The debate between Solana and Ethereum has flared up again on crypto Twitter after reports suggested that Solana could soon overtake Ethereum in terms of transaction fees.

Solana will surpass Ethereum

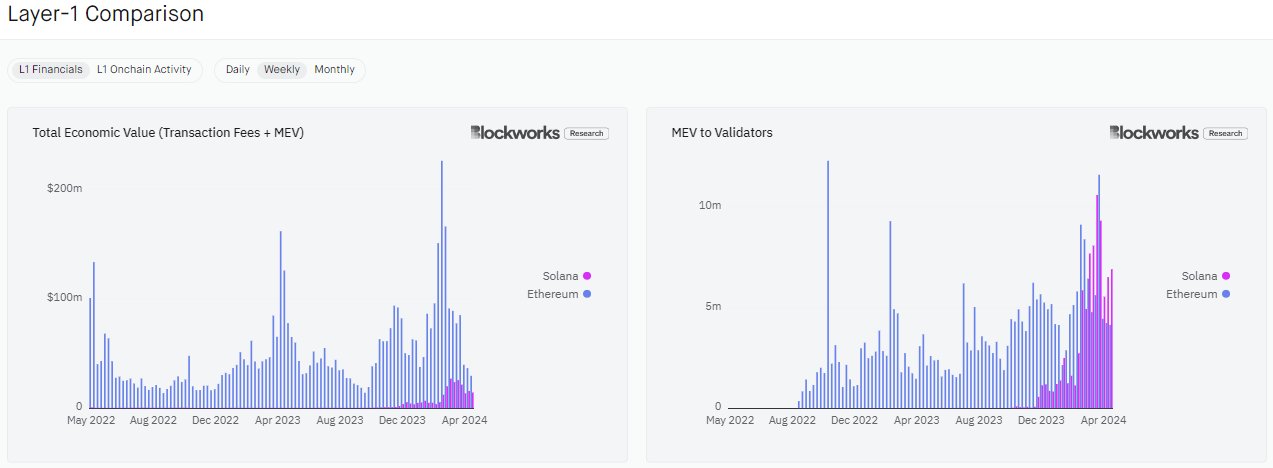

According to on-chain analyst Dan Smith, Solana has quickly approached Ethereum in terms of transaction fees. He stated that, “Solana will overtake Ethereum in terms of transaction fees + MEV gain this month, possibly this week.” Transaction fees refer to the fees associated with network operations, while MEV is the highest value a validator obtains by maximizing block production or ‘validation’.

Source: X/Dan Smith

Smith supports his argument with data, noting that there is a difference of about $300k between Solana and Ethereum fees. The chart shows that Solana recorded a significant spike in 2024, largely closing the gap with Ethereum.

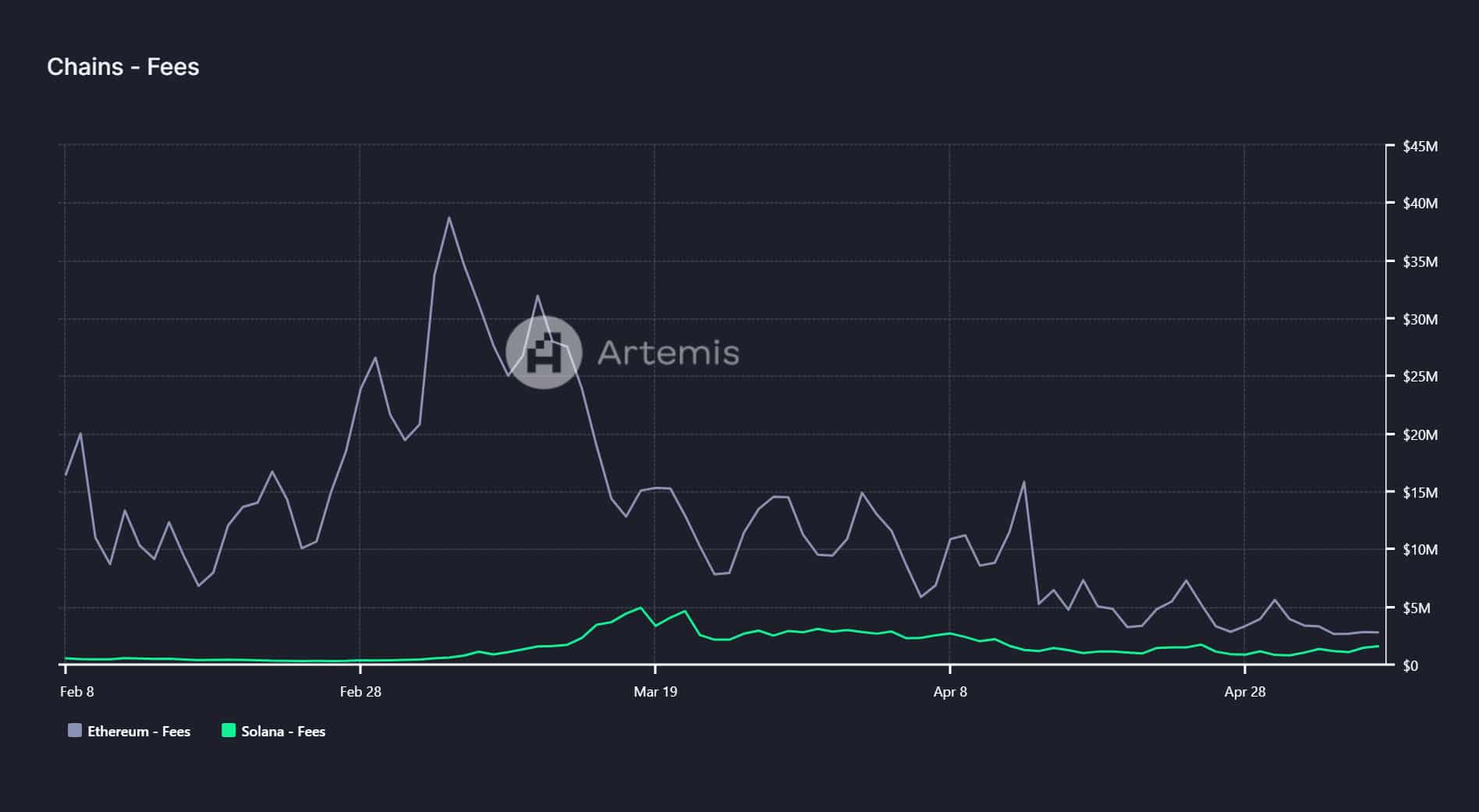

A review of Artemyz’s data confirmed the trend on the fee side. Data shows that Ethereum network fees have decreased significantly since the end of February. On May 7, Ethereum fees reached $2.8 million, while Solana had $1.6 million.

However, other market watchers argue that Ethereum transaction volume should include all of L2 to capture its “true value”. Dan Smith replied: The question continues to be whether to push activity to L2, where ETH, the asset used as currency, returns enough value to L1 to compensate for the loss of L1 activity.

Source: Artemyz

Although the network has its challenges, Solana generally has lower transaction fees than Ethereum. Responding to Smith’s prediction of SOL eclipsing ETH, crypto analyst Ansem wondered, “And transactions for users are still 100 times cheaper, let’s really think about this and explain it in detail for Why is ETH still worth 5x by market cap?

Related: Solana Price Continues to Drop Despite NFT Outperforming

Decentralized exchanges are heating up

Things are also heating up on decentralized exchanges (DEXs) after Solana’s Jupiter exchange outperformed Ethereum’s Uniswap on the Single Active Wallet (UAW) front. Like Ansem, most market observers emphasize that SOL is undervalued, especially after last week’s pullback.

However, Ethereum leads in terms of Total Value Locked (TVL) and overall token value on the price chart. Solana has a TVL of $4 billion, while Ethereum’s value stands at $53.3 billion at the time of writing, underscoring greater investor confidence in Ethereum.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Thank goodness