As of this writing, QNT is trading at $70.95, marking its highest price in nearly two weeks. So, what’s driving this increase in QNT’s value despite the broader bearish sentiment?

Bulls Take Control

The sharp rise in buying activity is the key factor behind QNT’s price surge. The Relative Strength Index (RSI) stands at 61, indicating bullish momentum. Despite the influx of buyers, QNT has not yet reached overbought territory, suggesting there is still room for further growth.

The RSI has also made a strong upward move, crossing above the signal line—another indicator that buying pressure is outweighing selling pressure.

The strength of this upward trend is further confirmed by the Directional Movement Index (DMI), where the +DI has crossed above the -DI. Traders may interpret this crossover as a buying signal, anticipating that the price will continue to rise.

QNT is approaching a key resistance level at $72, which corresponds to the 100% Fibonacci retracement. This price point has historically acted as a strong barrier, with previous rallies faltering when QNT neared this level.

However, with buyers rushing into the market, a breakthrough seems possible. If QNT manages to surpass this resistance, the next target could be $85, aligned with the 1.618 Fibonacci level.

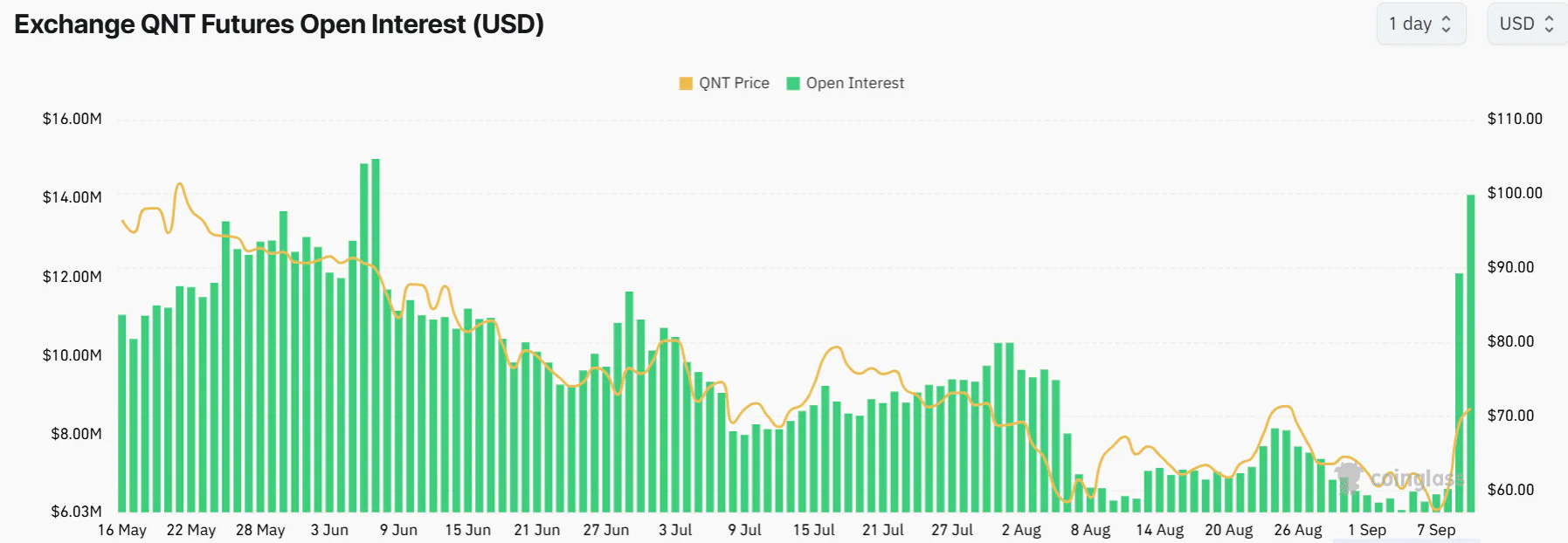

The derivatives market is also showing growing interest in QNT, evidenced by a surge in Open Interest to its highest point in months. QNT’s Open Interest reached $14 million at the time of reporting, doubling within 24 hours, according to Coinglass data.

On-Chain Metrics Support QNT’s Bullish Run

On-chain data further strengthens the bullish case for QNT. According to CryptoQuant, exchange reserves have dropped significantly, reaching their lowest point since mid-July.

This decline typically indicates fewer QNT tokens are available on exchanges for sale. Reduced exchange reserves amid rising demand reinforces the bullish outlook.

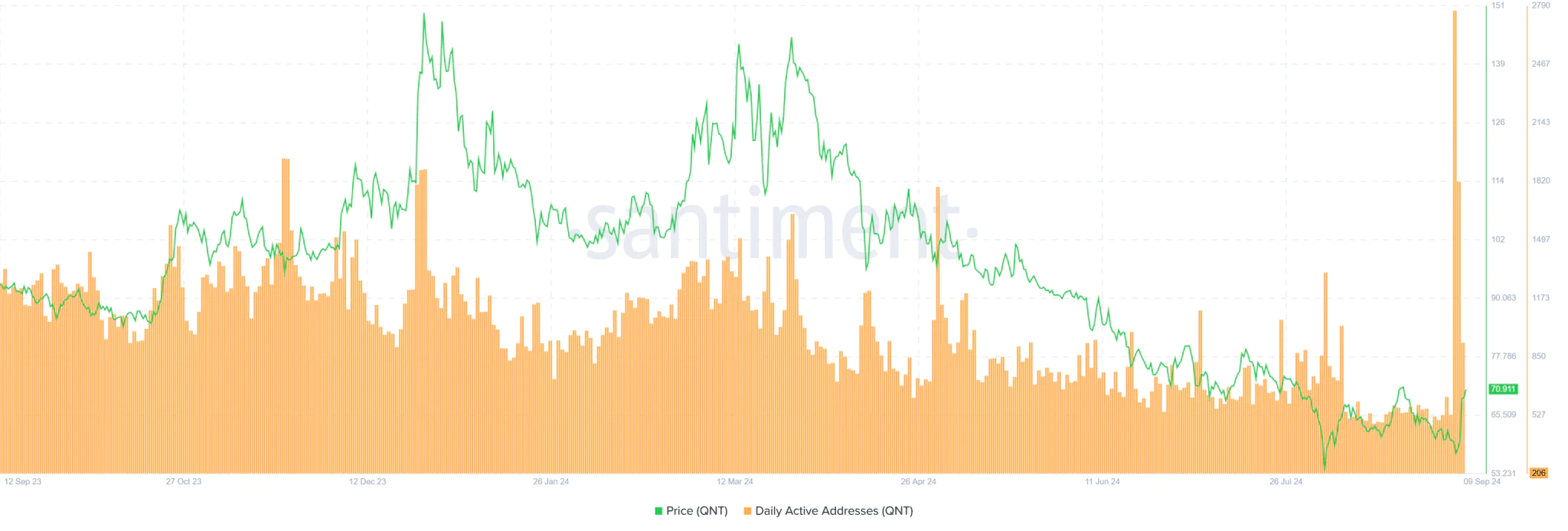

Additionally, activity on the Quant network is on the rise. Santiment data shows that daily active addresses have surged to their highest level in over a year, a positive sign of the network’s growth and adoption.

As more bullish signals emerge, the QNT buy/sell ratio has inched up from below 1 to 1.06 at the time of writing, indicating a slight increase in buying positions. However, the ratio still suggests a relatively balanced market.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE