Shiba Inu’s Layer 2 (L2) network, Shibarium, has experienced a notable decline in activity since the beginning of the year, as indicated by data from Shibariumscan. Ecosystem metrics monitoring user engagement on the L2 network have consistently decreased since January 1st.

The challenges faced by Shibarium are evident, with on-chain data revealing that the daily count of active addresses conducting transactions on Shibarium reached an all-time low of 608 addresses on January 25th. Year-to-date, Shibarium’s daily active addresses have fallen by 41%. Furthermore, there has been a substantial decrease in new demand for the network since the start of the year, with the count of daily new addresses created on Shibarium plummeting by 83% in the past four weeks.

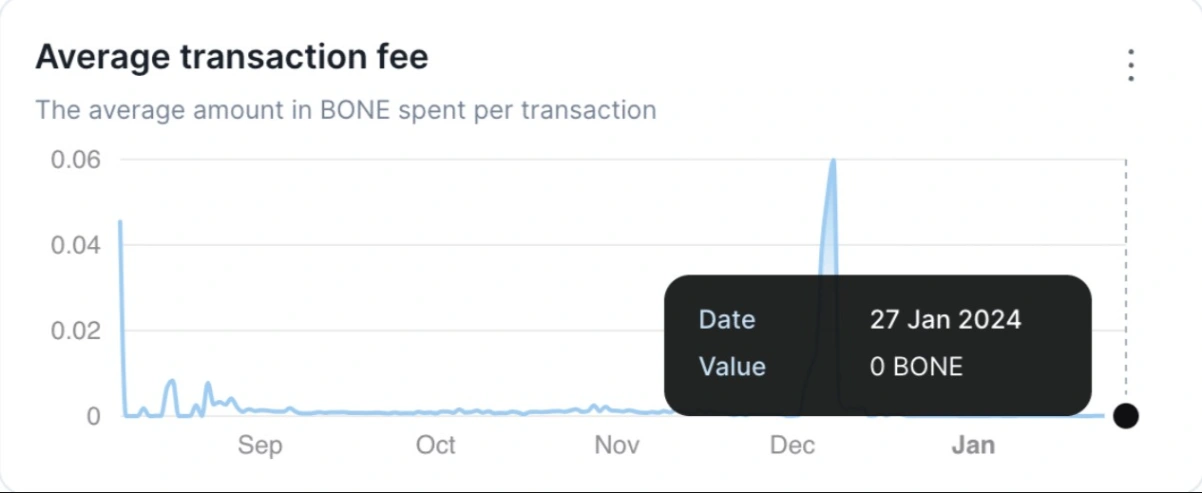

Consequently, the daily number of new transactions on the L2 network has also declined, hitting 2.65 million on January 27th—a 66% drop from the 7.84 million recorded a month earlier.

The diminished demand for Shibarium in the past month has led to a significant reduction in the average cost of completing transactions on the network. According to Shibariumscan data, L2 users have paid zero BONE for their transactions since December 27th.

Bears Persist as SHIB Records a 15% Drop in the Last Month

Over the past month, SHIB has faced a 15% decline in value, currently trading at $0.000009186, as per CoinMarketCap data.

Analysis of the daily chart indicates that SHIB has been in a bearish cycle since December 28, 2023. This was marked by the MACD line (blue) crossing below the trend line (orange), maintaining this position ever since. At present, SHIB’s MACD line remains below the zero line. A MACD value below zero suggests a negative short-term moving average relative to the long-term moving average, signaling recent negative momentum.

Related: Doge and Shiba Inu Fail to Impress Following Approval of Bitcoin ETF

Affirming the negative trend, the negative directional index (red) stands at 25.45, significantly surpassing the positive directional index (green) at 14.61. The coin’s average directional index (yellow) of 31.98 indicates a robust bearish trend that could pose a challenge for bulls in the short term.

BTC

BTC  ETH

ETH  XRP

XRP  USDT

USDT  SOL

SOL  BNB

BNB  DOGE

DOGE  USDC

USDC  ADA

ADA  TRX

TRX