the important indicators used by many traders to make decisions when investing in any coin/token. So what is Bitcoin Dominance and how is BTC.D used? Follow this article to get your answer.

What is BTC Dominance (BTC.D)?

BTC Dominance is a term that refers to the percentage of Bitcoin capitalization divided by the total cryptocurrency market capitalization. This ratio represents the dominance, dominance or market demand for Bitcoin over other Altcoins.

For example, BTC Dominance is at 49%, this can be interpreted as BTC capitalization accounting for 49% of the total market cap and altcoins (coins/tokens other than BTC) accounting for 51% of the total market capitalization.

As the first and largest cryptocurrency, at the time of launch, Bitcoin had BTC.D at 100% at ATH (All-time high). However, as the market matured and more tokens began to appear, it gradually lost its dominance and once reached an ATL (All-time low) of 35.41%.

Users can easily find BTC Dominance index when accessing sites such as coinmarketcap.com, coingecko.com….., it is an important indicator used by many Holders and Traders in their campaigns. your trading strategy.

How to calculate BTC Dominance.

BTC Dominance is calculated by taking the ratio of Bitcoin’s market capitalization to the total crypto market capitalization.

Example: The data provided by coinecko.com as of now (August 17, 2023) shows that the Cryptocurrency Market Cap is $1.179 trillion, while that of Bitcoin is $556 billion. From that, we can calculate Bitcoin Dominance as 47.2% (556/1179 * 100%).

How Bitcoin & Money Flow in Crypto

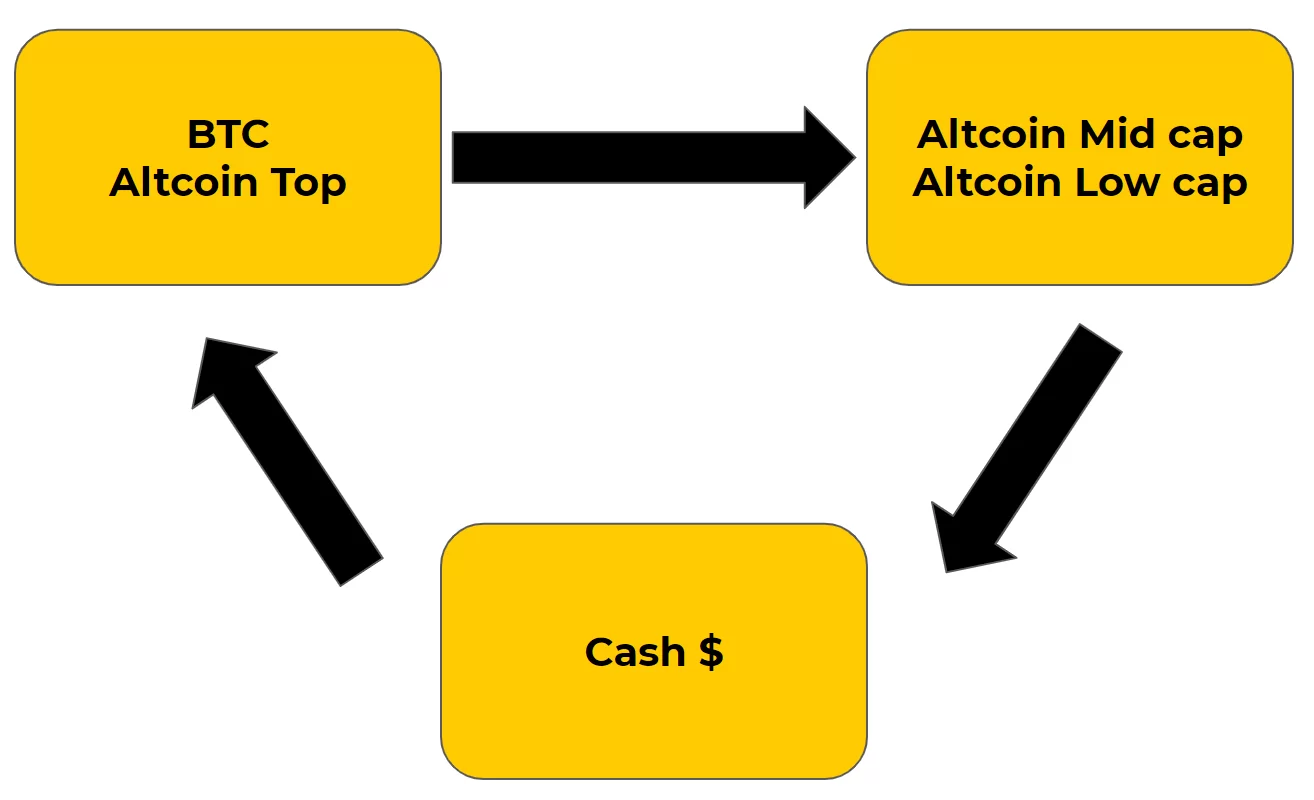

The Crypto market has its own characteristics, the money flow in this market does not pour evenly into the market or into each project, but tends to pour from the top down.

BTC → Top Altcoin → Altcoin Mid cap and Low cap → Cash → BTC… The flow of money circulating in Crypto tends to pour from the top

Of course, this is a general trend, in the market there will still be exceptions such as: affected by news, events, fundamental analysis factors, ..

How to use BTC.D to trade and invest?

By combining BTC price trend analysis and BTC Dominance, we will get some trading strategies on a case-by-case basis.

BTC.D rises

BTC Price Rises: Money is flowing from altcoins to BTC.

BTC Price Falling: The entire crypto market as a whole is down.

BTC Price Flat: Investors are taking profits from altcoins to Fiat/BTC.

BTC.D drops

BTC Price Rises: Money is flowing into BTC, which could drag altcoins and the entire market with it.

BTC Price Falling: The entire crypto market as a whole is down.

BTC Price Flat: Money is flowing from BTC to altcoins. Bitcoin’s sideways movement means it will have little impact on the price of altcoins, allowing them to grow freely. Good fundamental altcoins will surge during this period.

BTC.D is flat

BTC Price Rises: Money is flowing from outside crypto to BTC.

BTC Price Falling: The entire crypto market as a whole is down.

BTC Price Flat: BTC stands still, allowing altcoins to grow unaffected.

Specifically, the strategy in the first line can be interpreted as: When BTC.D increases ⇒ BTC price will increase ⇒ investors should buy BTC to make a profit, or those who are holding BTC can consider to take profits in the near future.

These strategies can be combined with flexibility with Holder’s or Trader’s trading strategies including Hold, derivatives trading.

Read more: How to Buy Bitcoin and Profit From It?

How to determine the trend of BTC.D

Interestingly, BTC Dominance can also be identified like a token or coin price chart with indicators in technical analysis such as: MA, EMA, Ichimoku, support, resistance, patterns, RSI … Investors can consider BTC.D like a coin and analyze the ups and downs based on the above indicators.

Limitations of BTC.D Index

In fact, the approach to Bitcoin Dominance above is oriented towards technical analysis, so the process of determining BTC Dominance will also have the same limitations as technical analysis such as:

Analysis may have errors: The main feature of technical analysis is to use past data to predict the future, so errors are inevitable.

Relativity: At the same time, the same chart, the same indicators, but 2 analysts can make 2 opposite opinions. Therefore, BTC.D is only approximate, not completely accurate.

There are always conflicting opinions.

Because of the above limitations, we think that, when investing with BTC.D, you should not All-in but need to have a reasonable capital allocation plan such as applying price averaging strategy. In addition, you can also combine with fundamental analysis to choose the right coin, then use technical analysis to Timing, choose the optimal entry point.

Is Bitcoin Dominance a Reliable Indicator?

– In fact, the approach to Bitcoin Dominance above is oriented towards technical analysis, therefore, the process of determining BTC Dom will also have the same limitations as technical analysis such as: there may be errors, relativity, there are always conflicting opinions,…

– The cryptocurrency market is a complex ecosystem. Therefore, no system can be simplified using only one indicator. Bitcoin Dominance is just one of many metrics that can describe the current market.

– Therefore, relying solely on BTC.D as an indicator can lead to unwarranted expectations. It is also worth noting that recently, the number of new altcoins is really increasing, pulling the BTC.D ratio lower.

– Plus, if the number of altcoins continues to expand in the future, that could also have a huge impact on Bitcoin and push dominance lower, or even reach new ATLs. If this really happens, then Bitcoin Dominance will no longer be useful.

Conclusion.

BTC Dominance is one of the most useful tools for users in the crypto market. Depending on the trend in Bitcoin’s rate and price, an investor can determine which trend is stronger for Altcoins or Bitcoins.

However, BTC Dominance will have a certain limit. Since the crypto market is new, it is possible that more Altcoins will appear directly, more in the next few years, making the index obsolete. But at least for now, Bitcoin Dominance data can help investors understand Crypto market conditions better. Hope this article is useful to you when you are learning about BTC Dominance.