One of the most pivotal events on Bitcoin’s blockchain is a halving when the reward for mining is cut in half. For investors in the crypto market, Bitcoin halving is a desirable event as it is the main factor that is expected to drive a new uptrend in the market.

So what is the Bitcoin halving? How does it affect the bitcoin price in particular and the crypto market in general? Invite readers to discover the answer to the above question through the following article of AZCoiner.

What is Bitcoin Halving

Bitcoin halving is when the reward for Bitcoin mining is cut in half. Halving takes place every four years.

The halving policy was written into Bitcoin’s mining algorithm to counteract inflation by maintaining scarcity. In theory, the reduction in the pace of Bitcoin issuance means that the price will increase if demand remains the same.

This rewards system will continue until about 2140 when the proposed limit of 21 million coins is reached. At that point, miners will be rewarded with fees for processing transactions, which network users will pay. These fees ensure miners are still incentivized to participate and keep the network going.

Read more: What is Bitcoin? Why was Bitcoin Created?

How many times has the Bitcoin halving event happened?

After the network mines 210,000 blocks—roughly every four years—the block reward given to Bitcoin miners for processing transactions is cut in half. The reward, or subsidy, for mining, started at 50 BTC per block when Bitcoin was released in 2009. The amount drops in half each time a new halving takes place.

As of August 2023, the bitcoin halving event has occurred 3 times:

- Nov. 28, 2012, to 25 bitcoins

- July 9, 2016, to 12.5 bitcoins

- May 11, 2020, to 6.25 bitcoin

It is calculated that there will only be 32 Bitcoin halving events, after that, there will be no more halving events and no more Bitcoins will be created because the number of Bitcoins has reached the maximum supply.

When is the next Bitcoin halving?

The Bitcoin algorithm dictates that the halving occurs based on the generation of certain blocks. No one knows exactly when the next halving will take place, but experts say the next halving will take place around May 2024 and the block reward will be 3.125 bitcoin. That’s almost exactly four years since the last one.

Experts say the predictable nature of the Bitcoin halving is designed so that it doesn’t cause a major shock to the network.

But that doesn’t mean there won’t be surprises around Bitcoin’s next halving.

Why does Bitcoin halving occur?

Slowing Inflation

The Bitcoin halving contributes to limiting excessive inflation in the Bitcoin ecosystem. The rate at which new Bitcoin reaches the market is decreased by lowering the block reward. This restricted issuance process aims to keep the coin stable and valuable in the long term.

Scarcity and controlled supply

Satoshi Nakamoto, the person or group of people who invented Bitcoin, wanted to create a digital currency with a constrained and managed supply. Reducing the mining rewards by half decreases the rate at which new Bitcoin is generated. Due to its rising scarcity over time, Bitcoin has a valuable value proposition as a deflationary asset.

Market forces and economics

The halving event has economic repercussions for both Bitcoin miners and the broader market. Miners must modify their operations to be profitable with a lower block reward, which increases competition and drives away less productive miners. This, in turn, can impact the overall security and decentralization of the network.

Stimulating the Growth of Cryptocurrency Value

Bitcoin halving directly affects its value change per unit of time. Each halving decreases the flow of new coins into circulation, increasing the price of Bitcoin — supply decreases while demand continues to rise. This phenomenon is an economic law that works not only in the crypto market but also applies to other financial markets and trading instruments. Bitcoin’s price is expected to rise exponentially, with each halving as mining approaches the maximum number of coins that can be mined online.

How does Bitcoin Halving happen?

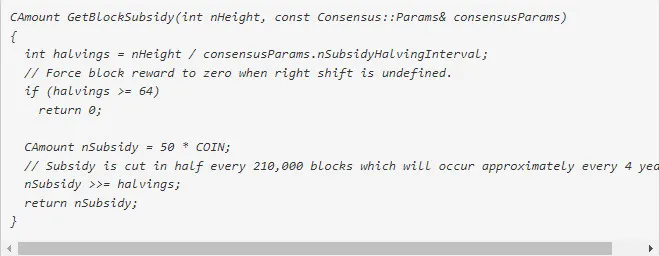

Halving happens automatically. The function to launch the halving is already built into the Bitcoin protocol. You can find this function on the Bitcoin Core Github.

One piece of Bitcoin code reads:

Accordingly, for every 210,000 blocks generated, the reward for each block will be halved. It is estimated that every 210,000 blocks are mined over a period of 4 years. During the upcoming 4th halving, the reward will be reduced from 6.25 BTC to 3.125 BTC.

What is the impact of Bitcoin halving on the crypto market?

Impact on miners.

As a rule, after each halving, the miners’ remuneration is significantly reduced, namely by half, which not only automatically reduces the profitability of mining but also increases the cost of the power required for the halving process. An increase in the cost of equipment for mining a coin can negatively affect the performance of private miners compared to mining companies since, in many cases, the former do not have enough cash and other resources compared to the latter.

On the other hand, halving fuels miners’ interest in altcoins, as their mining conditions may be much more economically and technically attractive. This will contribute to the rapid growth of those altcoins, their market capitalization, and their overall importance in the cryptocurrency ecosystem.

Impact on bitcoin price

In the past, after each Bitcoin Halving, the Bitcoin price would enter a strong bull run.

The first halving took place on November 28, 2012, when the Bitcoin price increased from $12 to $1,207 on November 28, 2013. The second halving took place on July 9, 2016, Bitcoin price from $647 rose to $18,972 on December 17, 2017. Then, within a year, the Bitcoin price dropped from that peak to $3,716 on December 17, 2018, still about 575% higher than the pre-halving price.

The last halving took place on May 11, 2020, when the Bitcoin price was at $8,821 on April 14, 2021, escalated to a peak of $63,233, up 617%. After 1 month, the price reached a record of $49,504, an increase of 461%.

The reason for the BTC price increase after each halving event is because Lower Bitcoin mining rewards will reduce the amount that miners can earn by adding new transactions to the blockchain. The miner’s reward determines the flow of new Bitcoins into circulation. According to the law of economics, when supply decreases, while demand continues to increase, prices will increase. However, this upward trend is usually not instantaneous.

Impact on the Cryptocurrency Market

Halving is not only beneficial for BTC alone but also for the entire cryptocurrency market. Currently, Bitcoin is the most popular currency in the market, considered a benchmark in the crypto world and a key reference point for the direction of market sentiment, one can observe. severe changes in the value of many altcoins with the volatility of the price of Bitcoin. Changes in altcoin values are observed not only after each Bitcoin halving but also in response to news and other factors that directly or indirectly affect the BTC price.

Conclusion.

The Bitcoin halving has big implications for its network. For miners, the Bitcoin halving that causes miners’ rewards to drop can lead to a consolidation in their ranks as individual miners and small organizations leave the mining ecosystem or are taken over by other miners play bigger takeover.

Besides, the Bitcoin halving event also greatly affects the price of BTC and other Alts in the cryptocurrency market. Based on past data and results from previous halving events, most investors believe that BTC will rise and possibly reach new ATH levels after the fourth halving takes place in 2024. So this is one of the important events that crypto investors are most interested in and look forward to in 2024.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE