What’s driving the surge in Ether (ETH) prices today?

The current upswing in Ethereum’s value can be attributed to a surge in network revenue and the successful breach of the $2,300 resistance. ETH, the native token of the Ethereum network, is experiencing a notable breakout, primarily fueled by a growing interest from institutional investors in the second-largest cryptocurrency by market capitalization. This mounting bullish sentiment has propelled Ether’s price upwards by an impressive 23.7% in the last 30 days, suggesting a notable shift in attention towards Ether. Year to date, ETH has witnessed a substantial increase of 96.5%.

Several factors contribute to the current strength in Ether’s price:

Institutional Interest Peaks Amid Expectations for a Spot ETH ETF:

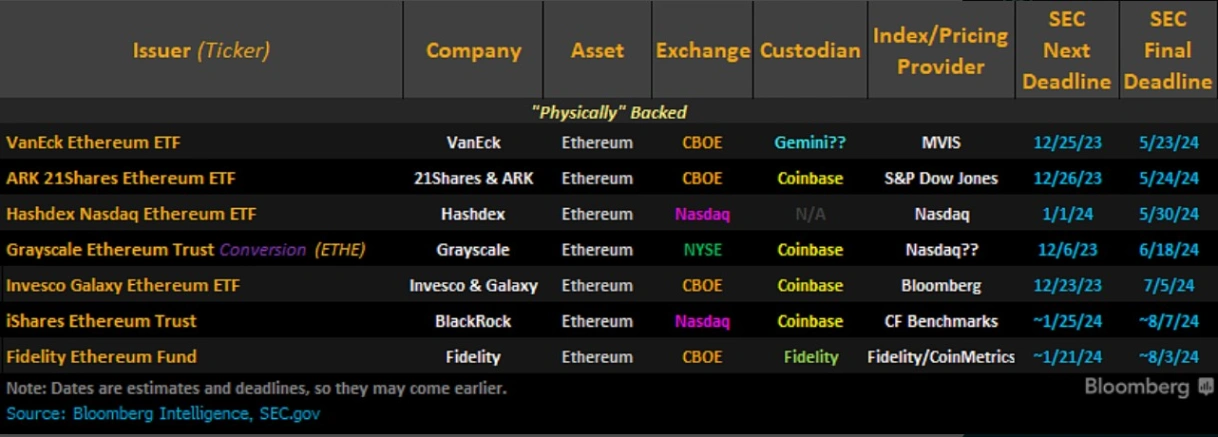

The surge in trader interest in Ether gained momentum on November 1 when the U.S. Securities and Exchange Commission (SEC) acknowledged Grayscale Investment’s application to convert its Ethereum trust into an ETF. This event marked a pivotal moment as the SEC, responding to a direct court order, began reviewing Grayscale’s pending ETF applications.

As of now, the SEC has yet to confirm the approval of a spot crypto ETF. Notably, on December 5, the SEC deferred the decision on Grayscale’s spot Ether ETF until January 2024.

BlackRock’s Entry into the Fray:

BlackRock, the world’s largest asset manager, further intensified the positive momentum by filing for a spot Ether ETF on November 9. This announcement prompted a surge in Ether’s price, propelling it to a six-month high above the $2,000 resistance level. BlackRock formally submitted the S-1 form with the SEC on November 16, solidifying its commitment to entering the Ether ETF space.

As Ether continues to garner increased attention and institutional support, the cryptocurrency’s price surge reflects a dynamic landscape influenced by regulatory developments and notable institutional players entering the market.

As of December 7, the SEC is currently reviewing a total of seven spot Ether ETFs, with their approval pending. Analysts widely speculate that the SEC’s initial approval of a spot Bitcoin ETF in early 2024 could pave the way for subsequent approval of a spot Ether ETF. This narrative has gained significant traction in recent weeks, particularly as Bitcoin encounters resistance at the $45,000 level, prompting some traders to shift their focus towards Ether.

Seems like people are slowly but surely realizing that $ETH is in fact also getting a spot ETF. #Ethereum pic.twitter.com/DXRykha8uT

