Despite the underwhelming performance, Toncoin remains optimistic about its potential for future growth.

Bullish Forecast for TON

Currently, TON is forming an inverted head and shoulders pattern – a bullish signal that indicates a potential increase in price.

According to the chart, the pattern consists of three peaks: the left shoulder, a higher peak in the middle, and a lower right shoulder. Typically, a bullish signal is confirmed when the price breaks above the neckline, which is the line connecting the two shoulder bottoms.

Currently, TON has not broken above the neckline. If this happens, the bullish trend will be confirmed, with a potential target of $5,804. Conversely, if it fails to break above, TON could fall to the October low of $5,139 or even lower. However, a close look at on-chain metrics is needed to predict the possibility of a breakout.

Uncertainty in Data

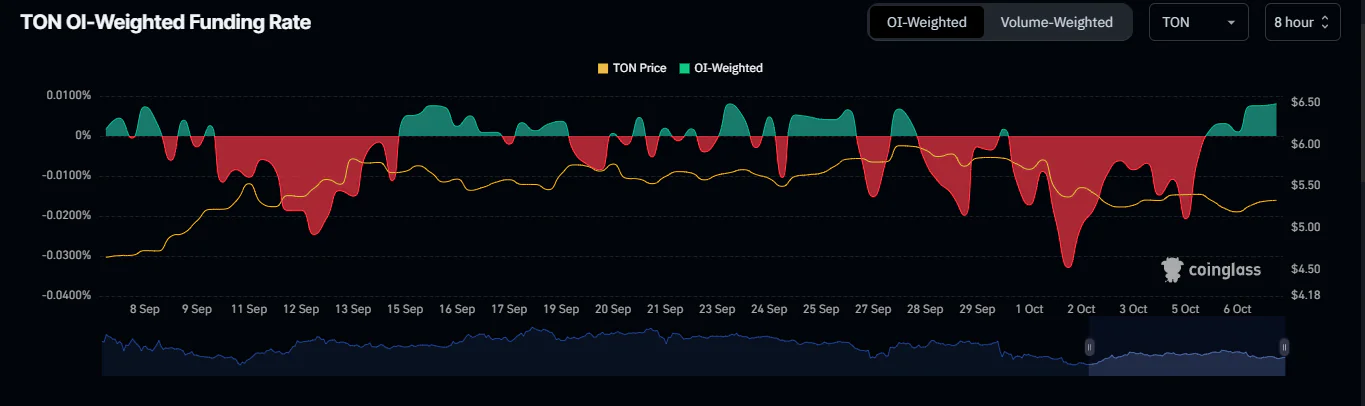

According to data from Coinglass, the OI-weighted funding ratio remains positive at 0.0080% at the time of writing, indicating that the market remains bullish.

The OI-weighted funding ratio combines Open Interest and Funding Rate to gauge market sentiment as well as the cost of maintaining long or short positions in derivatives contracts. While the metric suggests bullishness, the liquidation data is neutral, implying that the market could head in a bearish direction.

According to the latest information, the market has recorded $268.15k in liquidations, of which $146.96k came from long positions and $121.19k from short positions, reflecting a relative balance in the market.

To see a bullish breakout, there needs to be stronger liquidations from short positions, creating a large gap with buy liquidations. If this does not happen, TON could fall to $5,139.

Decreased supply could create momentum for a breakout

Recent data shows that a large amount of TON has been withdrawn from exchanges in the past week, which could potentially impact market momentum. According to Coinglass, more than $19 million in TON has been transferred from exchanges, indicating that traders are tending to keep their assets in personal wallets instead of selling.

If this outflow trend continues, it could reinforce the current bullish sentiment and contribute to a price breakout in the coming period.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE