Whales have accumulated 3.2 million dollars worth of Bitcoin in 48 hours

The recent silence from the SEC regarding the court ruling and the approval potential of Grayscale’s Bitcoin ETF application has piqued the interest of many investors, drawing their attention towards Bitcoin and cryptocurrencies. Furthermore, in the past two weeks, significant announcements from automotive giants Honda and Ferrari, stating their intent to accept cryptocurrencies for purchasing vehicles, have also garnered the attention of investors.

Investors are heavily focusing on Bitcoin accumulation by whales. Recent data from a blockchain analysis company has caught the eye of investors as Bitcoin whales accumulated 117 Bitcoins valued at approximately 3.2 million dollars within just 48 hours following the SEC’s silence.

This significant Bitcoin accumulation was also tweeted by a prominent cryptocurrency analyst on X (formerly Twitter), where others have speculated that this substantial accumulation could be driven by FOMO in the market.

#Bitcoin whales bought around 117 $BTC in the past 48 hours, worth roughly $3.2 million. pic.twitter.com/Aoshmy0r4D

— Ali (@ali_charts) October 15, 2023

Another data point related to investor sentiment is astonishing, as whales have been accumulating Bitcoin aggressively this month. Since the beginning of October, they’ve gathered about 20,000 Bitcoins, valued at approximately 550 million dollars, by October 11, 2023, according to data shared by renowned analysts. Throughout this year, whales have been accumulating significantly. By September 29, 2023, they had amassed over 13.03 million Bitcoins.

#Bitcoin whales have purchased around 20,000 $BTC since the beginning of October, worth roughly $550 million! pic.twitter.com/47ZePiaIII

— Ali (@ali_charts) October 10, 2023

Concerns regarding the approval of Bitcoin ETFs for immediate delivery are currently at the forefront of investors’ minds. Recently, experts and ETF analysts at Bloomberg have predicted a 90% chance of approval for Bitcoin ETFs in January 2024.

Currently, the price of Bitcoin has fluctuated between 25,000 and 30,000 USD over the past 200 days. This price range appears to be a favorable buying zone since most of the accumulation has occurred within this range. Furthermore, the leading Bitcoin holder, MicroStrategy, has made three purchases this year, taking advantage of these price levels.

Microstrategy’s Bold Declaration on Bitcoin

MicroStrategy’s bold declaration on Bitcoin has made waves this year. Since the beginning of the year, MicroStrategy has accumulated over 27,250 Bitcoins. In a recent event, MicroStrategy’s CEO, Michael Saylor, made a bold statement: “Don’t sell your Bitcoin; it will change the world.”

Go tell somebody that #Bitcoin is going to change the world.pic.twitter.com/cfJUzjsAOu

— Michael Saylor⚡️ (@saylor) October 2, 2023

As of now, there hasn’t been a significant change in Bitcoin’s price following this update, which might be attributed to the upcoming halving event in 2024. Currently, BTC is trading around 27,250 USD. On October 11, 2023, JP Morgan predicted that Bitcoin could drop by 20% until the halving, but some analysts believe that the price is stabilizing in the 25,000 to 30,000 USD range in the current circumstances due to the impending halving.

Bitcoin Price Predictions: Technical Indicator Suggests Another Bull Run

Bitcoin’s price performance over the past week may have dashed the high hopes of many enthusiasts, but this hasn’t deterred predictions of a price surge for the leading cryptocurrency. Crypto experts continue to present theories on why and how BTC is gearing up for another price rally.

The most recent Bitcoin price prediction comes from a well-known crypto trader and analyst using the pseudonym Mags on the X platform (formerly Twitter).

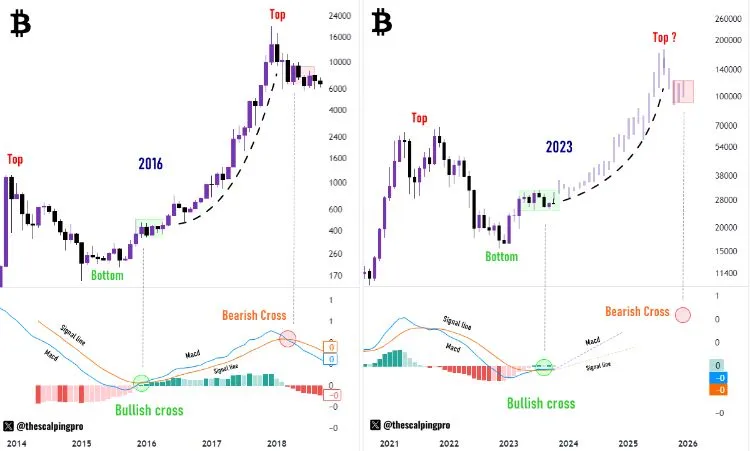

Could Bitcoin’s price history repeat itself? On Sunday, October 15, Mags shared their analysis of Bitcoin through a post on X, indicating an impending price surge for the top cryptocurrency. The analyst’s Bitcoin price prediction revolves around the Moving Average Convergence Divergence (MACD) technical indicator.

According to the chart marked in the post, Bitcoin’s MACD indicator has experienced a bullish crossover from below the zero line. Based on Mags’ analysis, this is the second time this has occurred on the Bitcoin price chart. The first MACD bullish crossover occurred in 2016 and triggered a significant price surge for Bitcoin, leading to a high of 20,000 USD in the following year.

Mags’ analysis suggests that if historical trends hold, Bitcoin’s price could rise to 200,000 USD by mid-2025. However, the analyst notes that the MACD technical indicator signals long-term trend changes, but short-term fluctuations are normal. Prices may move sideways or even experience a slight decline on lower time frames before a Bull Run begins.

>>> The U.S. Government Emerges as One of the World’s Largest Bitcoin Holders

Short-Term Bitcoin Price

As previously hinted, Bitcoin has struggled to maintain its recent upward momentum over the past week, leading the leading cryptocurrency to dip below 26,500 USD in October. According to CoinGecko data, Bitcoin is trading at 26,890 USD with sideways movement over the past day. However, BTC has experienced a 3.7% decrease over the weekly timeframe.

Currently, Bitcoin continues to contend with various external forces, including macroeconomic factors, overall adoption, and regulatory developments such as the potential approval of the Immediate Delivery ETF by the U.S. Securities and Exchange Commission (SEC).

Recently, the SEC decided not to oppose Grayscale’s ETF decision, sparking discussions about the upcoming launch of a Bitcoin Immediate Delivery Exchange-Traded Fund. Following this positive development, BTC has regained some lost momentum, although it seems to struggle to surpass the 27,000 USD mark.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE