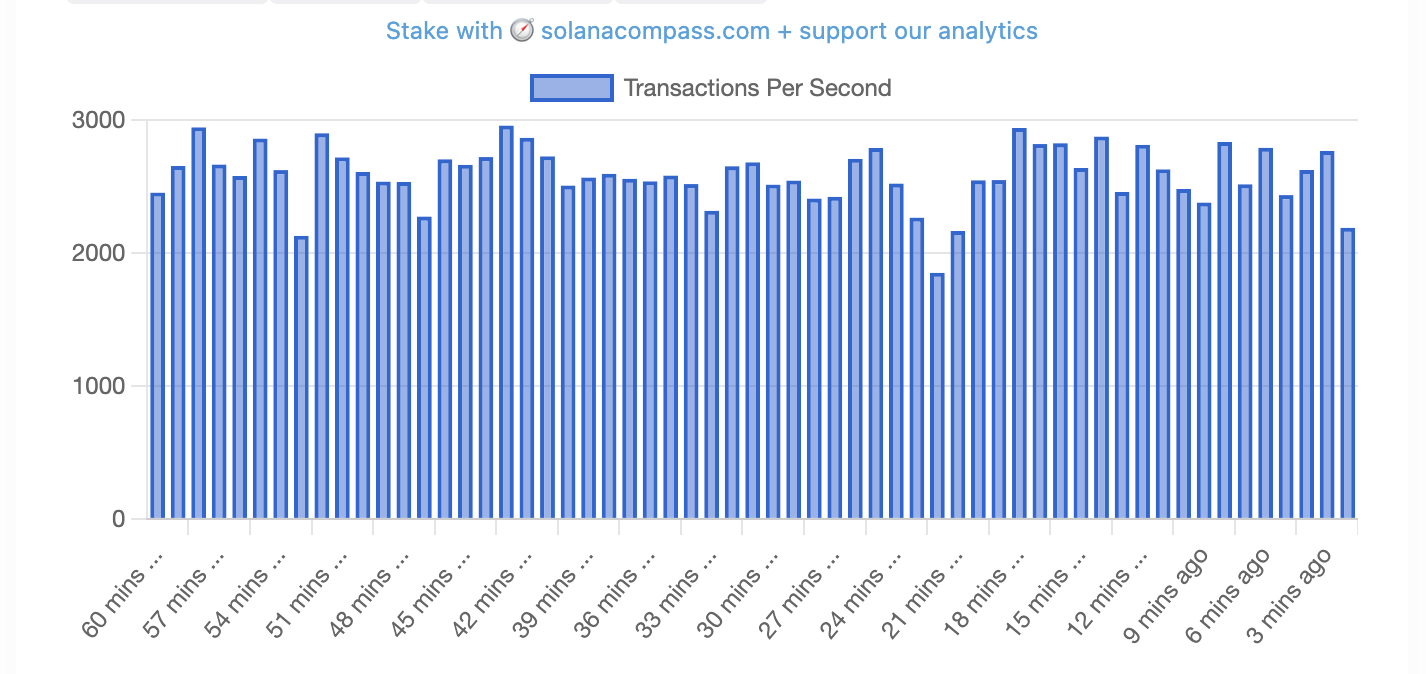

The report highlights Solana’s transaction processing capabilities, with a throughput of up to thousands of transactions per second (TPS), outperforming Ethereum’s TPS by 3,000%. In addition, Solana’s daily active users are 1,300% higher than Ethereum’s, while transaction fees on the Solana network are up to 5 million times lower.

According to the report’s authors, Solana’s speed and low cost advantages give it a clear advantage over Ethereum in the areas of payments and remittances. In particular, Stablecoins, which are considered a key driver in the decentralized finance ecosystem, can exploit Solana’s superior processing advantages to reduce costs for users. The authors also note that retail investors have begun to recognize Solana’s potential to challenge Ethereum as a smart contract platform, while institutional investors have yet to appreciate its merits.

The report hypothesizes that one of the reasons for the delay in institutional adoption of Solana may be due to the reticence of moving from blue-chip assets like Ethereum (ETH) to a much younger platform like Solana.

VanEck Analyzes Ethereum’s Dismal Price Performance

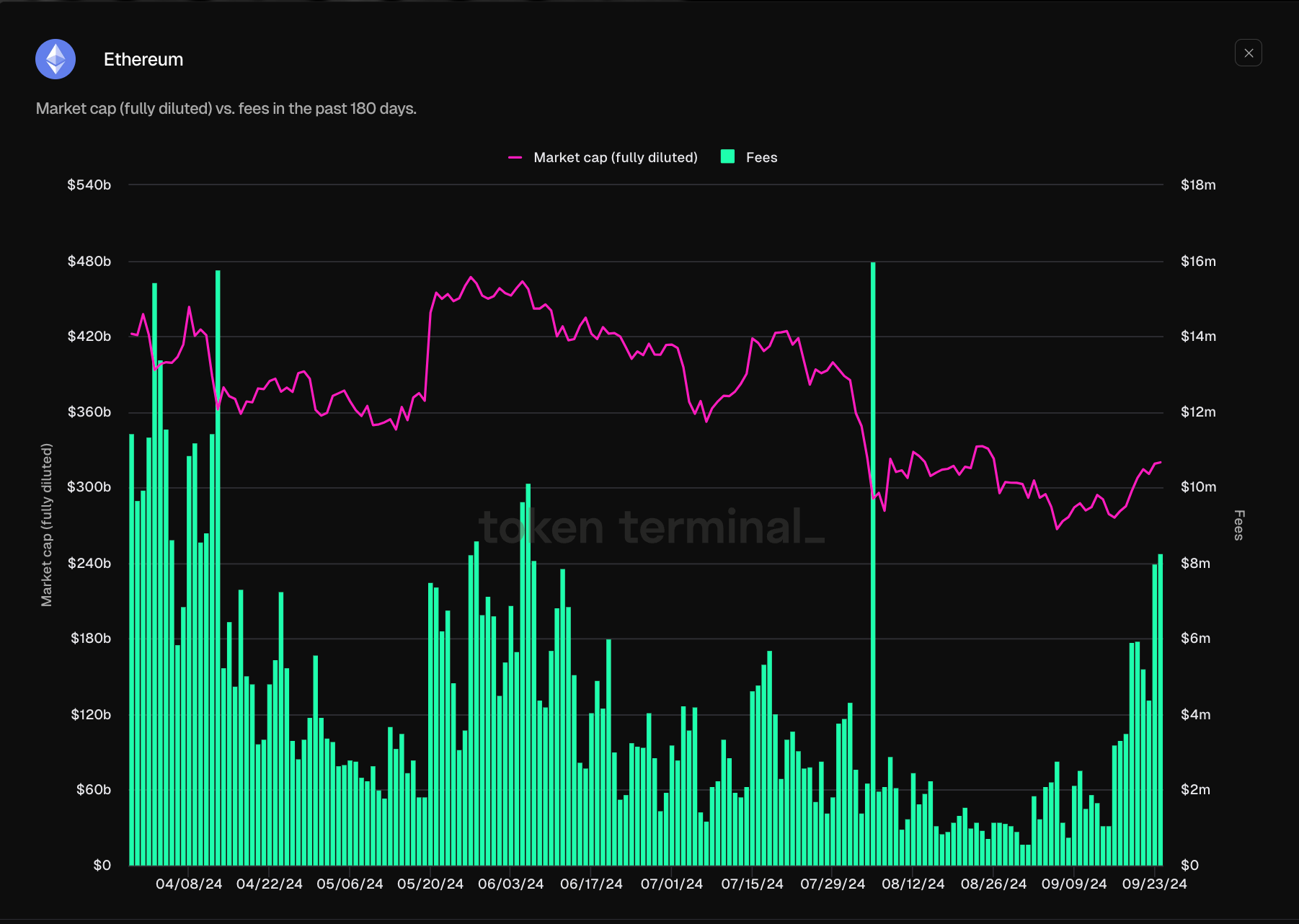

In early September 2024, VanEck also released a report analyzing the factors holding back Ethereum’s price. According to the report, the main reason for Ethereum’s poor price performance is the extraction of value from layer 2 scaling solutions on the Ethereum network.

This explosion of layer 2 scaling solutions came after Ethereum implemented the Dencun upgrade in March 2024, which significantly reduced transaction fees for layer 2 networks. This created a surge in layer 2 projects, but at the same time, Ethereum’s layer 1 revenue dropped by 99% since March 2024.

However, transaction fees on the Ethereum network gradually recovered by the end of September 2024. VanEck also specifically noted that the migration of users to faster layer 1 networks such as Solana and Sui (SUI) is another important factor affecting Ethereum’s price and transaction revenue. While Ethereum still has a first-mover advantage, the report indicates that this advantage is gradually eroding.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE