MicroStrategy (MSTR) stock has surged once again, surpassing $400 as Bitcoin hits a new high above $103,000. With a gain of more than 500% this year, MSTR has outperformed Bitcoin and is on track to hit new highs. This makes MSTR a top pick for funds looking to capitalize on the stock’s volatility.

MicroStrategy Stock Continues to Rally

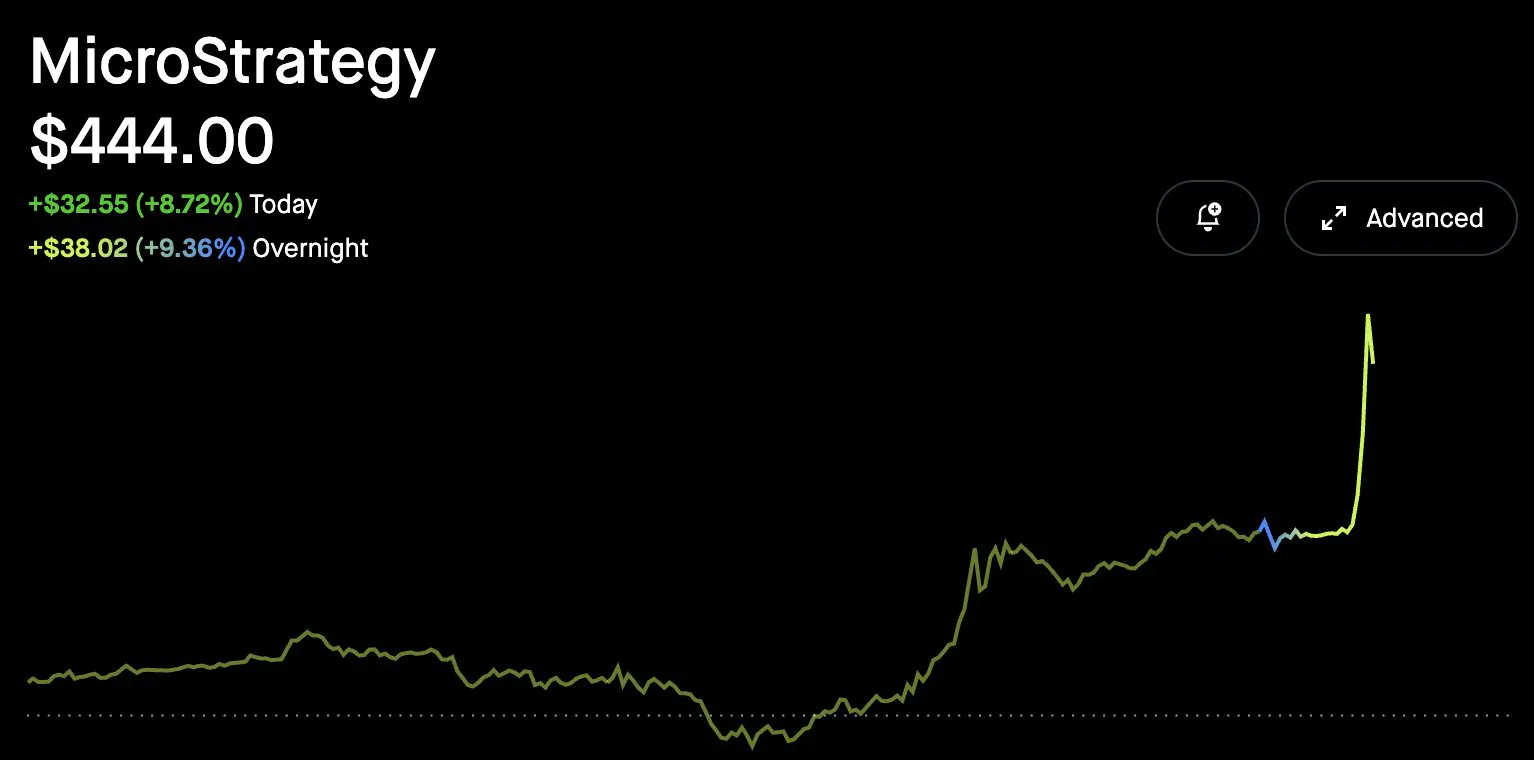

MSTR stock is showing strength as it rebounds from its $350 low last week as Bitcoin breaks out of its consolidation phase. On Wednesday, MSTR stock rose 8.72%, surpassing $400 once again.

The stock also jumped 10% overnight as Bitcoin crossed the $100,000 mark. The company’s Bitcoin holdings have surpassed $40 billion for the first time. MicroStrategy raised $13.5 billion in November to buy 149,880 BTC at an average price of around $90,231 per BTC, co-founder Michael Saylor said.

Read more: Bitcoin Surges to $99,000 Amid Promising Signals

This strategy generated a 38.7% return on Bitcoin, which translates to a net gain of 97,500 BTC for shareholders, or an average of 3,250 BTC per day. That amounts to around $10 billion. As BTC prices continue to rise, the total value of MicroStrategy’s Bitcoin holdings (402,100 BTC) has surpassed $40.8 billion. This has allowed the company to make a whopping $18 billion profit on its Bitcoin investment.

Analysts from Bernstein have set a $600 price target for MSTR shares, suggesting a potential upside of 50% from current levels.