According to technical indicators, TON could fall to $4.42, representing a 24% drop from its current value. This analysis explains why this could be the case.

Toncoin Demand Growth Thanks to Hamster Airdrop

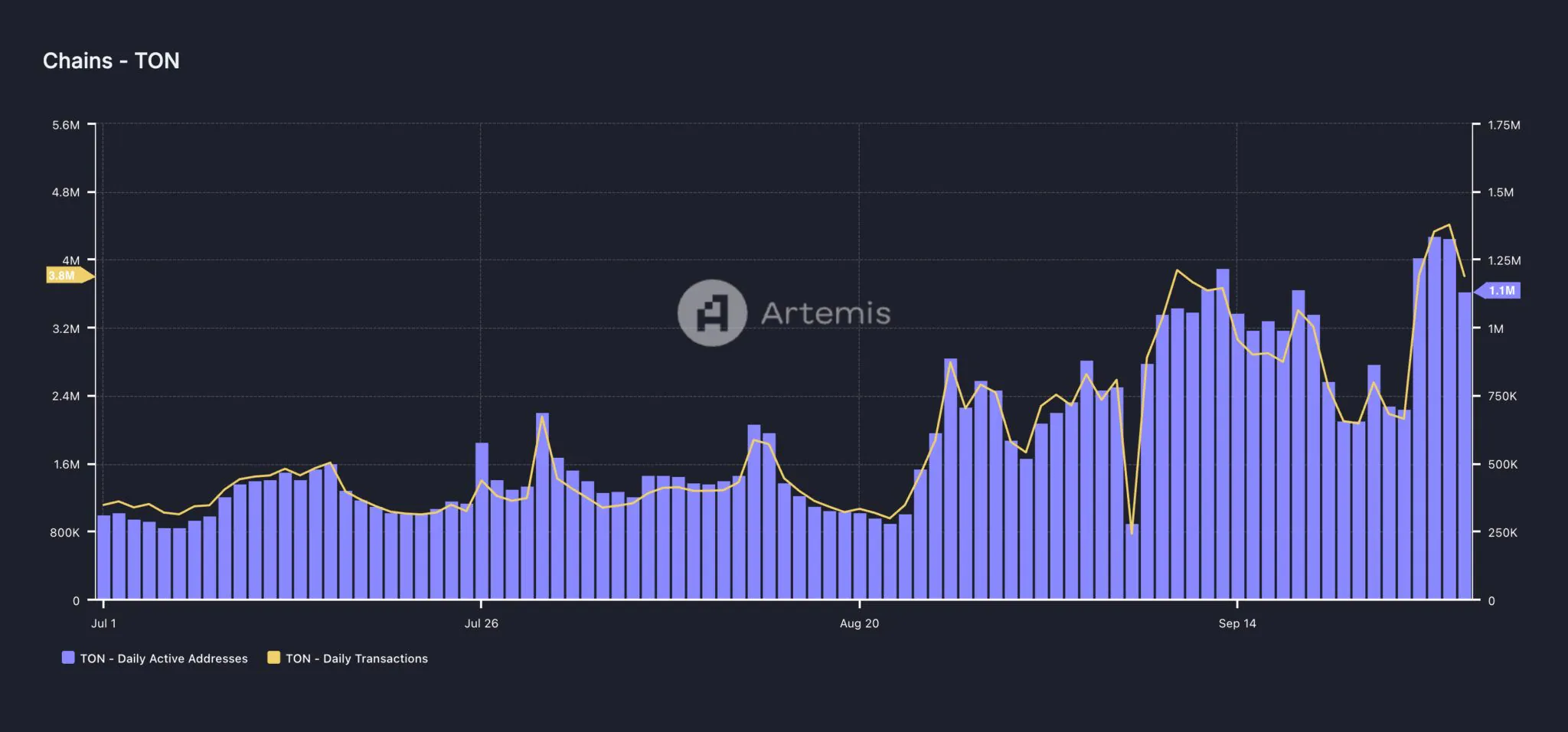

Over the past month, TON has experienced an explosion in network demand, with data from Artemis showing a 74% increase in the number of unique active addresses making at least one transaction in the past 30 days. At the same time, 4 million transactions were completed, reflecting a 67% increase in the number of daily transactions on the network.

The surge was largely driven by the Hamster Kombat token airdrop that took place on September 26. Within an hour of the airdrop, the network processed over 1 million transactions.

By September 27, daily network fees had spiked to a record $349,000. This spike in fees coincided with an all-time high in active users, with 1.6 million users in just 24 hours.

Despite the surge in demand for TON in recent days, traders are not sharing the same sentiment towards its parent coin. The altcoin is currently trading at $5.82, down 4% over the past three days.

The Chaikin Money Flow (CMF) index is trending down, confirming the decline in investor demand for Toncoin. As of press time, the index stands at 0.10. While still positive, the decline in CMF indicates weakening buying pressure, which also shows that capital inflows into the TON market are decreasing as profit-taking increases.

The negative trend for TON is also reflected in the negative funding rates over the past few days. When an asset’s funding rates are negative, it indicates that there is more demand for shorts than long positions. Many traders expect the asset’s price to fall, leading to increased short selling activity, which usually reflects bearish sentiment in the market.

TON Price Prediction: Possible 24% Drop

If buying activity continues to weaken, Toncoin’s price will fall to the $5.25 resistance level. If this level fails to hold, the altcoin’s price could continue to decline to the $4.42 support level, representing a 24% drop.

However, if TON sees a resurgence in demand, its price could climb to $7.37, a 26% increase from its current value.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  DOGE

DOGE  TRX

TRX