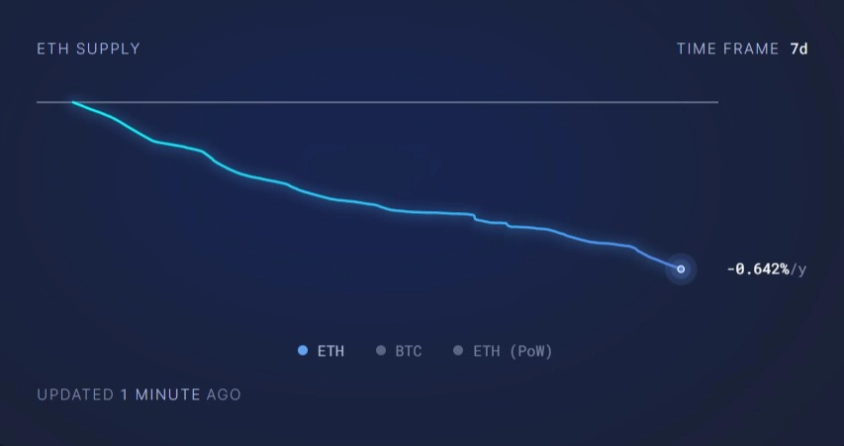

The Ethereum network’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS), known as the Merge, has triggered a notable transformation in its supply dynamics, particularly impacting its circulating supply. This shift has set in motion a deflationary trend, with more than 307,000 Ethereum (ETH) coins exiting circulation post-Merge. The diminishing net supply, currently decreasing at an annual rate of 0.248%, has significant implications for Ethereum’s long-term market value.

Contrasting Supply Dynamics

Under the previous PoW mechanism, Ethereum’s total supply would have increased by over 4.71 million, with an annual inflation rate of 3.168%. This stark contrast highlights the profound impact of Ethereum’s transition to PoS on its supply dynamics, steering it towards a deflationary trajectory.

Long-Term Projections

As of now, Ethereum’s supply stands at 120.21 million, with projections indicating that this figure has peaked. Anticipations suggest a gradual decline in the total circulating ETH, potentially reaching 117.7 million by the close of 2025.

Network Participation and Fee Dynamics

The transition period also witnessed phases of inflation, attributed to reduced network participation. Instances in September and early October saw the creation of new coins outpacing burning rates, leading to lower network fees. This decline signaled reduced transaction activity and fewer ETH being burned. The base fee, a portion of transaction fees, is permanently removed from circulation, enhancing Ethereum’s deflationary mechanism during periods of high network usage.

Related: Is Ethereum Primed for a $3000 Surge? Analyzing Chart Patterns for Insights

Market Sentiment Amid Corrections

Despite Ethereum undergoing significant corrections since October’s bull rally, market sentiment remains optimistic. Ongoing data indicates a prevailing sense of market greed, typically associated with driving up asset values. At the time of writing, Ethereum’s price stands at $2,170, with analysts and investors closely monitoring the potential repercussions of its evolving supply dynamics on future market value.

Post-Merge Landscape

As Ethereum navigates the post-Merge landscape, its altered supply dynamics and investor sentiments will shape its market performance. The network’s deflationary trend post-Merge signifies a noteworthy development in the cryptocurrency space, carrying potential ripple effects on Ethereum’s long-term value and influencing investor strategies.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE