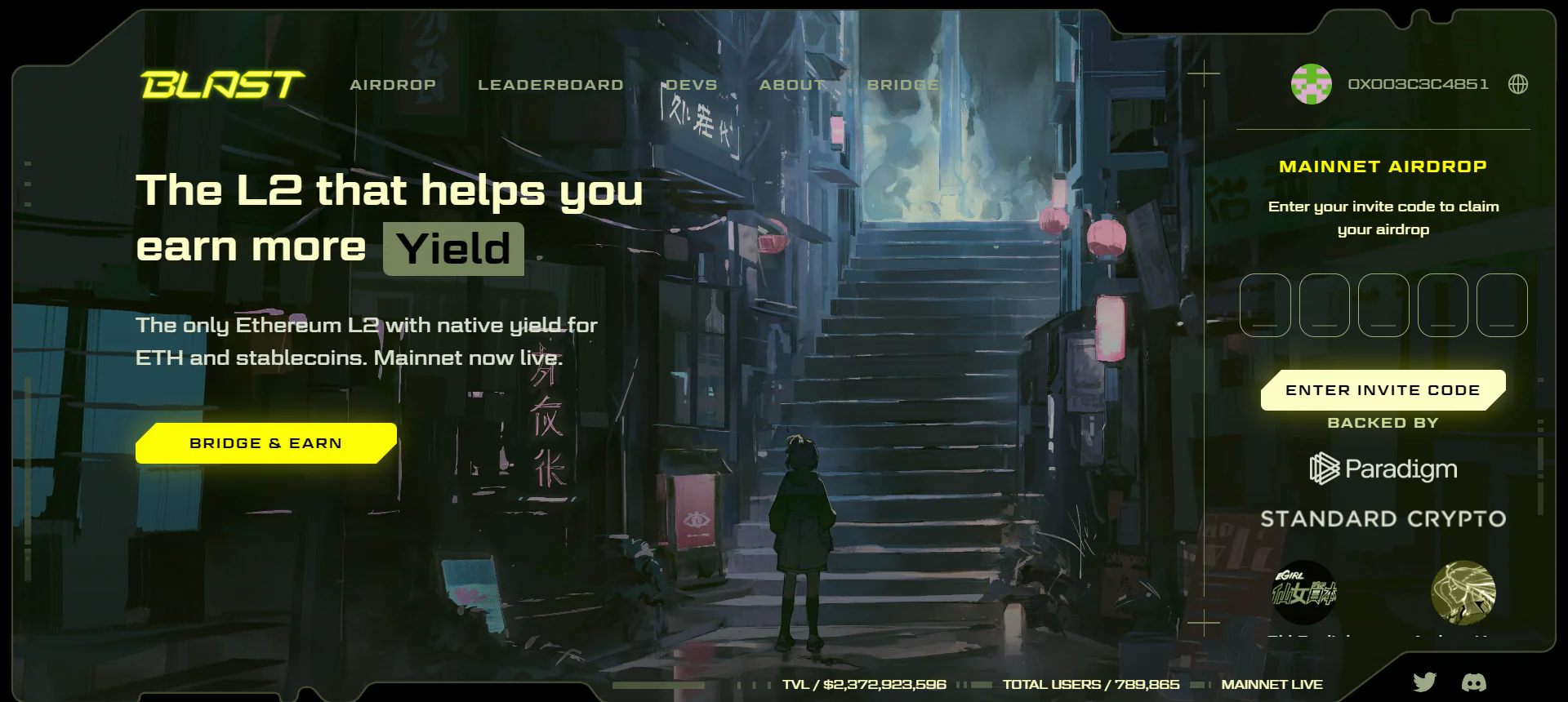

What is Blast?

Blast is a Layer-2 solution built on Ethereum’s Optimistic Rollup technology, fully compatible with the Ethereum Virtual Machine (EVM). It enables users to earn interest by participating in staking on the Ethereum network, with an anticipated initial deployment rate of 4% for ETH and 5% for stablecoins.

The project has attracted $20 million from three major investment funds, with the participation of notable figures like Andrew Kang from Mechanism Capital and Hasu from Lido Finance.

How does Blast operate?

Auto Rebasing:

Users conduct transactions using ETH, and Dapps are built around ETH. Blast is designed to optimize the direct use of ETH on Layer-2, featuring Auto Rebasing to automatically update user balances on Blast contracts.

Layer 1 Staking:

After Ethereum’s Shanghai upgrade, Blast became available. The ETH yield from staking on L1, initially from Lido, is automatically transferred to users through the ETH rebase process on L2.

T-Bill Yield:

Users converting stablecoins receive USDB, an automatically updating stablecoin. The yield for USDB comes from MakerDAO’s T-Bill protocol on-chain, and USDB can be converted back to USDC when transitioning back to Ethereum.

Key features of Blast

Most L2 solutions lack profitability, causing the gradual depreciation of user asset values over time. Blast is the first L2 to combine natural productivity; your balance on Blast compounds automatically.

Productivity surges from ETH staking and the RWA protocol. Profits from these decentralized protocols are automatically transferred back to users. The default interest rate on other L2s is 0%, but on Blast, it is 4% for ETH and 5% for stablecoins.

Specifically, Blast introduces an ETH staking product, generating profits, creating new revenue streams, and providing rewards for end-users.

Regarding gas fee revenue, Blast doesn’t retain this amount like most other Layer-2 solutions; instead, it is directed towards developers as part of the program. This means the project operations can subsidize gas fees for users.

Table comparing some advantages and disadvantages between Blast with Optimism and Arbitrum

Furthermore, Blast is currently offering an opportunity to accumulate Points through early participation. The rewards will be evenly split 50-50 between users and developers, expected to conclude in May 2024 (simultaneously with the end of Blur Season 3).

Related: Participate in Airdrop of Layer 2 Blast

Development Team

The development team of Blast is led by Pacman from Blur, with other members coming from FAANG, Yale, MIT, Nanyang Technological University, Seoul National University, and with experience working on various major protocols in the DeFi and Web3 space, primarily on Ethereum and Solana.

Roadmap

The anticipated deployment roadmap is as follows:

– November 21, 2023: Profit from earn yield and Blast Points.

– February 24, 2024: Mainnet – Dapp goes live, allowing withdrawals.

– May 24, 2024: Rewards Conversion – Converting Points into rewards.

Conclusion

The tight collaboration between Blast and Blur establishes an ideal foundation for a new Layer-2, similar to how Coinbase developed Base. Readers can experience the product early and look forward to new and unique features in the near future.

Through the article “What Is Blast? What’s Remarkable About The Layer-2 Project Calling For 20M Capital?” we have provided an overview of the Blast project. If readers still have questions, they can leave comments below for us to discuss together!