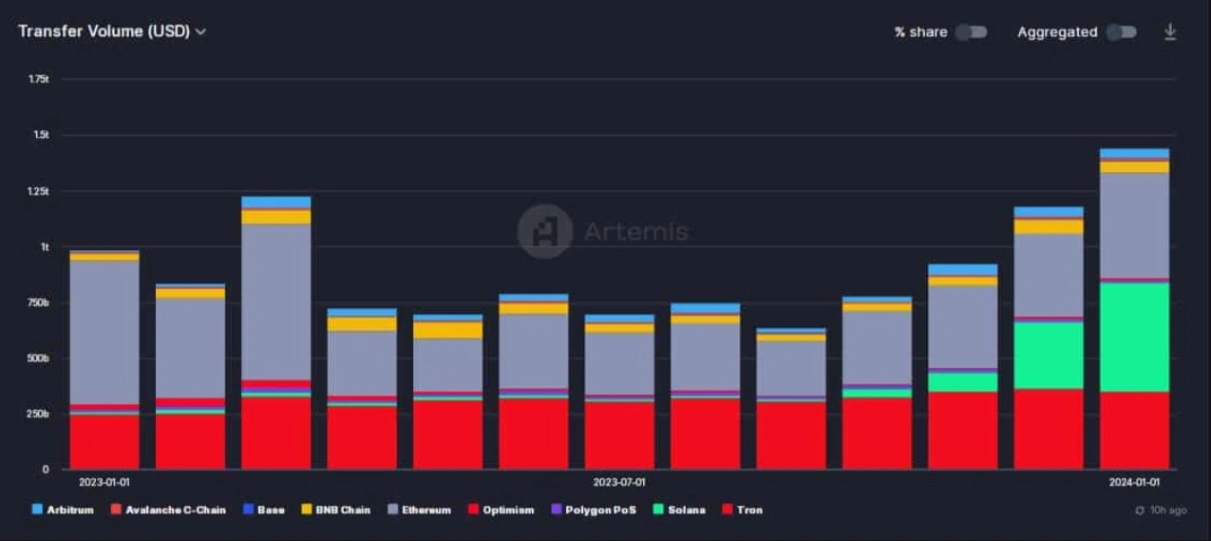

In a groundbreaking shift, Solana (SOL) emerged as the predominant blockchain for stablecoin transfers in January, surpassing established players such as Ethereum (ETH) and Tron (TRX). According to Artemis data, a staggering $497 billion worth of stablecoins were transacted on the Solana blockchain in January, marking an unprecedented high. This surge propelled Solana’s market share to an impressive 33.76%, a remarkable leap from just 1.17% a year earlier.

Solana’s dominance in facilitating stablecoin transfers comes amid a significant surge in demand for stablecoins over the last two months, primarily fueled by optimistic sentiments surrounding the potential approval of spot Bitcoin (BTC) ETFs. Contrary to the previous bear market, where Ethereum and Tron accounted for over 80% of stablecoin volumes, Solana has taken the lead in the latest upswing.

Upon closer inspection of the provided graph, AZC News observed a remarkable five-fold increase in monthly stablecoin volumes on the Solana blockchain from November to January. In comparison, Ethereum’s volume rose only by 31%, while Tron’s stablecoin trades effectively remained the same.

Is USDC behind the turnaround?

USD Coin [USDC] was the dominant stablecoin on the Solana blockchain, with over 56% share of the total supply, according to DeFiLlama. Interestingly, USDC’s market cap on Solana increased by more than 14% over the past month, while most other stablecoins recorded a drop. This strongly indicated that USDC volumes on Solana were the primary drivers in boosting overall stablecoin transfer volumes.

Related: Analyst Predicts Solana (SOL) to Surge to $333 USD

SOL is back to good health

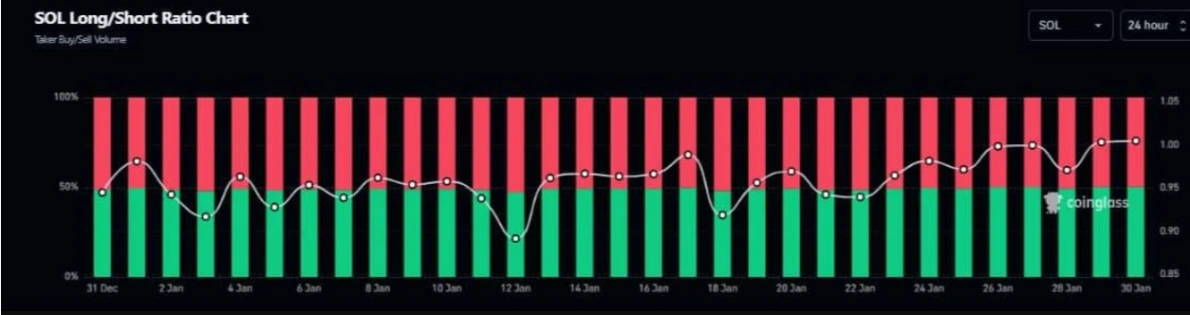

In another good news, the network’s native token SOL regained its bullish strength, bouncing above $100 for the first time in more than two weeks. According to CoinMarketCap, SOL was exchanging hands at $104 as of this writing, marking a 30% gain over the past week. As expected, the bullish price action led traders to go long on the asset. SOL’s bullish bets outnumbered bearish bets in the last two days, arccording to Coinglass data.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Some genuinely nice and useful info on this web site, too I conceive the design has wonderful features.