According to data from CoinGlass, these 11 ETFs attracted net inflows of $475.2 million on the day after Christmas, led by Fidelity Wise Origin Bitcoin ETF with $254.4 million inflows.

The ARK 21Shares Bitcoin ETF followed with $186.9 million in inflows, while BlackRock’s iShares Bitcoin Trust (IBIT) saw inflows of $56.5 million.

Grayscale’s Mini Bitcoin ETF and VanEck’s Bitcoin ETF also saw more modest inflows, with $7.2 million and $2.7 million, respectively.

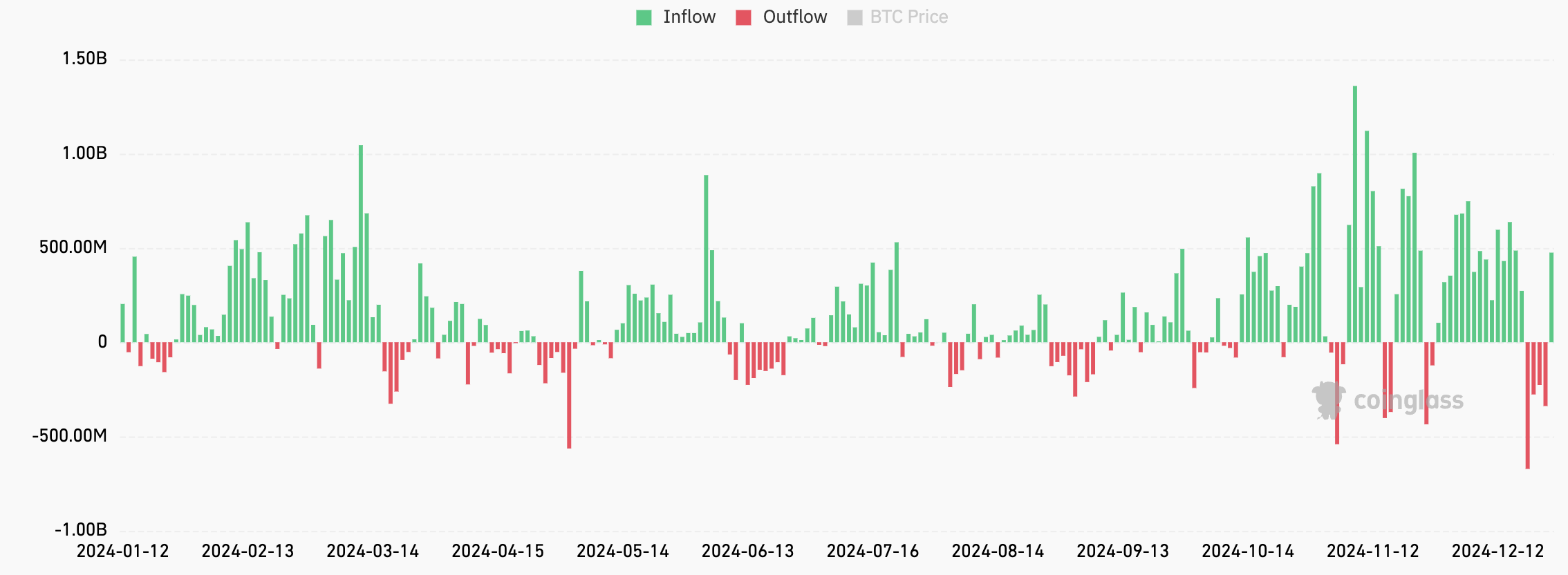

The U.S. markets were closed on December 25 for the Christmas holiday. Between December 19 and December 24, these ETFs experienced four consecutive days of net outflows, totaling $1.52 billion.

On December 24, the iShares Bitcoin Trust (IBIT) saw its largest net outflow in history, reaching $188.7 million, more than doubling the previous record of $72.7 million set on December 20.

Over the same three consecutive trading days, ETFs recorded a total of $301.6 million in net inflows. On December 26 alone, ETH ETFs attracted $117.2 million, led by Fidelity’s ETF with a net inflow of $83 million.

Coming in second was BlackRock’s iShares Ethereum Trust, which brought in $28.2 million, while Grayscale’s ETH Trust saw more modest inflows of $6 million.