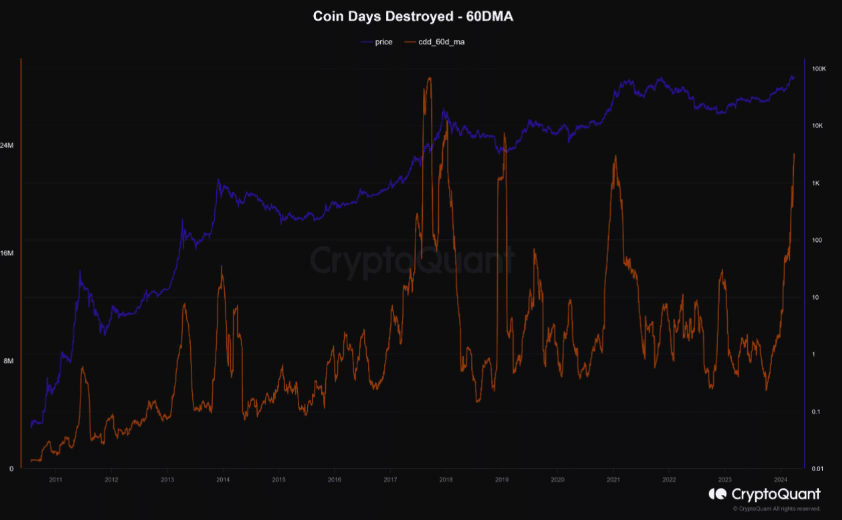

Coin Days Destroyed Index

According to information from CryptoQuant, Bitcoin’s Coin Days Destroyed (CDD) index has reached its highest new peak in the past 5 years. Maartunn, a blockchain analytics expert, discussed this issue in a recent article.

CDD measures the number of days that Bitcoin is inactive multiplied by transaction volume.

In the past, when CDD reached highs above the 60-day moving average (MA), this often indicated that long-term holders were starting to sell their assets. This is often accompanied by a significant correction period for Bitcoin. Maartunn also noted this in his article.

Source: CryptoQuant

“This model shows that during bullish periods, there is distribution from long-term investors. In the past, it took up to 5 months for Bitcoin to peak in price.”

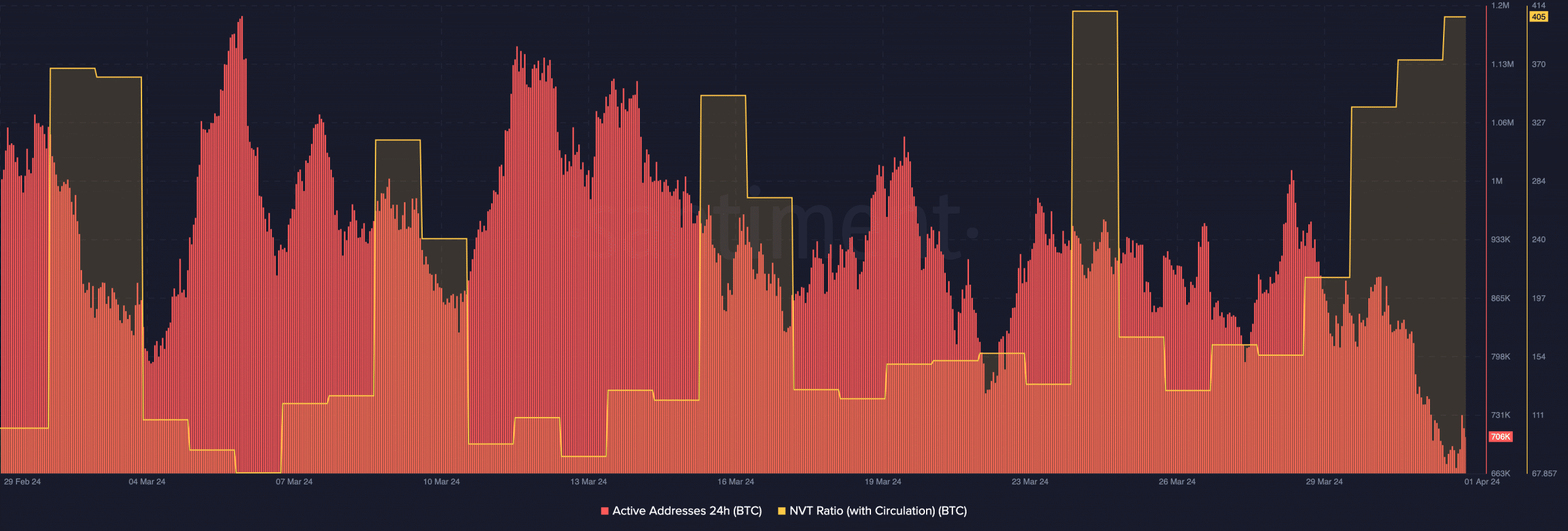

At the time of writing, the price of BTC is $69,663, representing slight fluctuations over the past 24 hours. Further analysis of Bitcoin’s on-chain state shows that activity on the network has decreased.

As of this moment, there are approximately 706,000 active Bitcoin addresses in 24 hours. A few days ago, this number surpassed 1 million. This recent decrease shows that Bitcoin’s successful transactions have decreased.

If the network is not performing strongly, prices may be affected as demand may decrease. If this happens, Bitcoin’s price could drop below $69,000.

Network Value to Transaction Ratio

Source: Santiment

In addition to looking at active addresses, the Network Value to Transactions (NVT) ratio should also be considered. This is an indicator of whether an asset is priced too high or too low, depending on how well the cryptocurrency is performing.

A low NVT ratio typically indicates that trading volume is growing faster than market capitalization. In this case, it can be predicted that investor sentiment is positive. However, Bitcoin’s NVT ratio is at a high level, around 405, indicating negative investor sentiment. This high level could indicate that Bitcoin is overvalued, especially considering current market conditions.

Related: LMAX CEO Foresees Bitcoin Trading in Six Figures

Cryptocurrency analyst Ali Martinez, in an article on X (formerly Twitter), also shared his views on Bitcoin in the short-term future.

#Bitcoin finds solid ground at $68,300, yet a break below could lead to a downswing to the next support range at $65,250-$63,150, where 760,000 wallets hold 520,000 $BTC.

On the brighter side, securing $70,320 as support is vital for #BTC next leg up! pic.twitter.com/EMPBRRADzT

— Ali (@ali_charts) April 1, 2024

According to Martinez, Bitcoin’s price could drop to $63,150 if bulls fail to hold the $68,300 support.

However, he also emphasized that Bitcoin price could increase if it breaks above $70,320.

It seems that the price of Bitcoin may drop before the halving event on April 19. According to historical observations, the currency often experiences large fluctuations as the halving event approaches.

Meanwhile, it is likely that Bitcoin will surpass $70,000 this cycle. However, this could happen after the halving event.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Amar lagbe bitcoin

Need more updates