Bitcoin has broken through to a new all-time high (ATH), surpassing $73,000 over the past 24 hours, although the battle between bulls and bears is intensifying at this key price level.

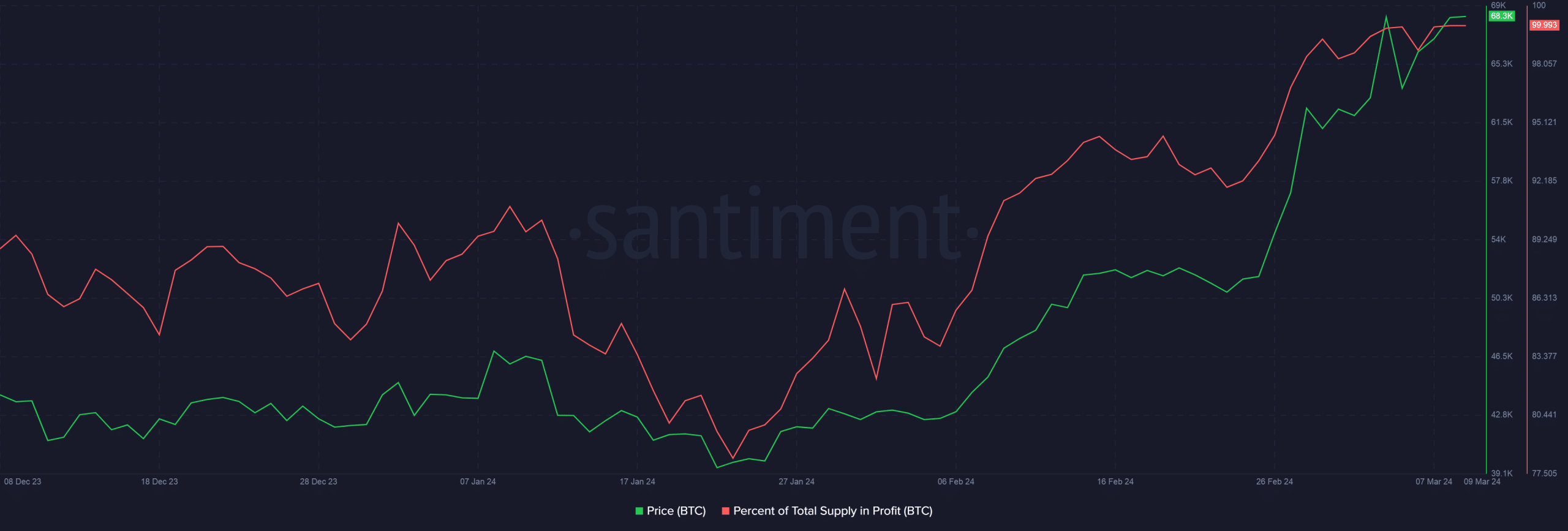

According to CoinMarketCap, the cryptocurrency has continuously increased in price since peaking earlier in the bull cycle and has increased by more than 70% since the beginning of 2024. With this sudden price increase, the entire Bitcoin supply is now recording profits, according to data from Santiment.

Source: Santiment

Whale addresses plummeted

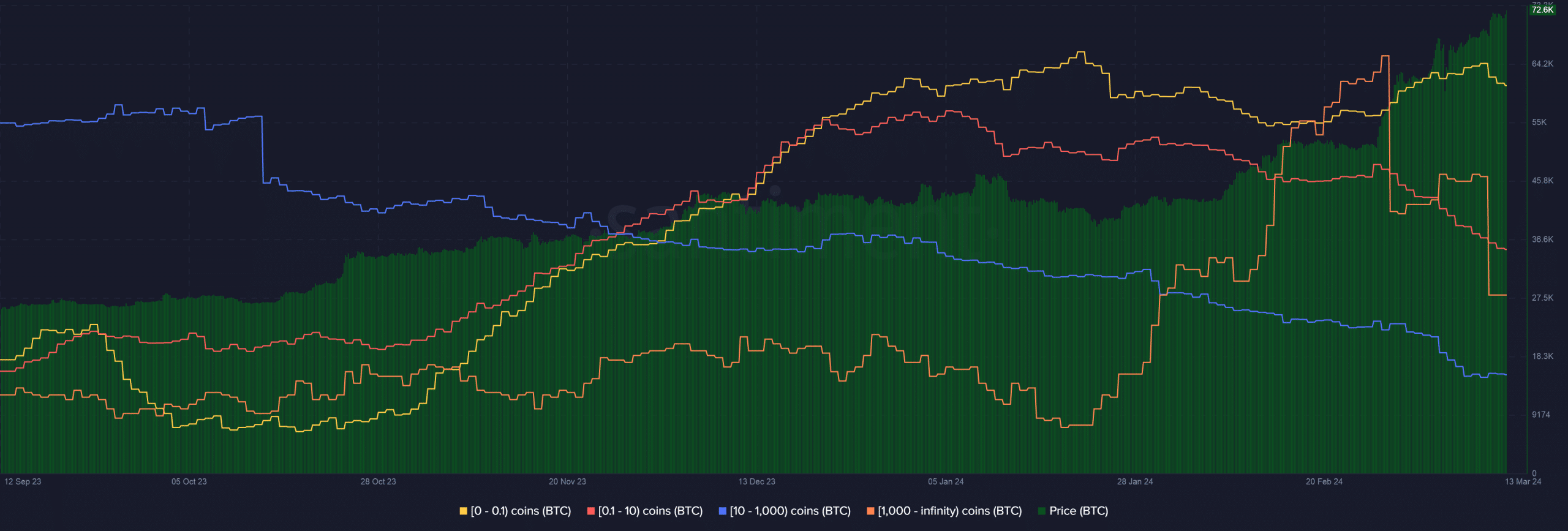

There are signs that large investors, including those holding wallets containing more than 1,000 Bitcoin, are making withdrawals. For example, these wallets are down almost 5% in the past two weeks. At the same time, groups of people holding between 10 and 1,000 Bitcoin coins also decreased by 0.5% during the same time period.

It is likely that many of these investors placed sell orders at a price slightly higher than the previous ATH at $69,000. When the price reaches this level, there will likely be strong selling.

Source: Santiment

However, in contrast to that, there are signs that small addresses holding less than 0.1 units of Bitcoin have increased by 0.6% over the past two weeks. This could be a sign of the return of retail investors to the market.

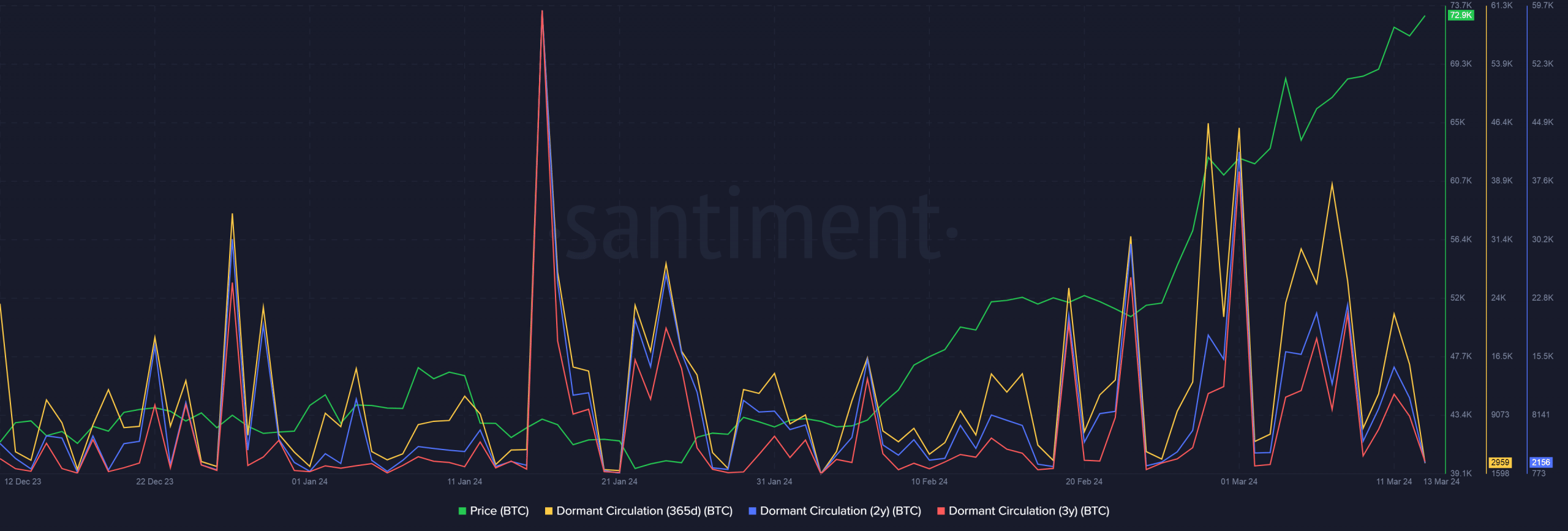

Dormant supply begins to move on the chain

Source: Santiment

Supply has begun to move on-chain, with signs that the dumping by large investors may also be related to the previous strong volatility of coins. There are coins that haven’t moved in the last 2-3 years that suddenly started being traded in the last two weeks. Many of these holdings bought Bitcoin during the recent bull cycle. They patiently waited for prices to recover and started distributing when the market increased sharply.

