The cross-chain protocol LayerZero has successfully completed its first snapshot airdrop on May 1, marking a significant milestone in the launch of its native token, ZRO. This snapshot signifies a crucial phase in the protocol’s development and has generated considerable excitement within the DeFi community.

LayerZero Labs has confirmed the completion of the snapshot airdrop through a post on X on May 2. This snapshot will determine the allocation of ZRO tokens for eligible recipients when officially launched, with the token issuance expected to take place in the first half of 2024.

LayerZero serves as an efficient solution for connecting independent blockchains, ensuring compatibility without compromising decentralization, security, and performance. Its success is demonstrated by attracting investments of up to $120 million and achieving a valuation of $3 billion in April 2023 through significant airdrop potential.

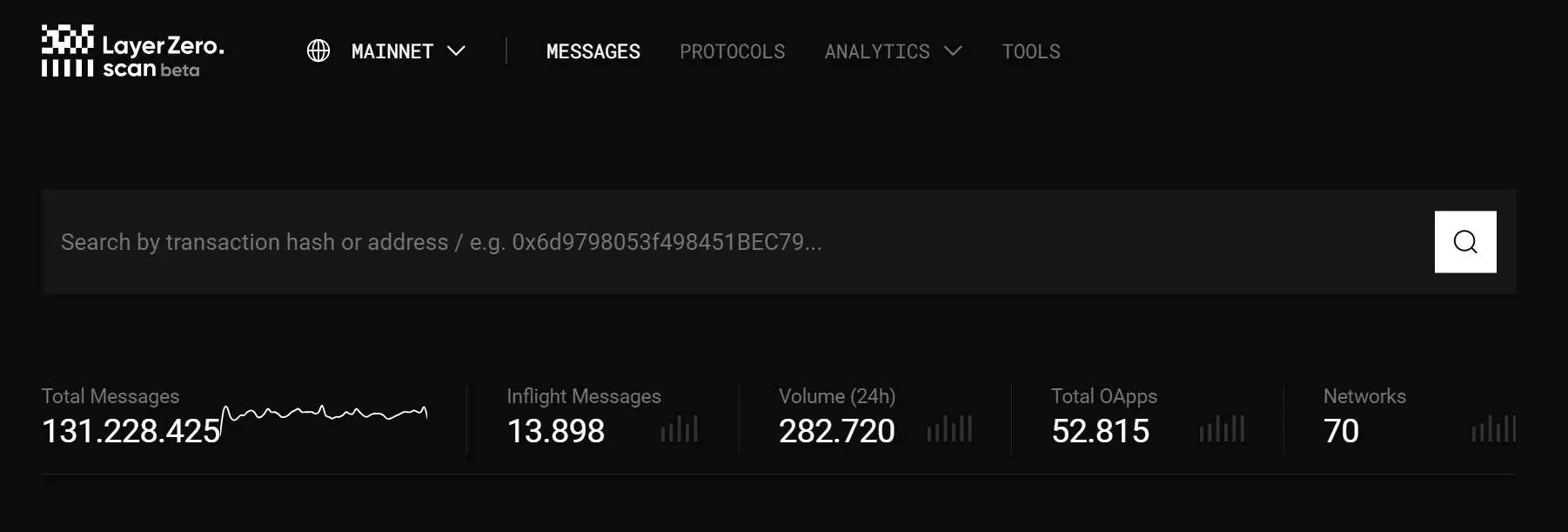

Recently, LayerZero has garnered significant market attention with over 131 million transactions and over $50 billion in value transferred across blockchain networks.

Related: LayerZero Activates Mainnet for Upgrade V2

Impact of the LayerZero Airdrop

While the LayerZero airdrop presents opportunities for its protocol and community, it also raises concerns about the potential impact of Sybil users. These users receive airdrops across multiple wallets solely to sell the reward tokens without intending to hold them long-term with the protocol. This behavior could lead to a significant price decline for the newly airdropped token upon launch.

Many past airdrop events have been affected by airdrop hunters. In February, it was discovered that the legitimate list for the Starknet airdrop primarily consisted of Sybil users, with 701,544 addresses out of a total of 1.3 million addresses associated with their activities. Similarly, in March 2023, 1,496 wallets of airdrop hunters accumulated over $3.3 million worth of tokens from the Arbitrum (ARB) airdrop, contributing to the subsequent price decline.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Je voudrais savoir comment pourrais-je être sur cette blockchain

Nice