— TraderLenny (@TraderLenny1) December 7, 2023

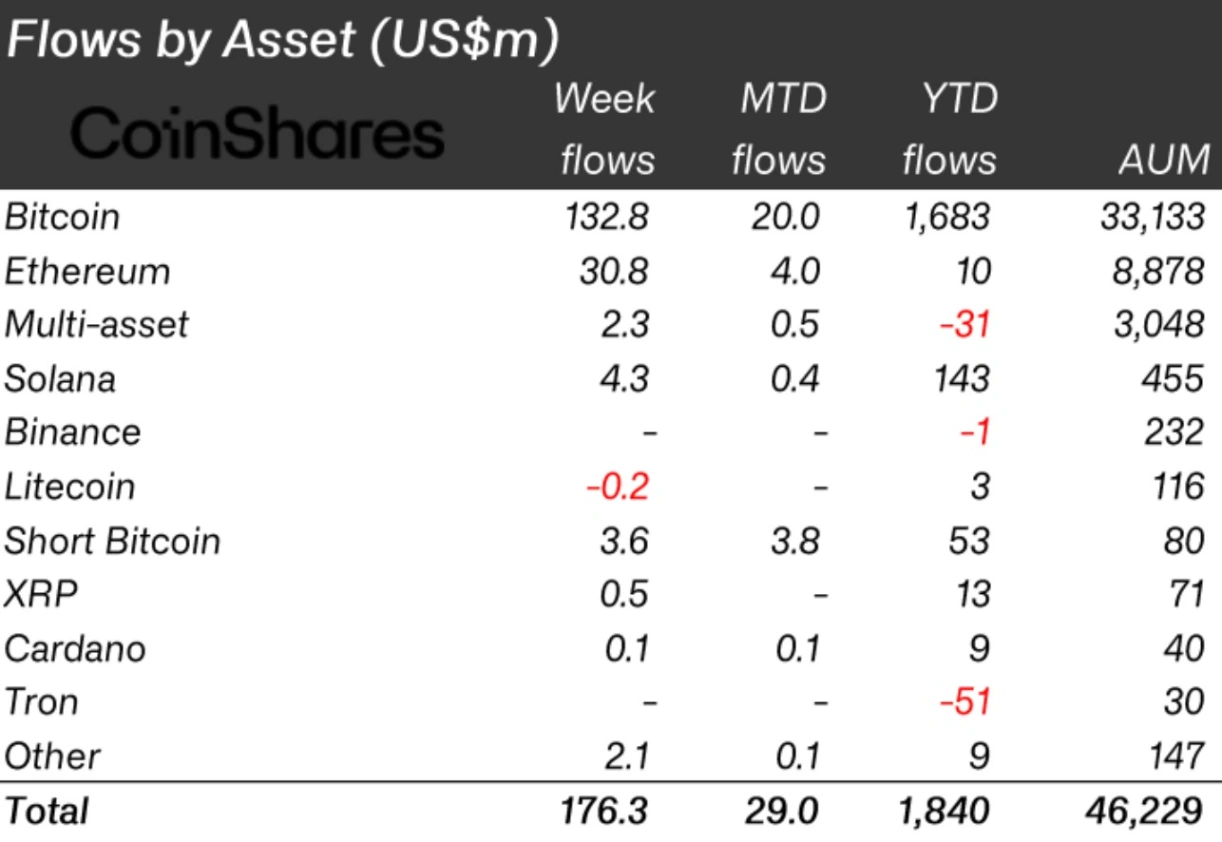

The growing anticipation of ETF approval is driving heightened institutional capital inflows. Over the past 10 weeks, a record-breaking $1.76 billion has flowed into the market, marking the highest influx since October 2021. Notably, this surge in institutional interest has translated into net flows of Ether, reaching $10 million for the first time this year and a substantial $30 million in the past week.

Ethereum Network Revenue and Fees Increase

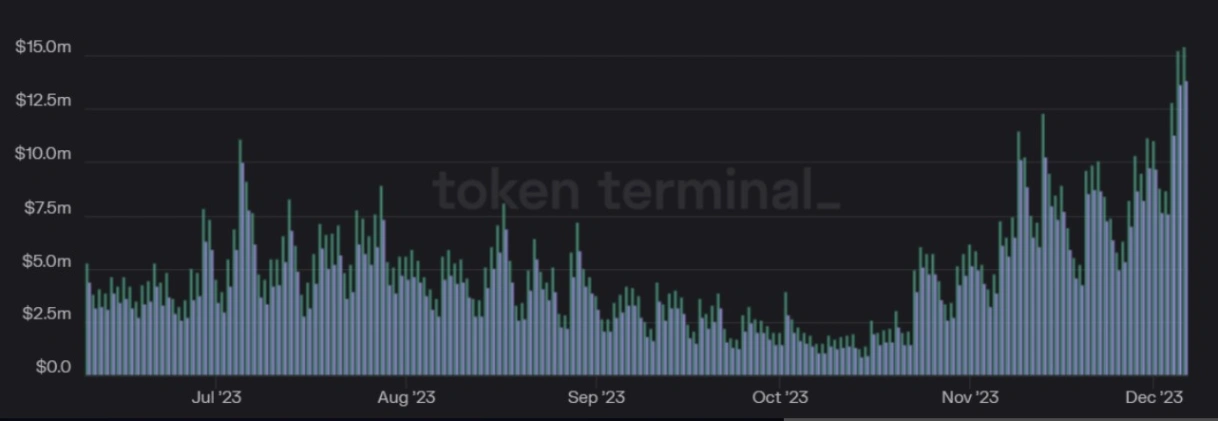

Parallelly, the Ethereum network’s decentralized finance (DeFi) ecosystem is experiencing a surge in daily fees and revenue, hitting a 180-day high on December 7. Over the past 30 days, fees have spiked by over 155%, aligning with the upward trajectory of Ether’s price. The consequential increase in Ether fees has propelled the Ethereum network’s revenue to surge by an impressive 178.2% in the last month, amounting to an annualized figure of $2.92 billion.

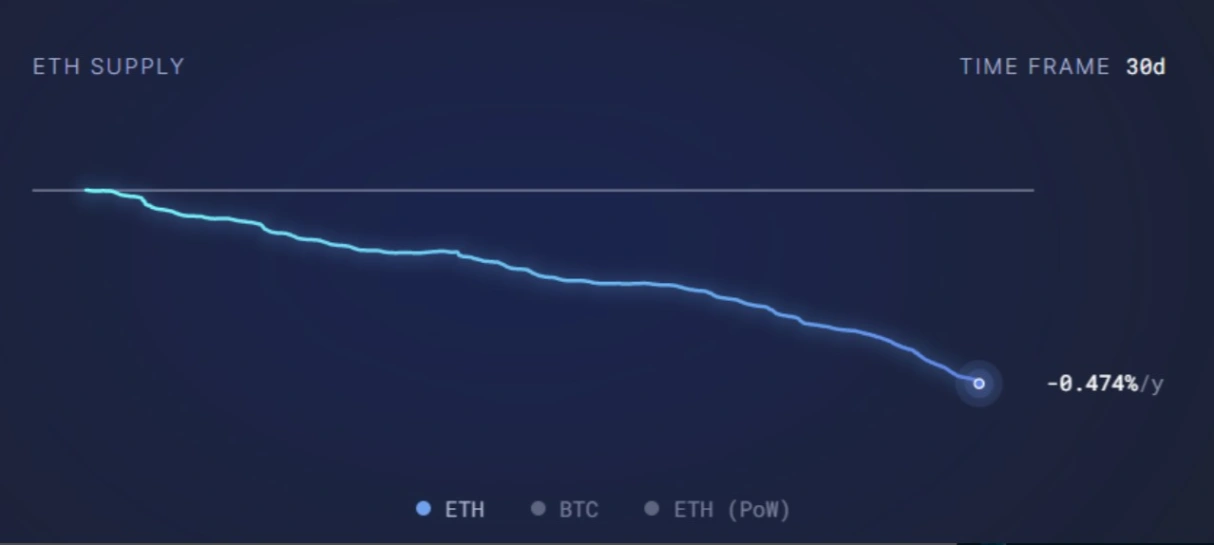

The growth of the Ethereum network has not only elevated gas fees but has also transitioned the network back into a deflationary phase. The last recorded inflationary emission on November 8 marked a sustained period of activity growth over the past 30 days. If this trend persists, Ether’s coin supply is poised to contract by an annual rate of -0.47%. This dynamic underscores the network’s resilience and its potential for sustained positive momentum in the coming months.

Bitcoin’s Price Movement Boosts Ethereum and Bolsters Investor Confidence

The upward trajectory of Bitcoin’s price has had a positive impact on both Ethereum’s price and investor sentiment. Although Ether successfully breached the crucial $2,300 level, it continues to lag behind Bitcoin’s remarkable 162% year-to-date gains. Despite occasional profit-taking by short-term sellers, the sustained increase in trading volume has enabled Bitcoin to maintain its position within the $40,000 range.

Related: Bitcoin and Solana Alleviate Market Pressure on Price Predictions

Bitcoin’s dominance remains prominent in the crypto market, especially in anticipation of the supply halving scheduled for April 2024. As of December 7, Bitcoin achieved a year-to-date high dominance of 53.89% relative to the entire crypto market.

Traditionally, when Bitcoin dominance stabilizes, there is a notable shift towards altcoins and other cryptocurrencies. Independent analyst Jacob Canfield highlights the strength of the ETH/BTC pair, indicating that it “ran the monthly lows yesterday and is putting in a very strong daily candle.” Canfield also identifies significant potential upward movement, pointing to “lots of thin air up to the $3,300 – $3,500 zone.”

While the current market exhibits signs of health, macroeconomic factors such as anticipated future rate hikes and the possibility of a U.S. crackdown on the crypto sector may exert a slight downward pressure on Ether’s price. However, potential catalysts for price growth include the approval of a spot Bitcoin or Ether ETF, positive developments in clarifying regulatory stances on crypto, and a robust U.S. economy. These factors, if realized, could contribute to the continued growth of Ether’s price in the market.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE