Bitcoin was the first cryptocurrency on the Crypto market and it remains the most valuable — at least for now. However, Bitcoin has a lot of problems as a currency. The term “Altcoin” refers to any cryptocurrencies other than Bitcoin — in other words, they are alternatives to Bitcoin. So what is an Altcoin? What types of Altcoins are there? Find out all you need to know about altcoins with AZC News and see if investing in altcoins is right for you.

What is an altcoin?

“Altcoin” (short for “alternative coin”) means alternative coin, referring to all coins other than Bitcoin (BTC). Altcoins are similar to Bitcoin. They are cryptocurrencies that use a technology called Blockchain, which enables secure peer-to-peer transactions.

Although the concept of Blockchain was invented by the creator of Bitcoin, Bitcoin does not have a monopoly on Blockchain technology. Others can create their own cryptocurrencies and their own Blockchains and that is generally cryptocurrencies.

For example, some of the biggest Altcoins you may have heard of include Ether, Ripple, BNB, Cardano,…

Types of altcoins

Altcoins come in various flavors and categories. Here’s a brief summary of some of the types of altcoins and what they are intended to be used for.

Payment Token

As the name implies, payment tokens are designed to be used as currency—to exchange value between parties. Bitcoin is the prime example of a payment token.

Stablecoins

Cryptocurrency trading and use have been marked by volatility since launch. Stablecoins aim to reduce this overall volatility by pegging their value to a basket of goods, such as fiat currencies, precious metals, or other cryptocurrencies. The basket is meant to act as a reserve to redeem holders if the cryptocurrency fails or faces problems. Price fluctuations for stablecoins are not meant to exceed a narrow range.

Notable stablecoins include Tether’s USDT, MakerDAO’s DAI, and the USD Coin (USDC). In March 2021, payment processing giant Visa Inc. (V) announced that it would begin settling some transactions on its network in USDC over the Ethereum blockchain, with plans to roll out further stablecoin settlement capacity later in 2021.

Read more: What are Stablecoins? Learn All about Stablecoins.

Security Tokens

Security tokens are tokenized assets offered on stock markets. Tokenization is the transfer of value from an asset to a token, which is then made available to investors. Any asset can be tokenized, such as real estate or stocks. For this to work, the asset must be secured and held. Otherwise, the tokens are worthless because they wouldn’t represent anything. Security tokens are regulated by the Securities and Exchange Commission because they are designed to act as securities.

In 2021, the Bitcoin wallet firm Exodus successfully completed a Securities and Exchange Commission-qualified Reg A+ token offering, allowing for $75 million shares of common stock to be converted to tokens on the Algorand blockchain.

This was a historic event because it was the first digital asset security to offer equity in a United States-based issuer.

Utility Tokens

Utility tokens are used to provide services within a network. For example, they might be used to purchase services, pay network fees, or redeem rewards. Filecoin, which is used to buy storage space on a network and secure the information, is an example of a utility token.

Ether (ETH) is also a utility token. It is designed to be used in the Ethereum blockchain and virtual machine to pay for transactions. The stable coin USTerra uses utility tokens to attempt to maintain its peg to the dollar—which it lost on May 11, 2022—by minting and burning two utility tokens to create downward or upward pressure on its price.

Utility tokens can be purchased on exchanges and held, but they are meant to be used in the blockchain network to keep it functioning.

Read more: What Is Ethereum (ETH)? An Overview of the ETH Project

Meme Coins

As their name suggests, meme coins are inspired by a joke or a silly take on other well-known cryptocurrencies. They typically gain popularity in a short period of time, often hyped online by prominent influencers or investors attempting to exploit short-term gains.

Many refer to the sharp run-up in this type of altcoins during April and May 2021 as “meme coin season,” with hundreds of these cryptocurrencies posting enormous percentage gains based on pure speculation.

Governance Tokens

Governance tokens allow holders certain rights within a blockchain, such as voting for changes to protocols or having a say in decisions of a decentralized autonomous organization (DAO). Because they are generally native to a private blockchain and used for blockchain purposes, they are utility tokens but have come to be accepted as a separate type because of their purpose.

Altcoin Exchanges & Wallets

Altcoin Exchange

The emergence of various altcoins has led to the proliferation of cryptocurrency trading platforms, increasing market activity. However, each of these platforms comes with different security features and policies. Therefore, choosing the best and most suitable altcoin trading platform depends on a number of factors, including investor preferences.

For new investors, it is safer to choose reputable exchanges such as Binance, Coinbase, Okx… and avoid unfamiliar, unknown exchanges.

Altcoin Storage Wallet

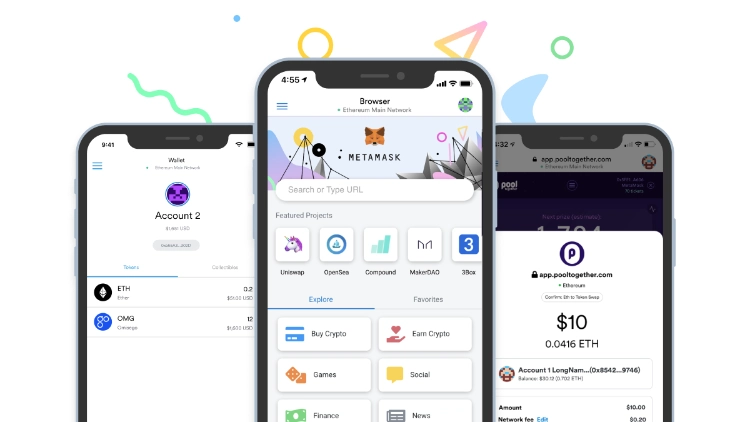

There are some people who like to keep coins right on the exchange for easy trading and exchange. However, others prefer to be safe and avoid being hacked, so they choose a reputable wallet to store.

Here are a few suggestions for you about altcoins wallets:

Hot wallets: Hot wallets store assets online, so you need to remember your private key carefully, don’t give it to anyone and store it securely to avoid the wallet being hacked.

Cold wallet: This is a physical wallet that stores coins offline, which is considered the safest method of storing coins.

Exchange wallet: Almost all exchanges today support storing assets right on the exchange. However, if the exchange is accidentally hacked, you can lose all your money.

Important Indicators for Altcoins

Market capitalization: The total market value of the circulating supply of a coin. It is similar to the stock market measurement of multiplying the price per share by the stock available in the market (not held by the Government or locked up by developers.

24h Trading Volume: A measure of trading volume across all platforms tracked over the past 24 hours.

Circulating Supply: The amount of a coin in circulation and tradable by investors.

Total Supply: Number of coins created, minus coins burned (removed from circulation).

Maximum Total Supply: The number of coins tokenized to last for the life of the cryptocurrency.

Should you invest in Altcoins?

To answer the above question yourself, take a look at the list of benefits and risks when investing in Altcoin that Azcoiner points out below.

Benefits of Investing Altcoins?

Cost savings: Bitcoin transactions have high fees and can take a significant amount of time to process, so some Altcoins are designed for lower fees and faster processing times.

Growth Confidence: Bitcoin’s growth from $0 to $6100 has led many to believe that Altcoins will thrive in the way that Bitcoin exploded.

Easier Mining: Bitcoin mining will be gradually restricted over time. However, Altcoin has continuously improved the mining channels from Mining to Staking while maintaining the mining speed.

Lower price than Bitcoin: Bitcoin has reached a fairly high value for small-cap investors, investing in Altcoins will make it easier for small-cap traders to access the market.

Risks when investing Altcoins?

Increased risk of volatility: Altcoins with a small market cap face the risk of market manipulation and high volatility in the market.

Scam: There are many projects built then Rug Pull – DEV withdraws all investors’ money and flees.

Limited liquidity: For Altcoins that are not widely known, there will not be too many investors buying/selling, limiting the liquidity of those Altcoins.

Conclusion.

If you’re looking to diversify within the cryptocurrency market, altcoins can be less expensive than Bitcoin. However, the cryptocurrency market, regardless of the type of coin, is young and volatile. Cryptocurrency is still finding its role in the global economy, so it’s best to approach all cryptocurrencies cautiously.

BTC

BTC  ETH

ETH  USDT

USDT  SOL

SOL  BNB

BNB  USDC

USDC  XRP

XRP  DOGE

DOGE  TON

TON  ADA

ADA