FTX’s Proposal to Return 90% of Customer Funds Carries a Caveat

A revised proposal, slated for submission by FTX Debtors in mid-December pending approval, outlines FTX, the bankrupt cryptocurrency exchange’s, intention to return as much as 90% of creditor assets held at the exchange prior to its November insolvency.

An amended proposal, set to be filed by the FTX Debtors by mid-December if approved, presents the bankrupt crypto exchange FTX’s plan to return up to 90% of creditor holdings held at the exchange before it went bankrupt in November.

The debtors, currently overseeing the bankruptcy process, will officially submit the plan for review by a U.S. Bankruptcy Court by December 16, 2023. The proposal outlines dividing missing customer assets into three pools based on circumstances at the beginning of the Chapter 11 cases: assets segregated for FTX.com customers, assets for FTX.US customers, and a “General Pool” of other assets.

Customers with a preference settlement amount of less than $250,000 can accept the settlement without any reduction of claim or payment. The preference settlement represents 15% of customer withdrawals on the exchange nine days before its collapse.

Creditors would also receive a “Shortfall Claim” against the general pool, corresponding to the estimated value of assets missing at their exchange. This is estimated to be nearly $9 billion for FTX.com and $166 million for FTX.US, the exchange’s U.S. arm.

However, there are potential hindrances to recoveries, including taxes, government claims, token price fluctuations, and more.

The debtors may also exclude “insiders, affiliates, customers” from the settlement if they were aware of the commingling and misuse of customer deposits and corporate funds, or if they changed their KYC information to facilitate withdrawals when they were halted.

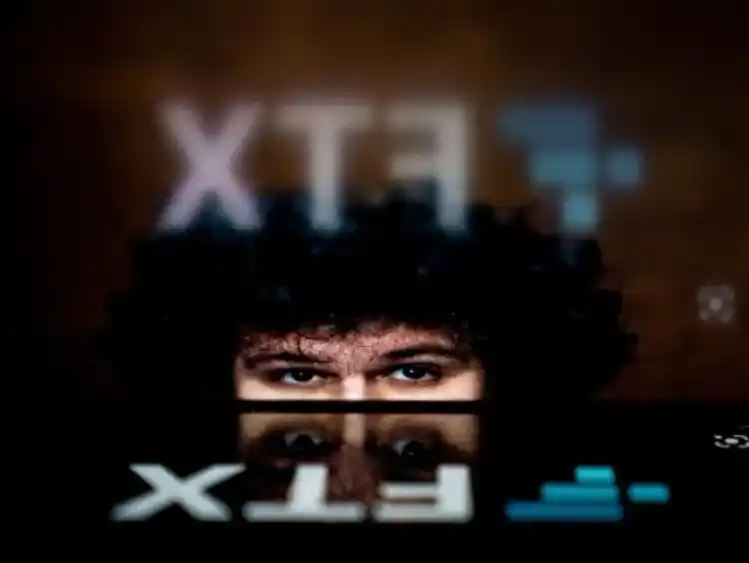

FTX collapsed last year after revelations about the state of its balance sheet, and its new CEO, John J. Ray III, has criticized the financial controls at the company. Meanwhile, founder Sam Bankman-Fried is facing trial.

Former FTX Head of Engineering Admits to Financial Crimes, Implicates Iconic Figurehead Sam Bankman-Fried

Nishad Singh, former Head of Engineering at FTX, openly admitted to engaging in financial crimes during his tenure at the company, implicating prominent figures like Sam Bankman-Fried in activities ranging from defrauding customers to money laundering.

>>> BlackRock CEO Addresses Bitcoin Price Surge Caused by False ETF News

Singh’s testimony revealed a series of alleged malpractices, including discussions about acquiring major lending platforms like Celsius, Voyager, and BlockFi following the 2022 Terra Luna crypto crash. These acquisitions aimed to provide Alameda, FTX’s parent company, with more capital to borrow and save the struggling crypto space. Customer fiat deposits were channeled into Alameda’s bank accounts from FTX’s inception, violating customer trust.

Singh’s disclosures also revealed FTX’s lack of a system to deal with liquidation losses, exposing the firm to potential regulatory actions and lawsuits. Additionally, there were malpractices related to Serum tokens, and Singh recounted a controversial $120 million deal with Telegram for TON tokens.

Singh’s testimony sheds light on internal dysfunction at FTX and raises questions about the cryptocurrency industry’s integrity. Regulators are likely to tighten controls, and customers will reevaluate the security and ethics of their chosen platforms. This revelation is more than a scandal; it’s a significant wake-up call for cryptocurrency trading and governance.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE