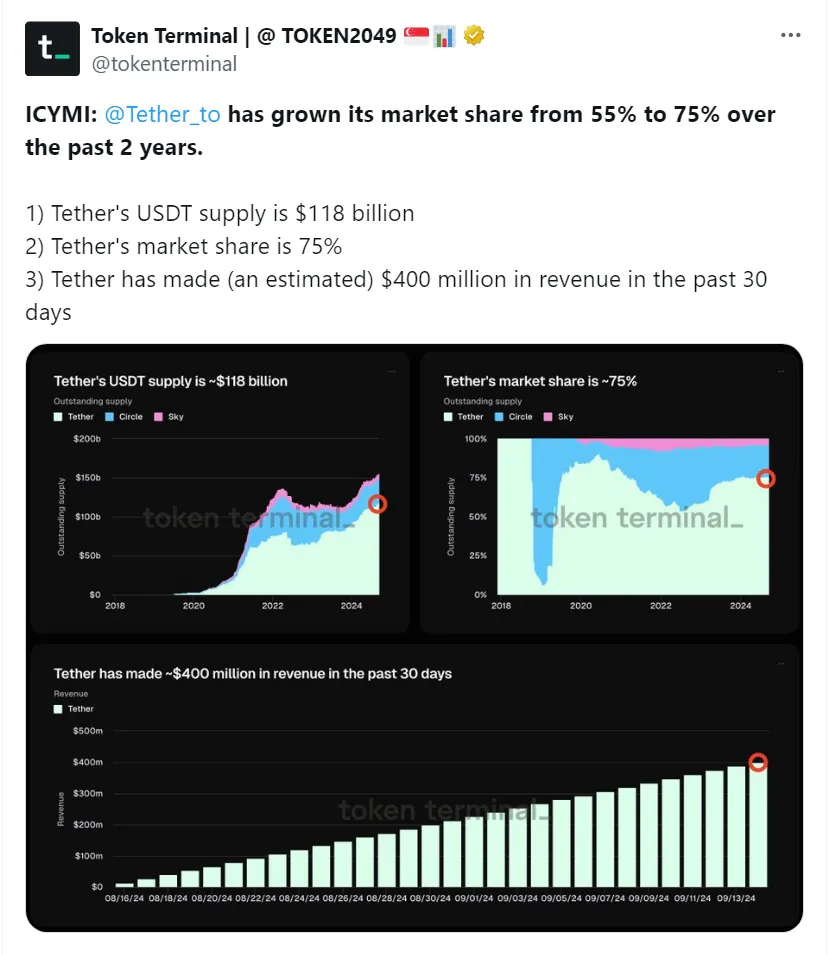

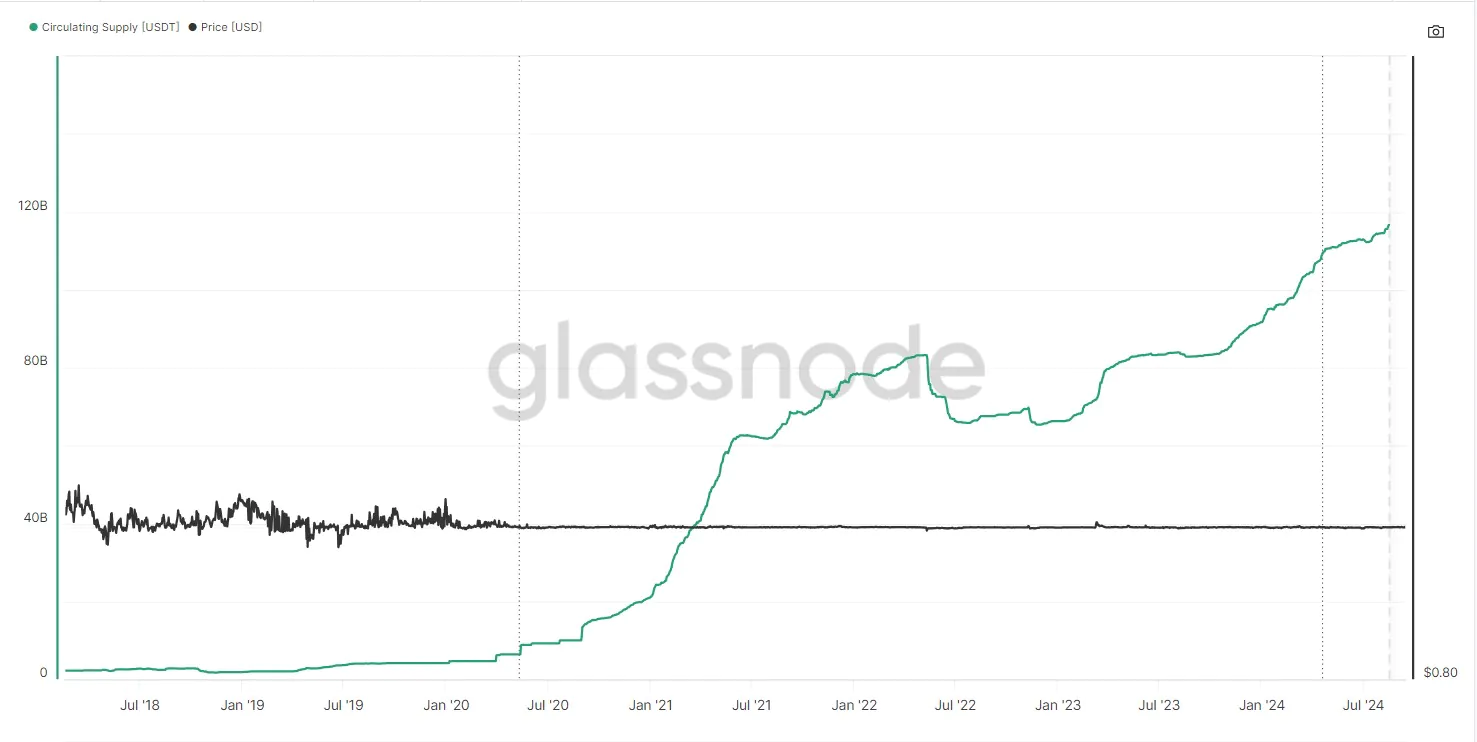

According to information shared by Token Terminal on the X platform on September 16, the total supply of USDT has now reached $118 billion. Tether has grown its market share from 50% to 75% over the past two years, becoming one of the largest stablecoin issuers with an estimated revenue of $400 million.

The increasing market capitalization of stablecoins like Tether reflects growing investor interest in cryptocurrency. This also indicates that stablecoins are acting as a bridge between fiat currencies and the world of cryptocurrencies.

A chart shared by Token Terminal on September 16 shows that Tether generated $400 million in revenue over the past 30 days. Since the beginning of 2024, Tether has achieved profits of over $4.5 billion, demonstrating that its financial strategies and operations are delivering significant success.

A large portion of Tether’s profits comes from the company’s financial investments in Bitcoin and gold. Additionally, profits from cutting operating costs have brought in $1 billion.

On September 13, Tether appointed Jesse Spiro as the new head of its Government Relations department. Spiro was previously PayPal’s director of legal affairs. Since his arrival, recent data shows that Tether has experienced significant growth.

Tether sets a record of $20.3 billion in exchange balances

On August 13, the USDT balance on cryptocurrency exchanges hit a record high of $20 billion. This indicates that investors are ready to use stablecoins for other cryptocurrency investments. The Tether balance on exchanges has surged during both bullish and bearish markets. In bullish phases, traders convert volatile cryptocurrencies into USDT to safeguard their assets against unpredictable market fluctuations. Meanwhile, during bearish phases, they accumulate USDT to purchase other cryptocurrencies when prices drop.

To further enhance its focus on compliance and regulatory matters, Tether plans to expand its workforce to 200 employees by mid-2025.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE