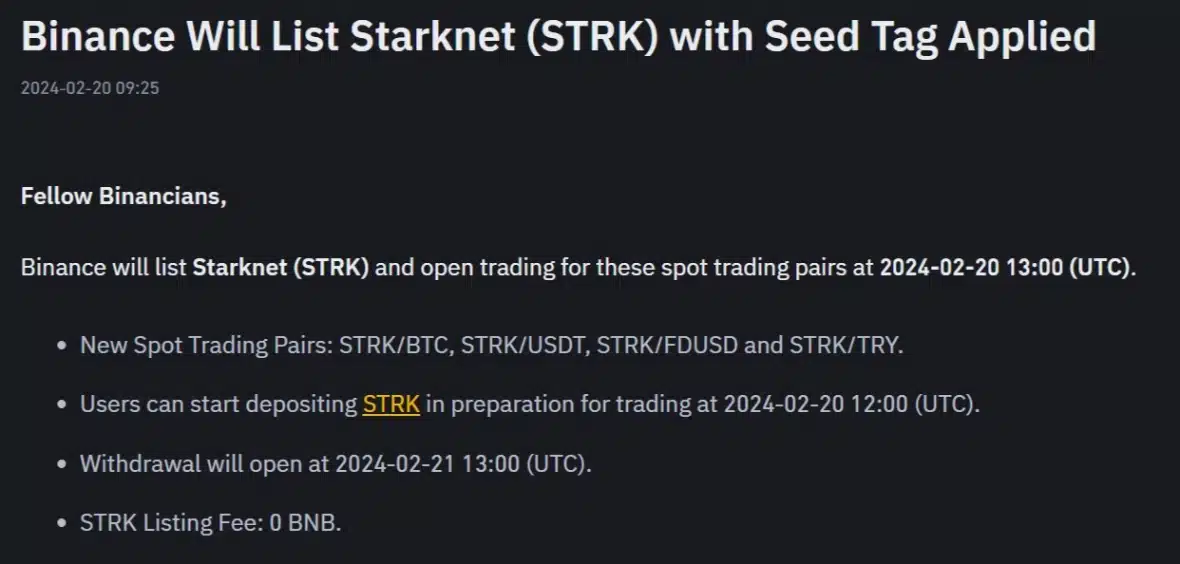

Binance will list StarkNet (STRK) and is scheduled to open trading for these spot trading pairs on 2024-02-20 at 12:00 UTC.

The newly added spot trading pairs are: STRK/BTC, STRK/USDT, STRK/FDUSD, and STRK/TRY.

Users can commence STRK deposits immediately, while STRK withdrawals are expected to open on 2024-02-21 at 12:00 UTC.

Listing fee for STRK: 0 BNB

Note: Withdrawal opening times are estimates. Users can check the actual withdrawal status on Binance’s withdrawal page.

Overview

STRK functions as a permissionless, Validity-Rollup, commonly referred to as a zero-knowledge rollup (ZK rollup) designed for Ethereum. Positioned as a Layer 2 (L2) blockchain, it empowers any decentralized application (dApp) to achieve extensive computational scale without compromising the composability and security inherent in Ethereum.

Starknet aims to facilitate secure, cost-effective transactions and high performance through the utilization of the STARK cryptographic proof system. The programming language for STRK contracts and the STRK OS is Cairo, a purpose-built, specialized language.

Scaling Ethereum with Starknet

Blockchains aspire to maintain three fundamental attributes: security, decentralization, and scalability. Within the blockchain landscape, a well-recognized trilemma asserts that achieving all three simultaneously is challenging, often requiring a compromise on one. Ethereum prioritizes security and decentralization, impacting its scalability. The growth in Ethereum user numbers results in sluggish transaction speeds and elevated gas prices, impeding widespread adoption.

The challenge becomes clear: how can Ethereum achieve scalability without sacrificing security and decentralization? Enter Starknet’s Validity Rollup. By integrating Ethereum with Starknet, significant scalability is attainable.

Related: Disappearance of Nearly 2,000 Starknet Airdrop Participants

STRK achieves scalability by relocating transaction processing off the Ethereum Mainnet (referred to as off-chain) while maintaining a condensed summary of the transactions on-chain. Transactions are organized into blocks, processed off-chain, and then summarized into a singular on-chain transaction. As these transactions occur off-chain, ensuring their integrity and execution without re-execution is crucial.

Starknet addresses this challenge by employing STARK (Scalable, Transparent ARgument of Knowledge) proofs for verifiable computation. Starknet transmits only essential information about the block and the proof to Ethereum, where it undergoes verification with minimal computational effort.