A Surge in Swaps on Solana

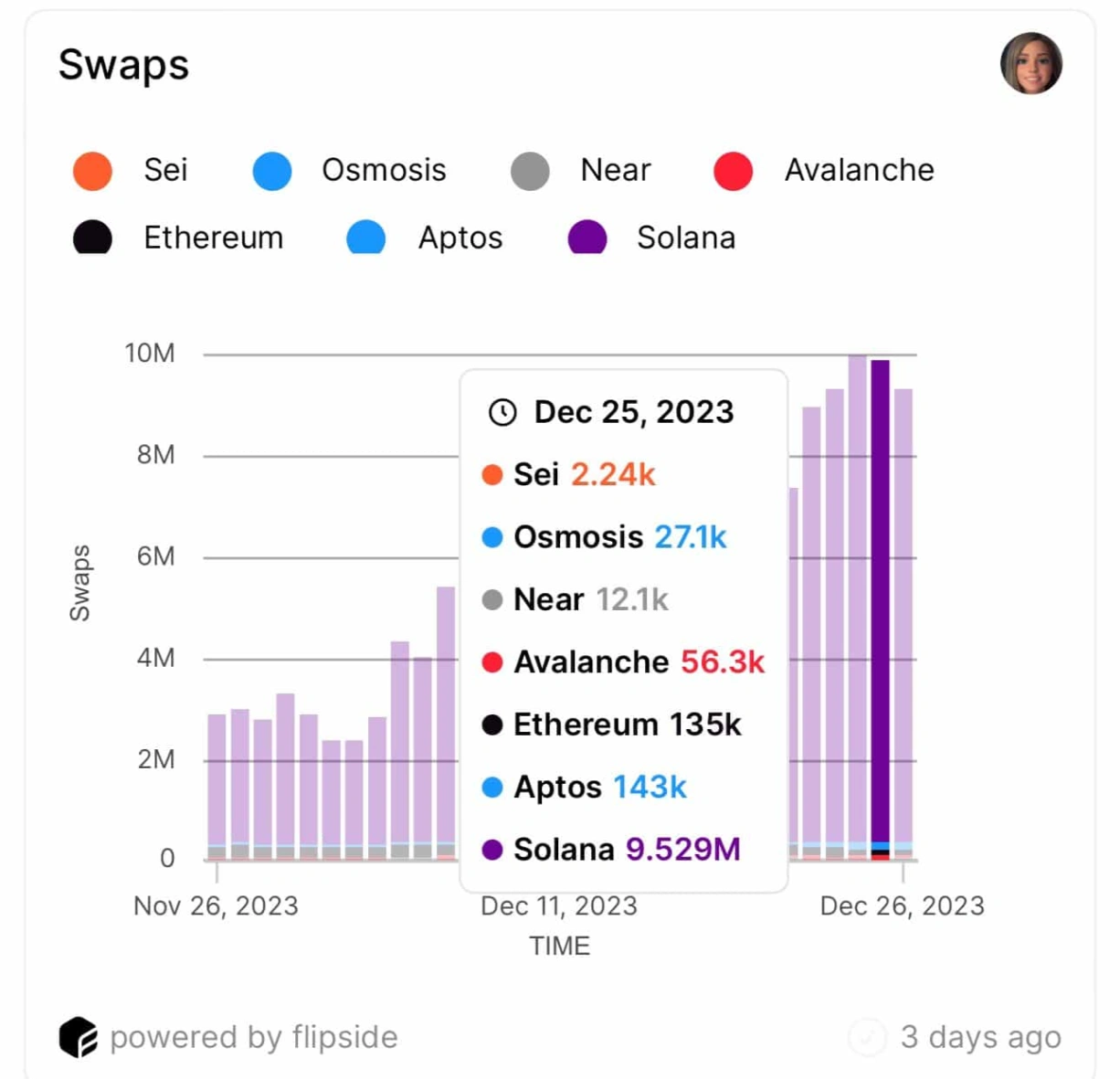

Flipside’s statistics reveal an impressive surge in daily swap transactions on Solana, reaching 9.52 million on Christmas day. In contrast, the larger Ethereum [ETH] smart contracts network recorded only 135,000 transactions. Crypto swaps, a well-known method for instantly trading one cryptocurrency for another without involving crypto-to-fiat exchanges, have become a crucial indicator of a protocol’s DeFi growth.

Solana’s substantial number of swaps signifies growing confidence and demand for its DeFi protocols, particularly decentralized exchanges (DEXes).

Exploring Solana’s DEX Growth

Over the past week, Solana-based DEXes logged trades worth $10.74 billion, surpassing Ethereum’s $9.42 billion in trades, as per DeFiLlama’s data.

December has proven to be a standout month for Solana’s DEX activity, settling more than $24 billion since the month’s commencement—a phenomenal threefold increase compared to the previous month.

Beyond the DEX Frenzy

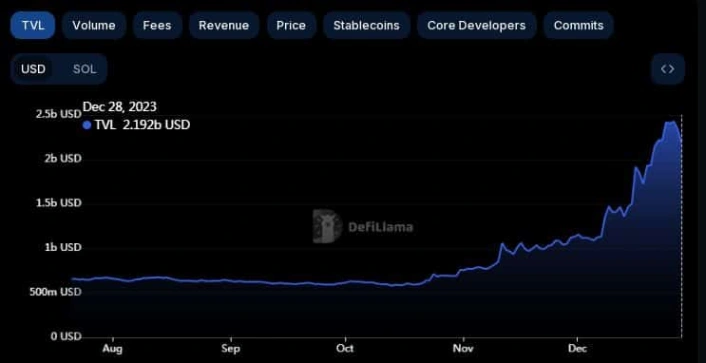

In addition to the excitement surrounding its DEXes, Solana’s network has witnessed a significant uptick in the USD value of cryptocurrencies locked in its DeFi projects. This increase highlights the growing adoption and utilization of Solana’s DeFi ecosystem.

Over the past month, Solana’s Total Value Locked (TVL) has more than doubled, reaching $2.19 billion at the current press time. Notably, Solana has exhibited the fastest monthly growth rate among the top ten networks.

The evident surge in TVL can be attributed primarily to SOL’s impressive rally in the price charts. Notably, the TVL denominated in SOL also experienced a notable uptick of 5.6% over the week.

However, a recent retracement occurred as impatient traders seized the opportunity to lock in gains, leading to a sharp pullback in SOL’s value over the last 24 hours. This retracement caused SOL’s market cap to decline, temporarily pushing it to the fifth position in the rankings according to CoinMarketCap.

Related: Donald Trump Liquidating Ethereum Holdings

Taking a broader perspective, the overall trend for SOL remains positive. Despite the recent retracement, SOL has demonstrated remarkable gains of 87% over the last month, nearly multiplying its value by 11 compared to the beginning of the year.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE