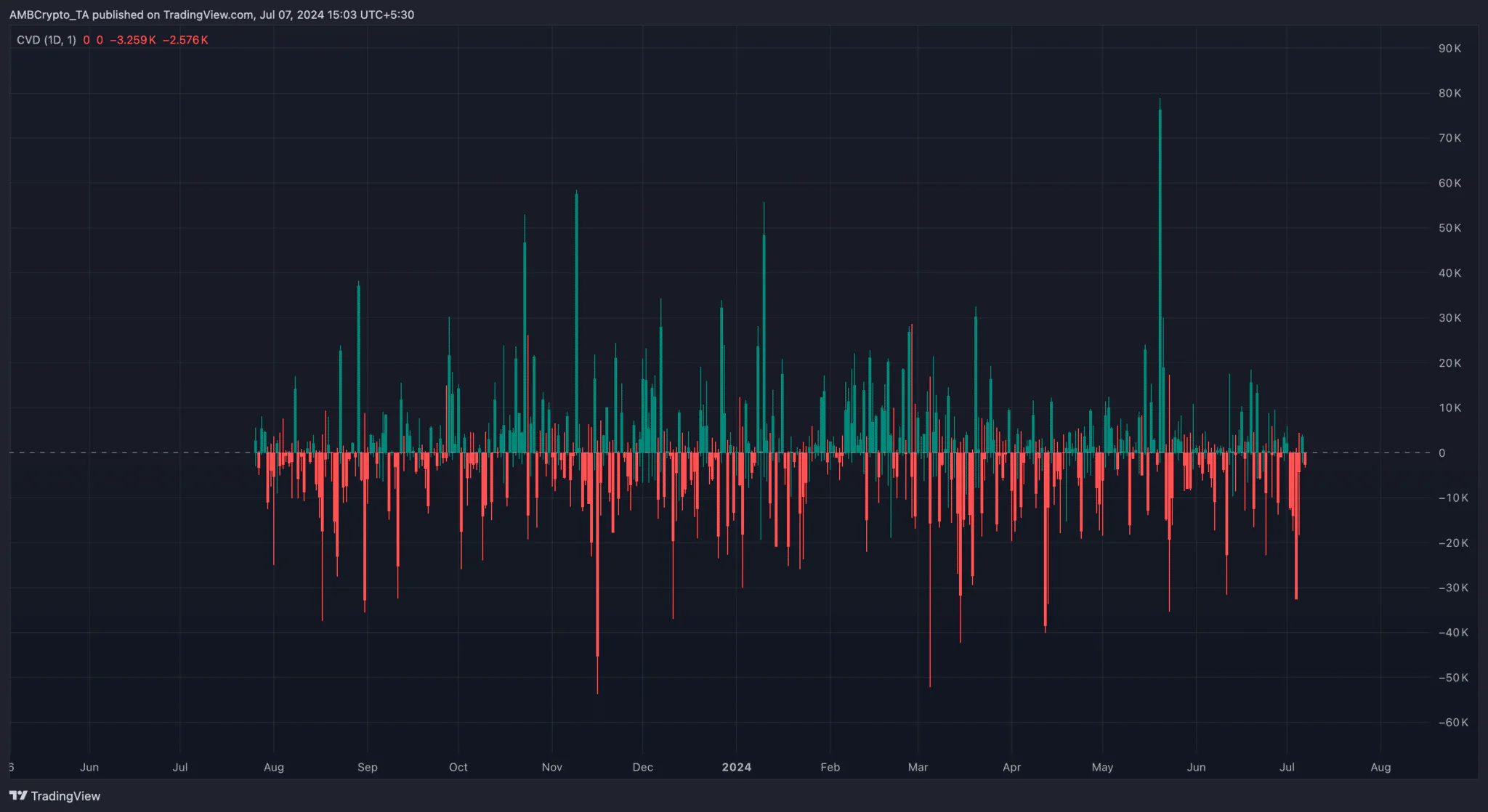

The price of Ethereum (ETH) is at risk of falling below $3,000 for the second time in a few days, according to data from the Cumulative Volume Delta (CVD).

On the daily ETH/USD chart, the spot CVD has dropped into negative territory. CVD tracks the difference between buying and selling volume for a cryptocurrency over a given period.

Buyers are struggling to maintain pressure

When the value is positive, it indicates more holders are buying than selling, suggesting a potential short-term price increase. Conversely, a negative value means sellers are dominating. In such a scenario, the price is unlikely to rise. At the time of writing, the altcoin’s price was $3,012. Earlier, ETH had attempted to flip the $3,100 level, but sellers thwarted this move.

Besides CVD, other metrics indicate that a full recovery for the cryptocurrency may take some time.

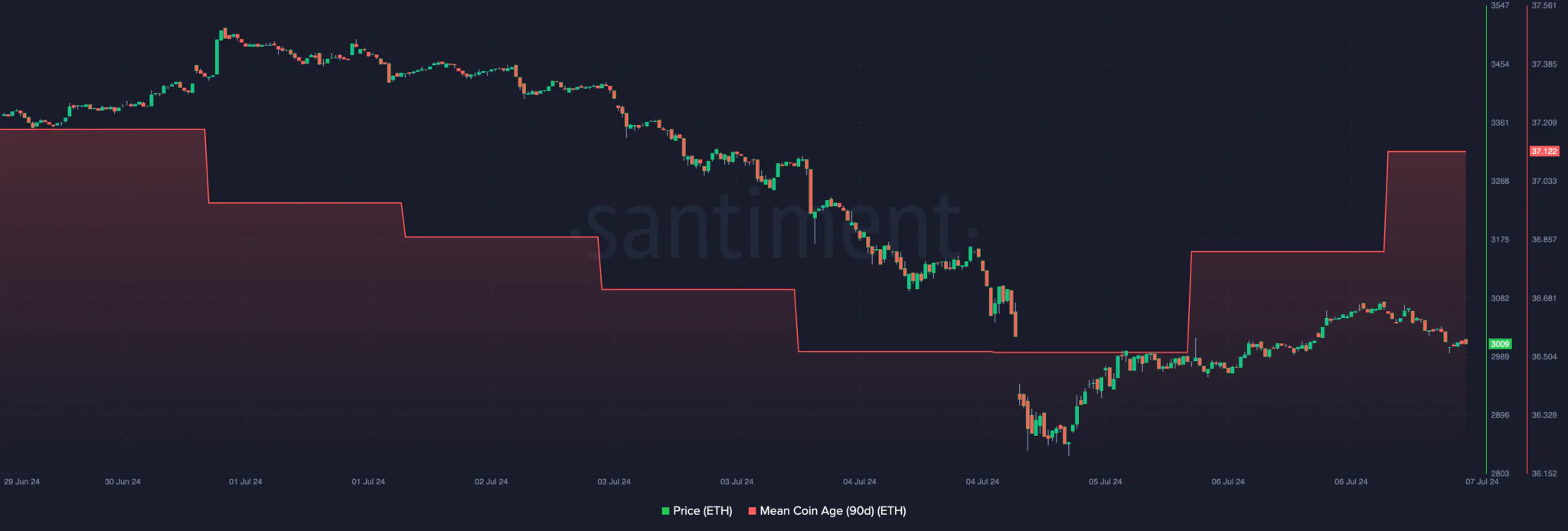

One such dataset is the Mean Coin Age (MCA). MCA represents the average age of coins on the blockchain. An increase in MCA means older coins are re-entering circulation, thereby increasing the likelihood of a sell-off.

However, the decline in coin age suggests that holders are refraining from selling. Instead, they are opting to keep their assets in non-custodial wallets.

More old coins, more problems

As of this writing, ETH’s 90-day MCA has risen from 36.50 to 37.12. This increase implies a rise in trading activity involving the cryptocurrency.

Since the price has fallen compared to its value on July 6, this suggests that most trading has ended in a sell-off.

If this trend continues, ETH’s price could drop below $3,000. Additionally, if buying pressure fails to keep up, the price may fall to $2,881 as seen on the 5th.

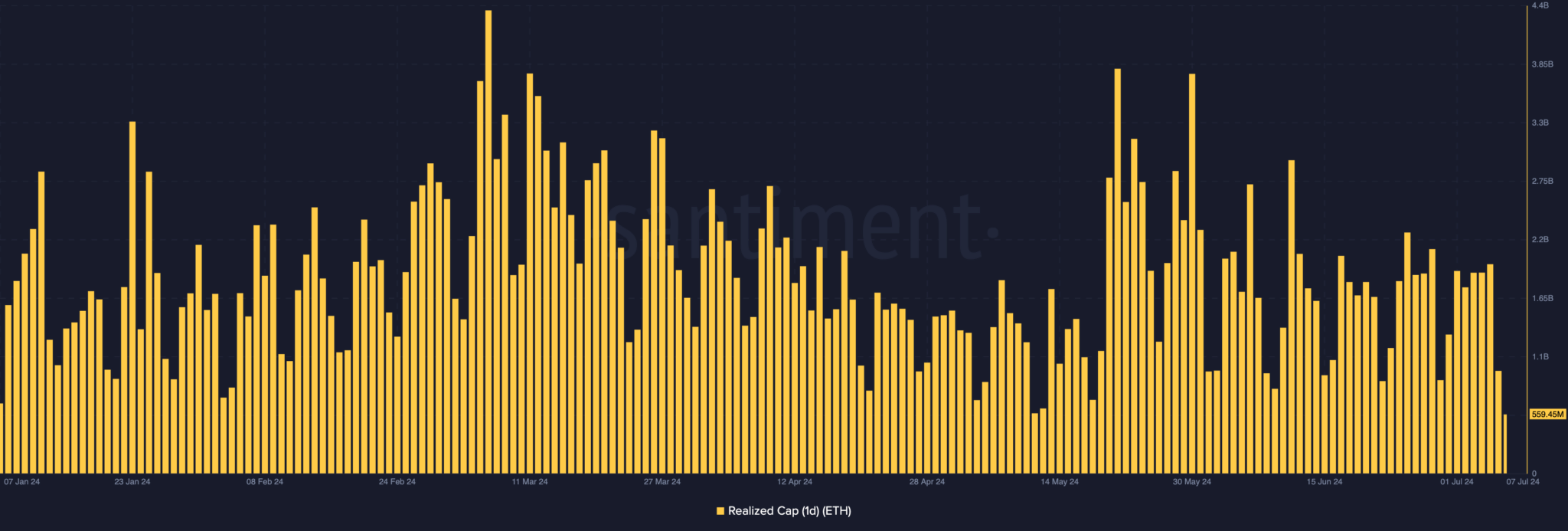

Moreover, the Realized Cap aligns with this forecast. Realized Cap represents the value of each coin at its last movement compared to its trading value.

According to the cost basis measure, the one-day Realized Cap has dropped to $559.45 million. This decline indicates that some ETH holders are now experiencing unrealized losses.

If this situation persists, the broader market might lose confidence in Ethereum, potentially leading to decreased demand for the cryptocurrency. If that occurs, the price could fall as previously mentioned.

Interestingly, this drop also presents a buying opportunity, as ETH remains in a bull market. However, the benefits of this change may not be apparent for several days or weeks. In the long run, though, ETH’s price seems poised for growth.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE