Pepe [PEPE] is currently experiencing a robust uptrend, significantly outperforming other prominent large-cap meme coins. Over the past week, PEPE has surged by 57.6%, in stark contrast to Shiba Inu’s [SHIB] -0.01% and Dogecoin’s [DOGE] 11.6% increase.

With a clear trajectory towards the next Fibonacci extension level, PEPE’s long-term potential suggests even greater heights. The question arises: could PEPE be the catalyst for the next altcoin rally? The solid bullish structure may present an opportunity for bulls to re-enter the market.

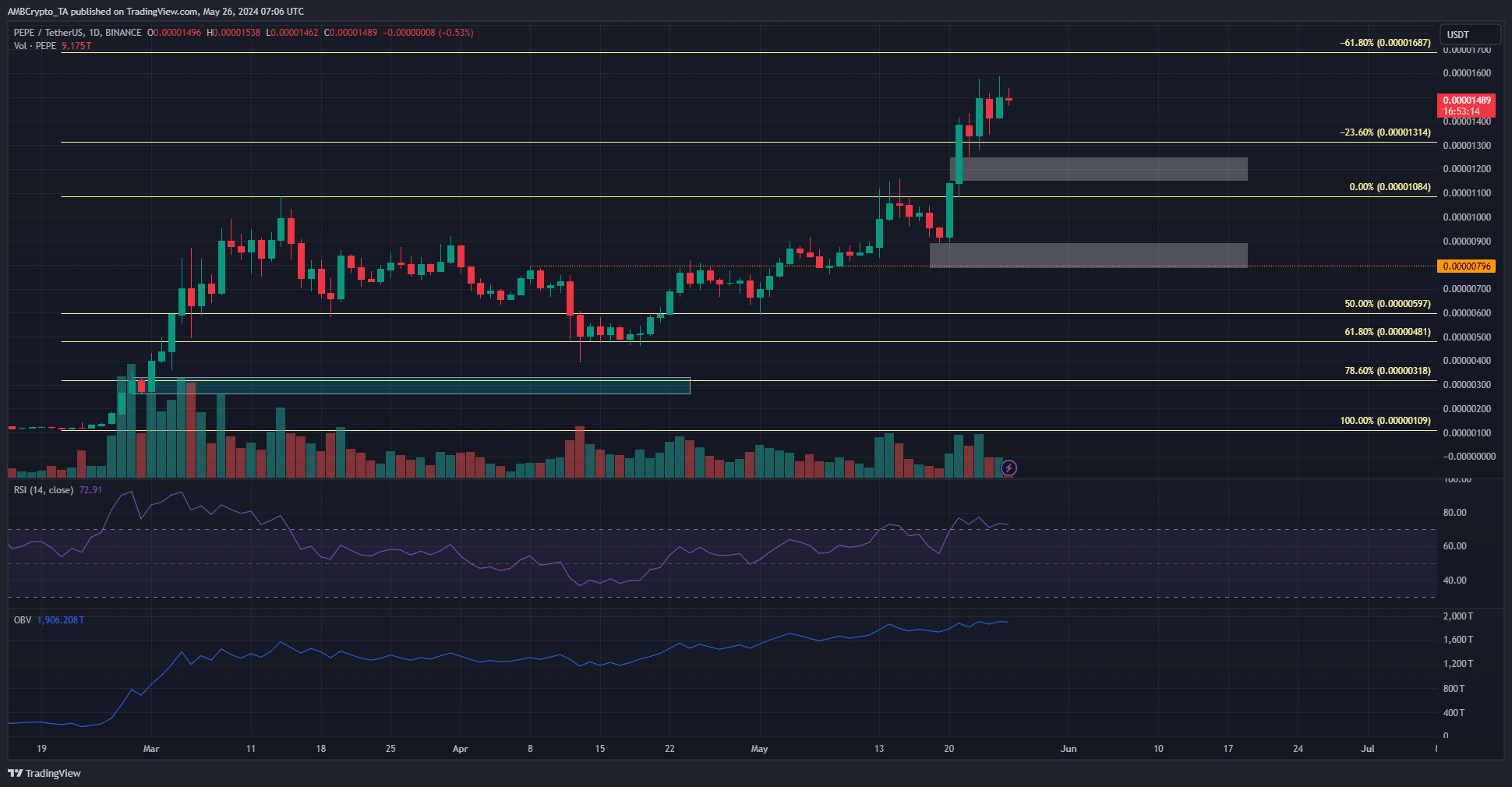

Since early May, the daily chart has been bullish, with prices breaking past the resistance level at $0,00000796. Over the past week, the remaining imbalance at $0,0000122 may serve as a short-term bearish target if prices seek liquidity.

The 61.8% Fibonacci extension level (marked in light yellow) at $0,0000168 is a potential zone where selling pressure could intensify as PEPE holders take profits.

The RSI on the daily chart is at 72, highlighting the strength of the upward momentum over the past two weeks. Additionally, the OBV has risen sharply, indicating consistent buying volume. The daily trading volume for PEPE has not soared as it did at the end of February, but this may not be a significant concern given the steady upward trend throughout May.

PEPE’s magnetic zones might not pull the price towards them

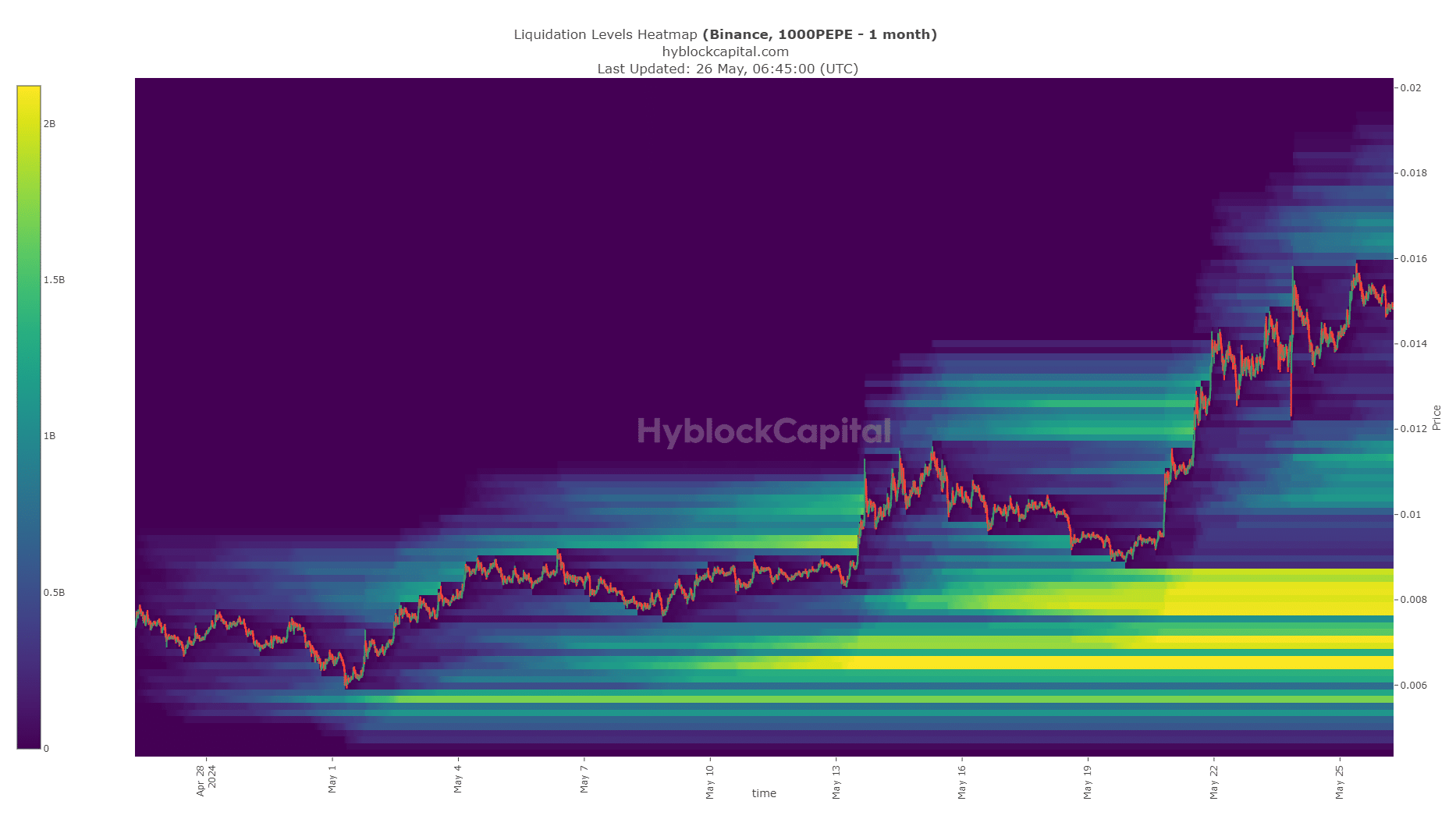

The liquidation levels from the previous month are concentrated around the $0.000008 region, which is also marked on the daily price chart as a liquidity cluster. The $0.00000645 and $0.000007 levels also hold substantial long liquidation positions. However, these prices are more than 50% below the current market price.

A retracement to these levels may not occur soon. Market sentiment remains solidly optimistic, especially regarding PEPE. It may rise further to attract more leveraged long positions from impatient bulls.

Source: Hyblock

Therefore, reaching the Fib extension at $0.0000168 is likely before any significant retracement. In the event of a pullback, the $0.0000105-$0.0000103 zone could counter the initial wave of sellers before a deeper retracement occurs.

Traders should be prepared for the possibility that prices might not dip below $0.0000113 for several weeks, particularly if Bitcoin [BTC] initiates another rally and drags PEPE along with it.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

AZ carnar

Sounds promising.