JMP Securities predicts that the value of Bitcoin will increase sharply, possibly reaching $280,000, this prediction is based on the latest report from the firm. The report says there could be a large amount of money waiting to pour into Bitcoin exchange-traded funds (ETFs), with a total value of up to $220 billion over the next three years. This demonstrates the growing interest of investors in cryptocurrencies and makes Coinbase one of the beneficiaries of these developments.

Bitcoin price up to 280,000 USD

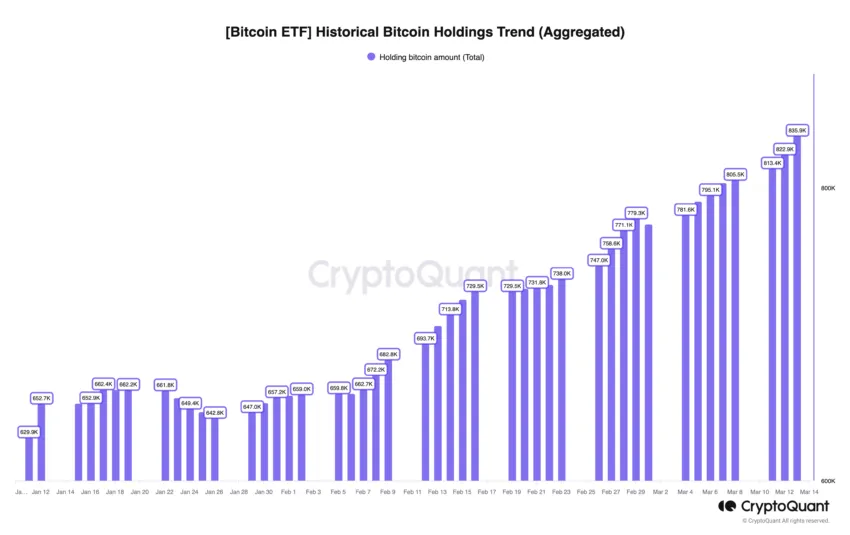

JMP’s report also highlights the remarkable growth of spot Bitcoin ETFs, with capital inflows reaching $10 billion after just two months of launch. Analysts say this number shows we are in the early stages of a much larger trend.

With ETF approval as a catalyst, it is expected that this capital flow will continue to increase. Ki Young Ju, CEO of CryptoQuant, emphasized that “a sell-side liquidity crisis is imminent if institutional capital flows into Bitcoin continue to increase.”

He added that “Sellers cannot win this game until spot Bitcoin ETF inflows stop… At this rate, we could see a short-side liquidity crisis in within 6 months… Once the sell-side liquidity crisis occurs, the peak of the next cycle may exceed our expectations due to limited sell-side liquidity and thin order books.”

At the heart of this optimistic outlook is the potential multiplier effect of new capital on Bitcoin prices. JMP analysts, including Devin Ryan, have made it clear that the expected capital inflow of $220 billion could massively increase the cryptocurrency market capitalization exponentially, pushing the price of Bitcoin to high levels 280,000 USD per coin.

This forecast is based on an estimated current multiplier of new capital of approximately 25x, suggesting a significant impact on Bitcoin’s overall market capitalization.

Bitcoin ETF Holdings. Source: CryptoQuant

Interestingly, JPMorgan analyst Nikolaos Panigirtzoglou pointed out that the recent inflows could be due to a shift of capital from traditional cryptocurrency platforms, such as exchanges, to Bitcoin ETFs. However, he also admitted that this could change in the future.

Related: Bitcoin Whales Begin Withdrawing Funds

“Cryptocurrency exchanges have recorded cumulative Bitcoin outflows of approximately $7 billion since the launch of the Bitcoin Spot ETF. In other words, there is likely net outflow from retail investors into The newly created ETF will be closer to $2 billion instead of $9 billion,” Panigirtzoglou said.

Mr. Panigirtzoglou also pointed out that the spot Bitcoin ETF market is expected to expand to $62 billion within the next two to three years. And Coinbase is well-positioned to benefit from the growing ETF market, with JMP Securities adjusting the price target for COIN stock to $300, up from $220.

Cette application est intéressant

hello