Despite facing increasingly fierce competition in the stablecoin sector, USDT has continued to expand, especially on the two networks Ethereum and Tron, where there are huge transaction volumes and active users.

USDT’s market capitalization surpasses $120 billion

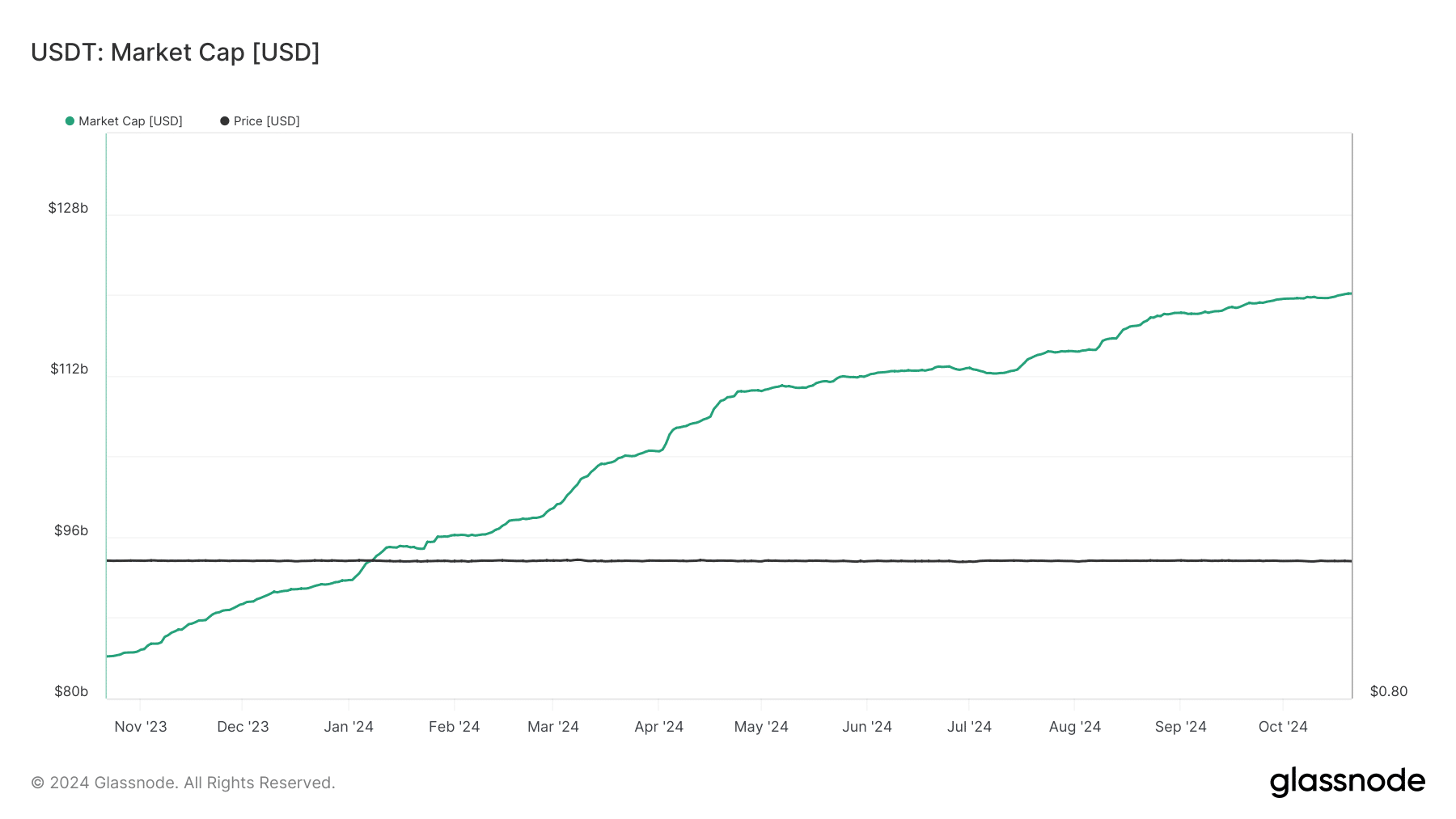

According to the latest analysis from Glassnode, USDT’s market capitalization has recorded strong growth in recent months. At the beginning of the year, USDT’s capitalization was around $92 billion, but up to now, this figure has surpassed $120 billion, an increase of more than $28 billion in just 9 months. This increase shows that the demand and usage of USDT are very large.

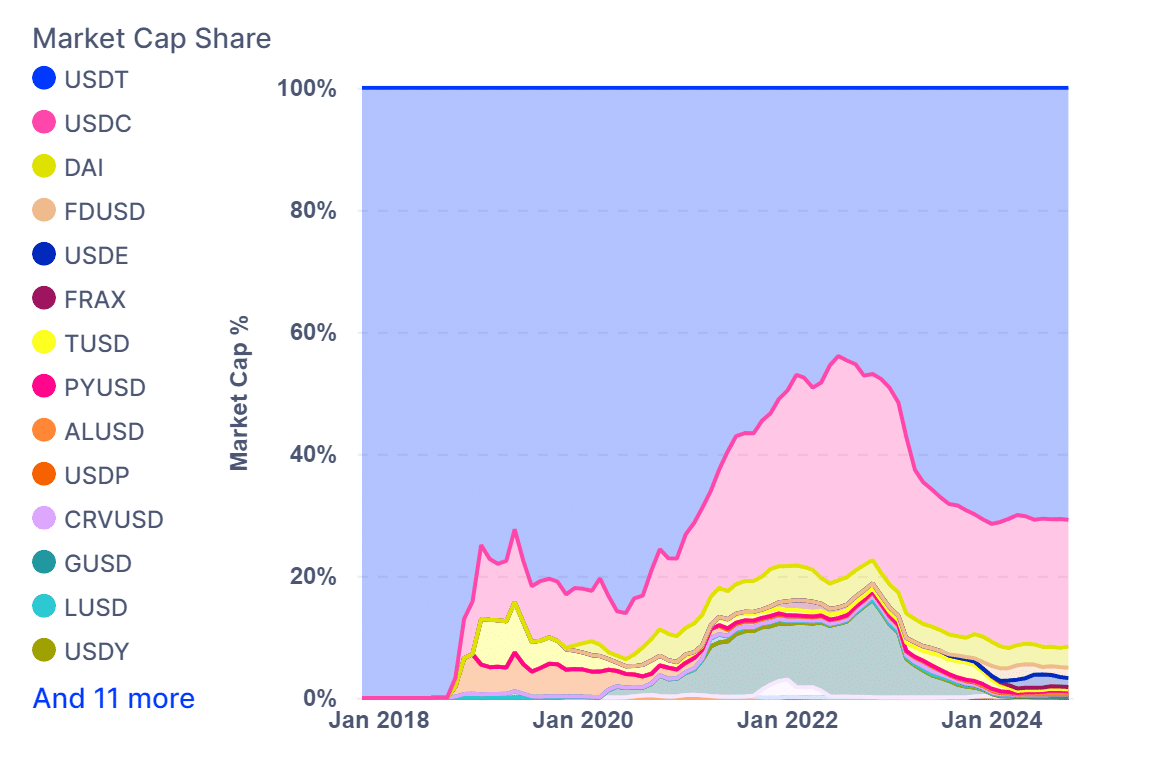

USDT Continues to Dominate the Stablecoin Market

Data from IntoTheBlock shows that USDT not only leads in market capitalization but also holds the top spot in trading volume compared to other stablecoins.

The majority of USDT transactions currently take place on the Ethereum and Tron networks, with Tron accounting for over 70% of the total trading volume.

Although Ethereum remains the popular platform for USDT transactions, high gas fees have driven many users to Tron, which offers lower transaction costs and faster processing speeds. Additionally, Layer 2 solutions such as Arbitrum and Optimism are increasingly supporting USDT transactions, expanding the coin’s presence across multiple blockchains.

USDC, USDT’s closest competitor, is falling behind in both market capitalization and trading volume, further solidifying USDT’s position.

Read more: Layer-1 Sui Integrates with Google Cloud to Combat Fraud and Support Gaming

What’s next for USDT?

As USDT crosses the $120 billion mark, it faces increasing competition from other stablecoins like USDC. However, thanks to its strong liquidity, large user base, and presence on multiple blockchain networks, USDT is well-positioned to maintain its leadership position in the space. USDT’s future depends on its ability to overcome regulatory challenges and maintain transparency in its reserve management. However, with its current strong growth, USDT continues to be a shining star in the stablecoin market and consolidates its leading position.