Related: BlackRock’s IBIT Overshadows MicroStrategy with 12,000 BTC Purchase

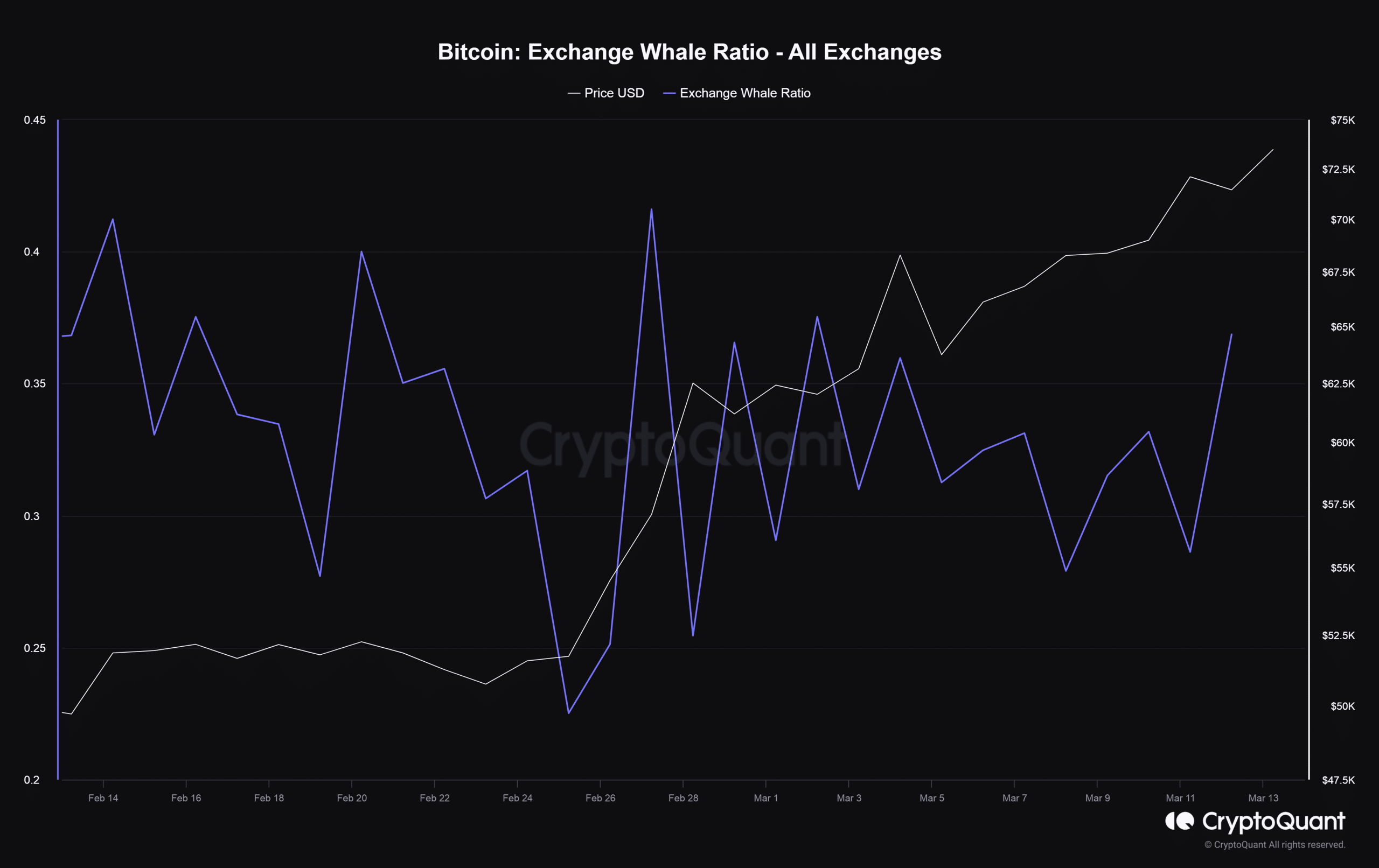

The whales’ exchange interactions are not alarming

Source: CryptoQuant

Although profit-taking by large investors often causes anxiety in the market, the current situation is not at the level of causing panic. Data from CryptoQuant shows that whales only account for about 36% of all Bitcoin flowing into exchanges, suggesting that they are not a large selling group driving down cryptocurrency prices en masse.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Relatable💰