Institutional investors retreat from Solana

Solana’s price was expected to benefit from the approval of a second spot SOL ETF in Brazil this week. This approval had the potential to spark a recovery and set a precedent for altcoins globally.

However, institutional investors have significantly withdrawn from SOL, which may hinder any potential price increase. In fact, on the downside, Solana has even underperformed compared to Bitcoin and Ethereum.

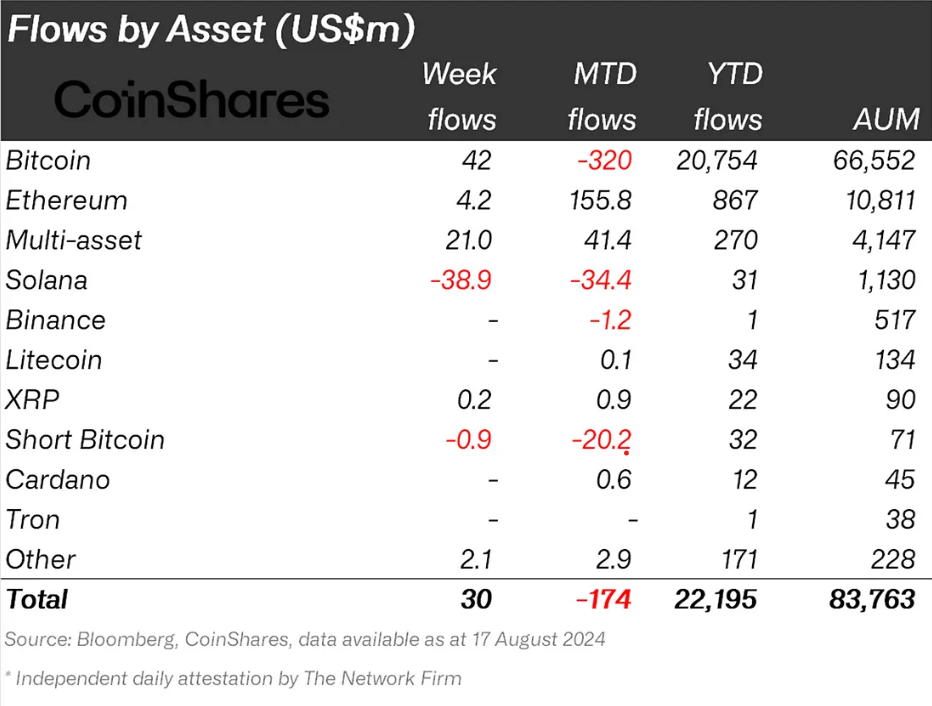

According to a report by CoinShares, in the week ending August 17, SOL saw outflows totaling $38.9 million. This has brought Solana’s year-to-date outflows down to just $31 million, less than Litecoin.

This withdrawal could exacerbate the pessimistic atmosphere surrounding altcoin prices, as broader market signals have been negative. After briefly entering bullish territory, the Relative Strength Index (RSI) has fallen back below the neutral line. This decline indicates unsustainable buying momentum, leading to further weakness. As long as the RSI remains below the neutral line, the chances of a recovery appear bleak.

SOL Price Forecast: A Cautious Outlook

At the time of writing, Solana’s price is trading around $142, hovering above the $137 support level. The short-term recovery of SOL from $130 to $162 earlier this month has nearly fizzled out. The cryptocurrency is likely to consolidate below $156, as it has in the past.

Should the $137 support level be breached, the altcoin could eventually drop to $126, which serves as a crucial support level. A rebound from this point would reinforce the broader range between $186 and $126.

However, the outlook could shift if a gradual recovery allows Solana to reclaim the $156 support level. While SOL might not fully recover from the 30% decline since July, it could still rally to $169, potentially invalidating the bearish outlook.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE